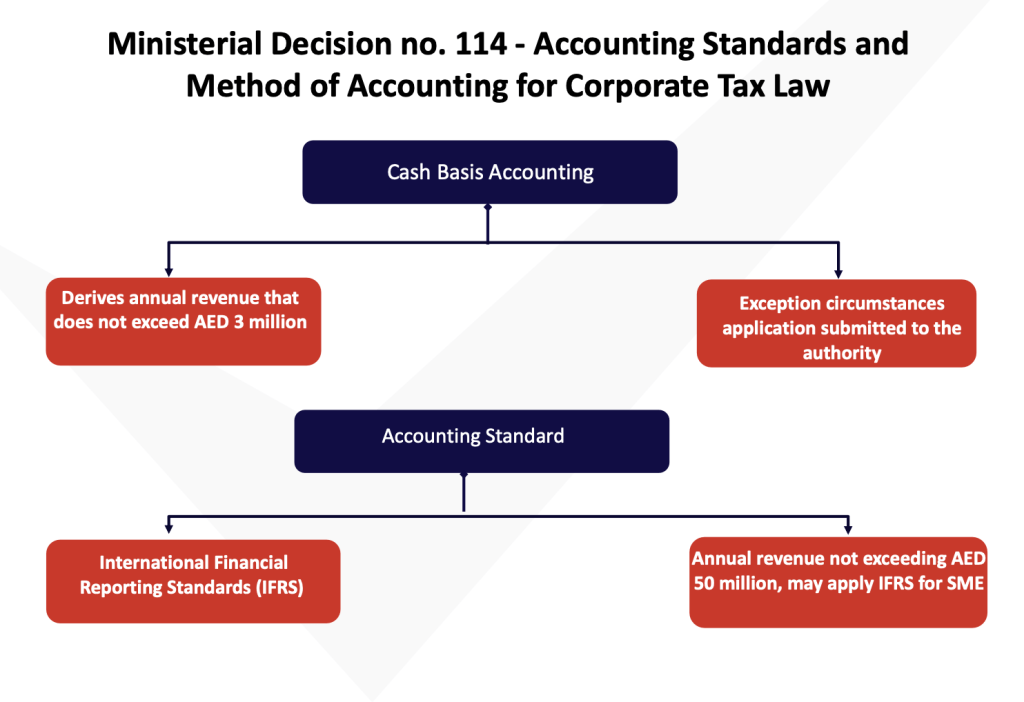

The UAE Ministry of Finance has released a Ministerial Decision on the accounting method to be followed and the accounting GAAP to be followed for the purpose of paragraph (a) of Clause (5) of Article (20) of the Corporate Tax Law, a Person may prepare Financial Statements using the Cash Basis of Accounting, in any of the following instances:

Financial Statement of Tax Group

Stages for Consolidation of Tax Group financials

- Preparation of standalone financial statement for each subsidiary

- Consolidation of standalone financial statement of subsidiary with parent, eliminating the transaction between them

Why maintaining accounting methods and standards as per law is important for companies?

Maintaining accounting methods and standards as per the law is crucial for companies for several reasons.

Firstly, adherence to accounting laws ensures transparency and accuracy in financial reporting. By following standardized accounting methods, companies can provide reliable and consistent financial information to stakeholders, such as investors, creditors, and regulators. This transparency builds trust and confidence in the company’s financial statements, making it easier to attract investors and secure financing.

Secondly, compliance with accounting standards promotes fair competition. When all companies use the same rules and principles, it becomes easier to compare their financial performance. This allows investors and stakeholders to make informed decisions based on accurate and comparable financial information. Without standardized accounting practices, companies could manipulate their financial statements, leading to unfair advantages and a lack of trust in the financial markets.

Thirdly, maintaining proper accounting methods is essential for legal and regulatory compliance. Companies are required to fulfill various reporting obligations, such as filing tax returns, submitting financial statements to regulatory bodies, and complying with industry-specific regulations. Failure to follow accounting laws can result in penalties, fines, legal disputes, and damage to the company’s reputation.

Moreover, accurate financial reporting is vital for internal decision-making within the company. Reliable accounting information enables management to assess the company’s financial health, make informed strategic decisions, and allocate resources effectively. It also helps identify potential areas of improvement and detect financial irregularities or fraud.

In summary, adhering to accounting methods and standards as per the law is crucial for companies to ensure transparency, promote fair competition, comply with regulations, and make informed decisions. It enhances trust, credibility, and accountability, benefiting both the company and its stakeholders.

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us