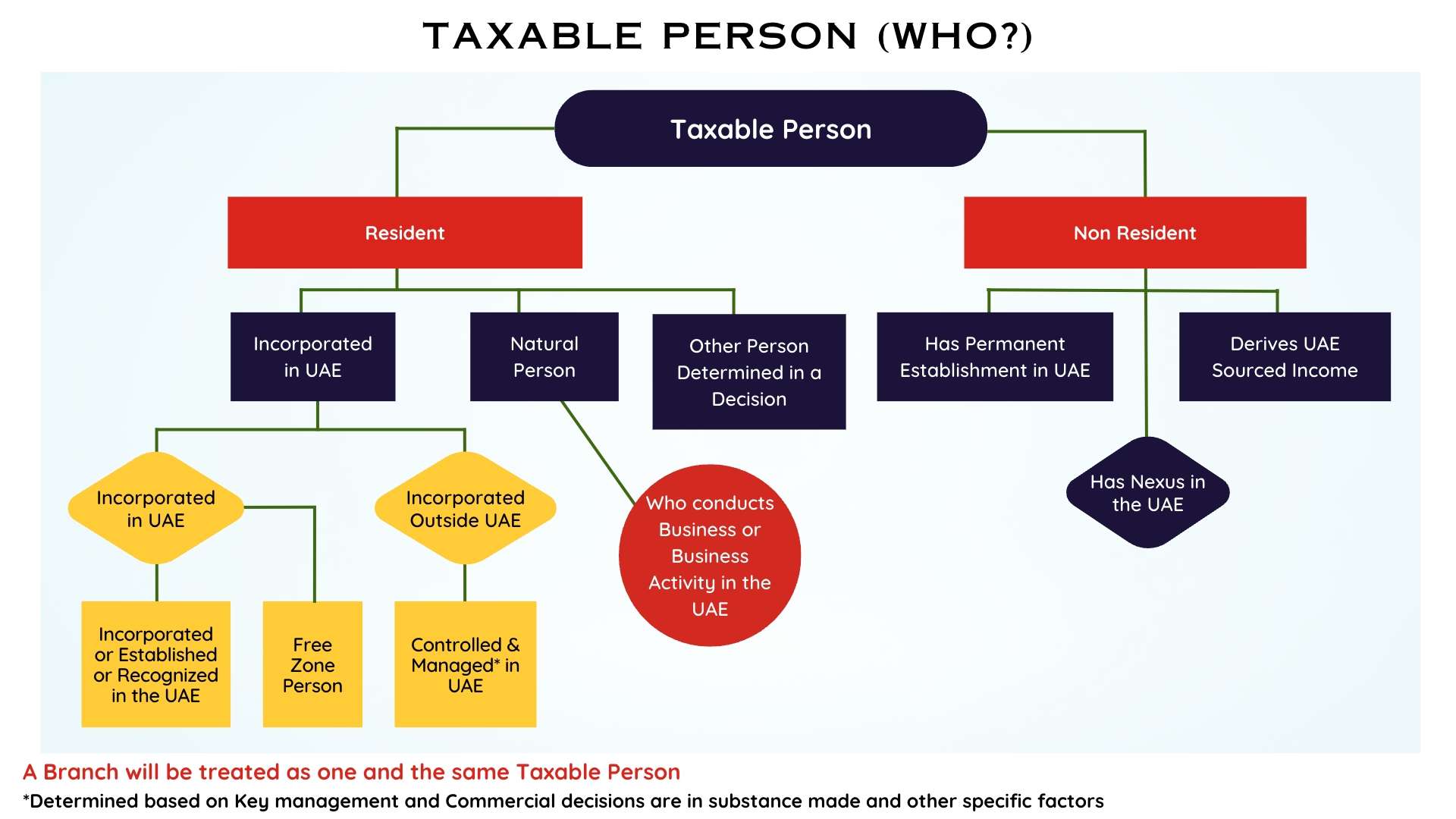

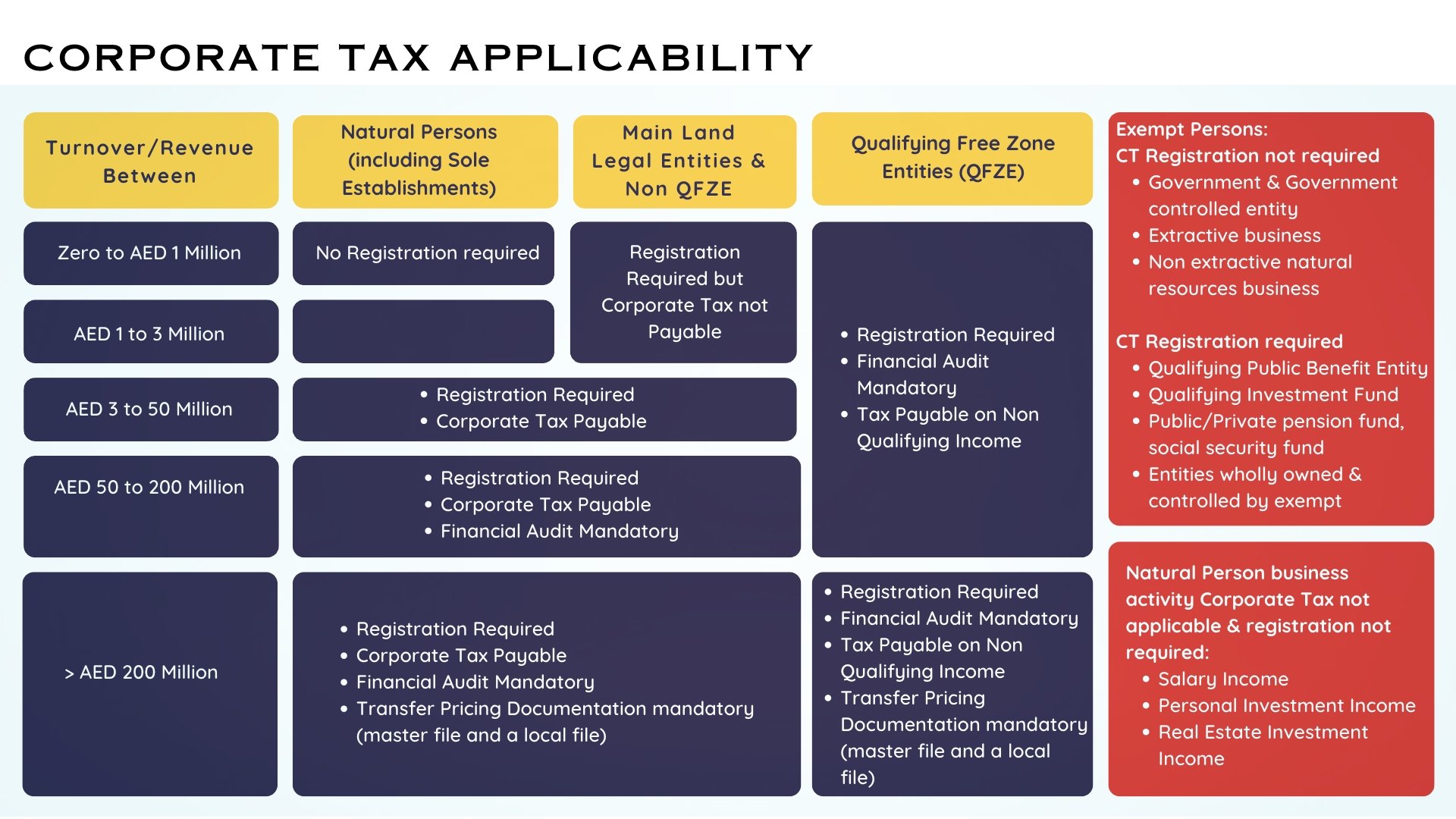

- The Ministry of Finance introduced Corporate Tax Law (Federal Decree Law no. 47 of 2022), w.e.f., 1st June 2023, in UAE on business profits. The Corporate tax in UAE will be applicable to Juridical person and Natural person. Every taxable person needs to register for Corporate Tax with the authority before filing the first return.

- As per Article 61 of the Corporate Tax Law, opening balances for the 1st tax period are required to be prepared as per IFRS, and transactions between connected persons and related parties shall be reported taking into consideration the arm’s length principle in accordance with Article 34 of the Decree Law.

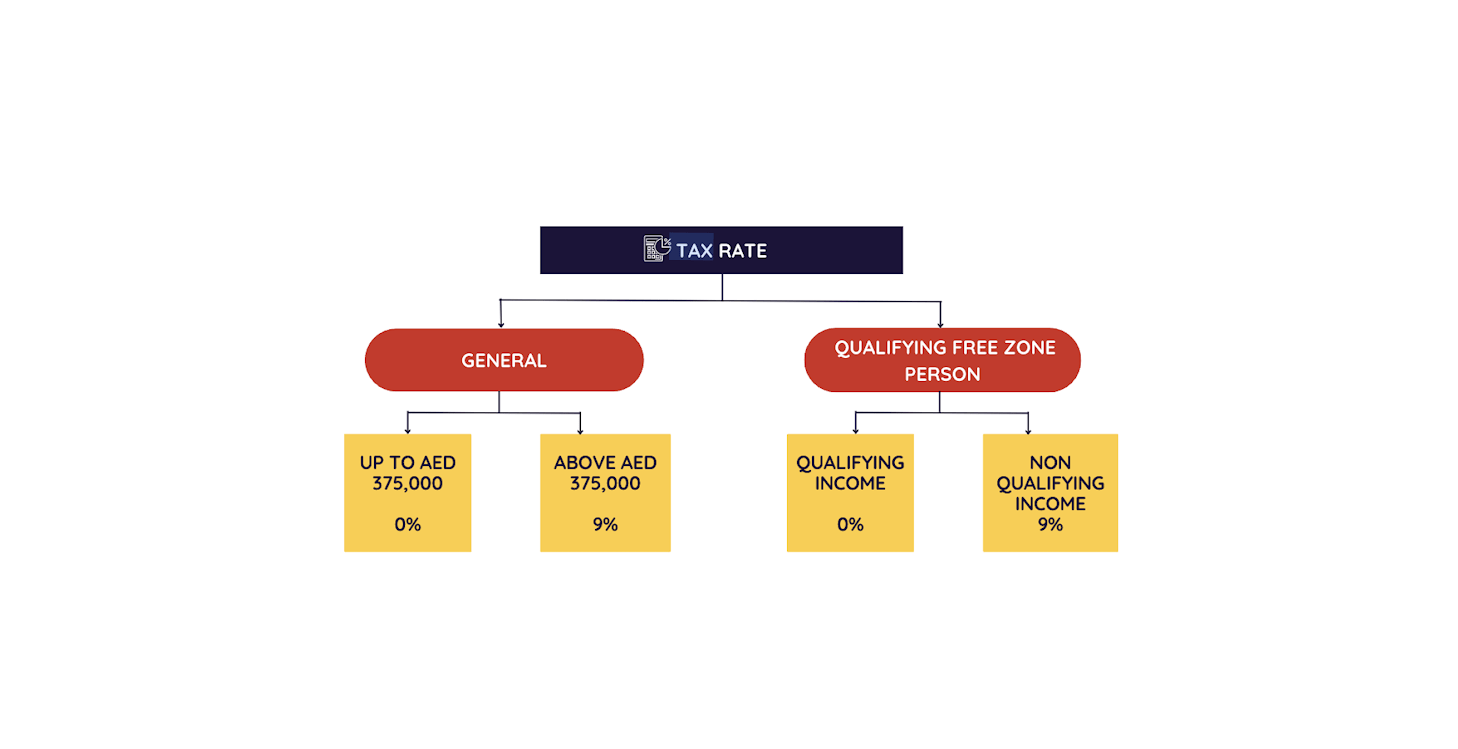

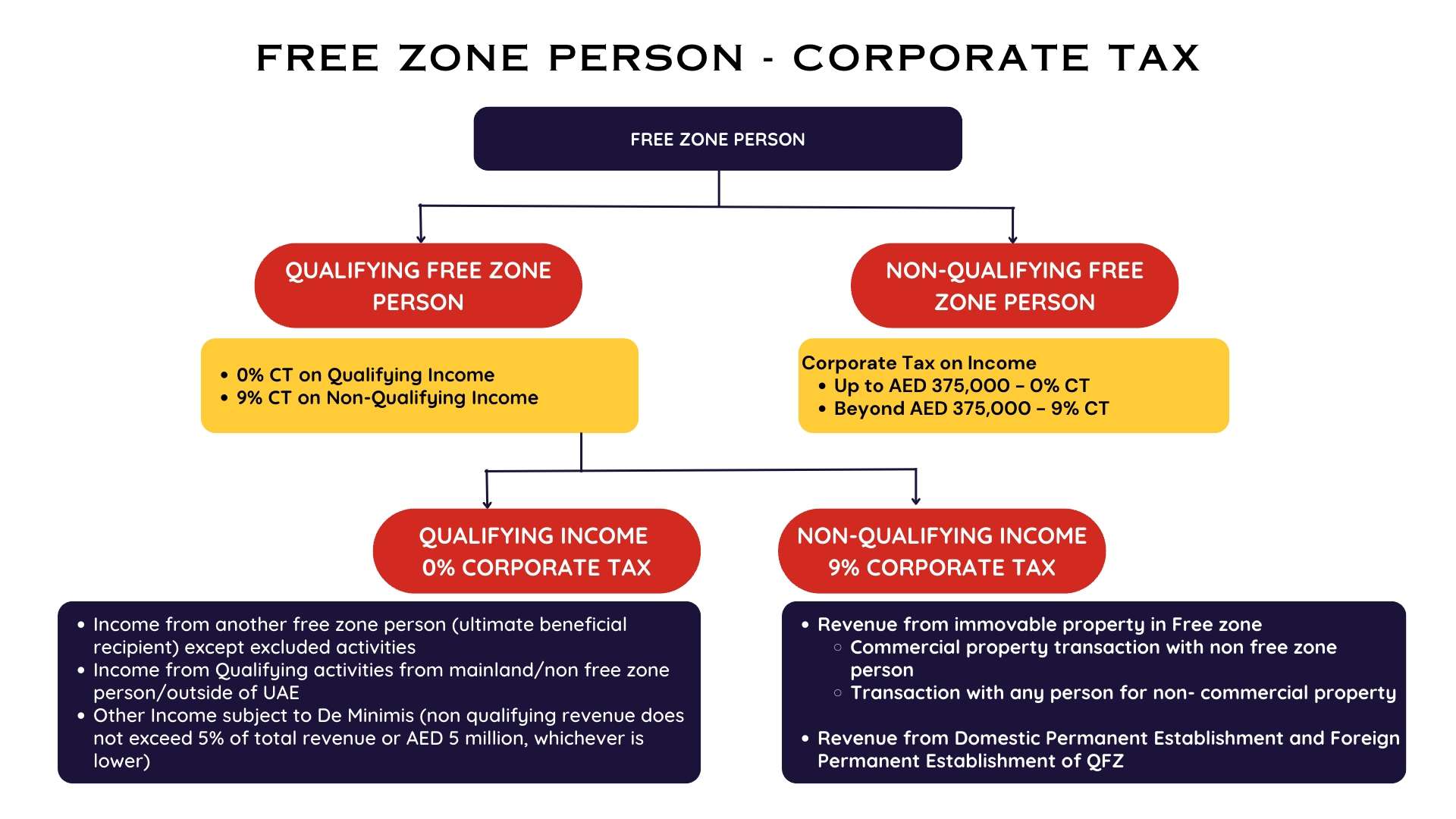

- The Qualifying Free Zone Persons will pay 0% on their Qualifying income and 9% on the non-Qualifying income. The other businesses and professions including the mainland ones pay the Corporate tax at 0% up to the Taxable income (adjusted profits) of AED 375,000 and 9% in excess of that.

Corporate Tax

Corporate Tax

The corporate tax will be levied on the profits calculated in accordance with the International Financial Reporting Standards (IFRS) after making the adjustments to it as mentioned in the Corporate Tax law. The Annual Corporate Tax (CT) Returns shall be submitted within 9 months from the end of the financial year along with the payment of the tax amount.

Following are some of the other key elements of the Law:

![]()

The Taxable person shall prepare and maintain the books of accounts as per IFRS for 7 years from the end of the financial year. FTA can ask the taxable person for the records while submitting the CT returns.

![]()

The Taxable person with annual revenue of less than AED 3 million has an option to prepare their books of accounts on cash basis of accounting.

![]()

A Taxable person with annual revenue of AED 50 million and Qualifying Free Zone Persons shall get their financial statements audited.

![]()

Taxable person (except Qualifying Free Zone Persons & MNE entity) with annual revenue less than AED 3 million can opt for small business relief which gives the benefit of Nil corporate tax to be paid.

![]()

Tax losses can be carried forward for the following years and offset against the subsequent years’ taxable income subject to meeting certain conditions.

Corporate Tax Services

- Corporate Tax Registration

- Corporate Tax Impact Assessment & restructuring advisory

- Assessment of business operations & transactions

- Review the UAE’s current existing group tax structure

- Group Structuring (Tax planning considering Legal & Operational Structure),

- Business Segments, Free Zone Vs Mainland, Market Jurisdictions, Supply Chain, Transactions Flows and Substance Tests)

- Pre and Post Tax Impact Assessment (Qualitative & Quantitative analysis)

- Accounting & Tax Treatment, Adjustments and Closures (Revenue Vs Capital recognition & treatment, Chart of Accounts, Interest & Depreciation Calculations, Closing & Opening balances, TP adjustments, Year-end provisioning & adjustments)

- Consolidated Vs Business Segment Wise Vs Entity Wise Tax Impact Analysis

- Effective Group Tax Rate under various alternatives

- Tax Computation Analysis (Deductions, Exemptions, Losses and Reliefs)

- Tax losses absorption planning

- Tax Grouping Evaluation

- Advise on supporting documentation to be maintained for substantiating the tax positions

- Impact of CT & TP with VAT, IFRS, Customs, ESR and other local regulations

- Assist in managing entities & group tax compliances under single dashboard

- Arms Length Pricing documentation

- Identification of related parties and, connected persons, their transaction flows

- Analyze and implement documentation requirements for the transaction with above person

- Training the client internal team on Corporate Tax Law requirements

To Assess the impact of Corporate Tax applicability in your business, contact us for professional services.

Transfer Pricing

![]()

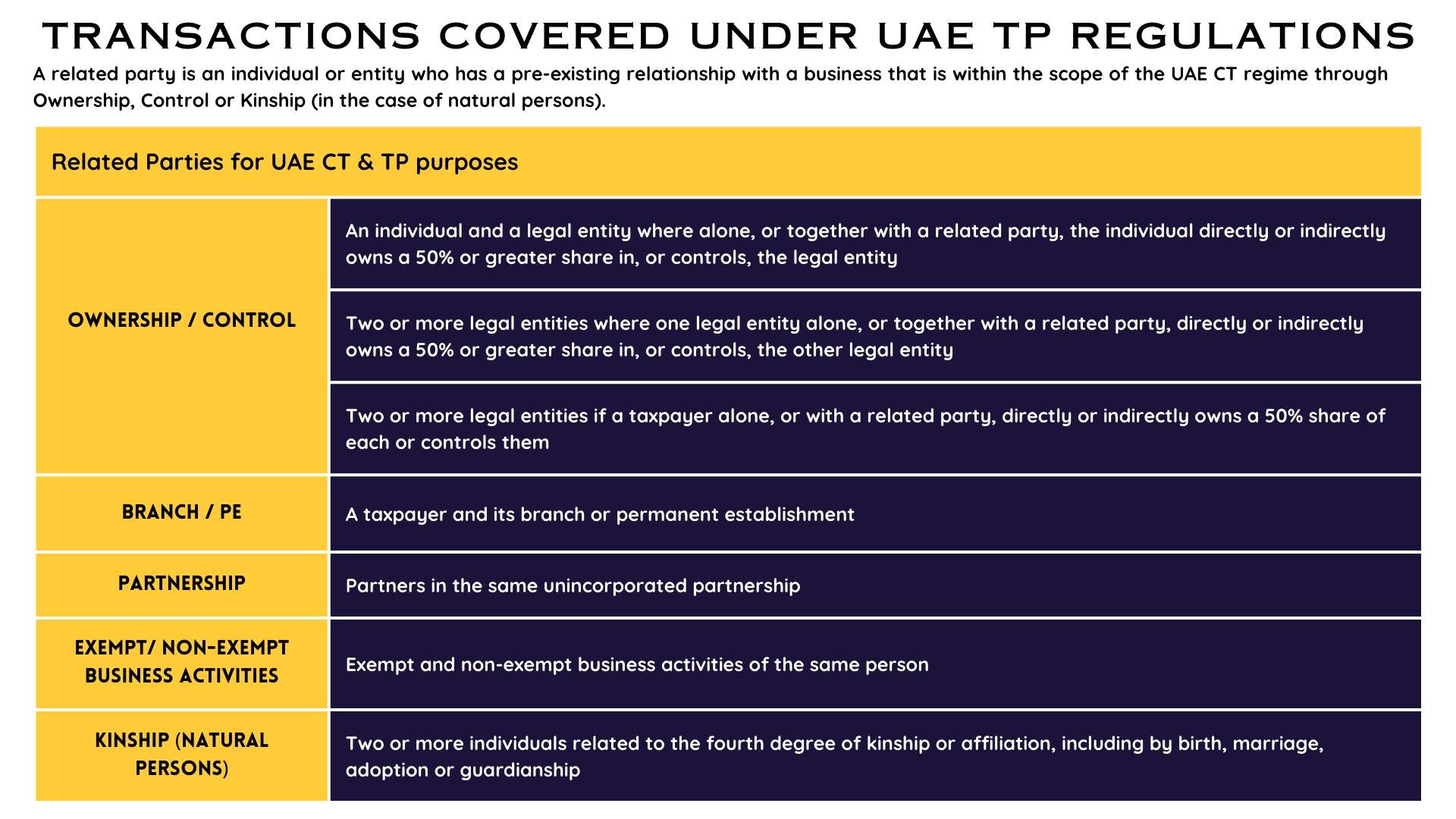

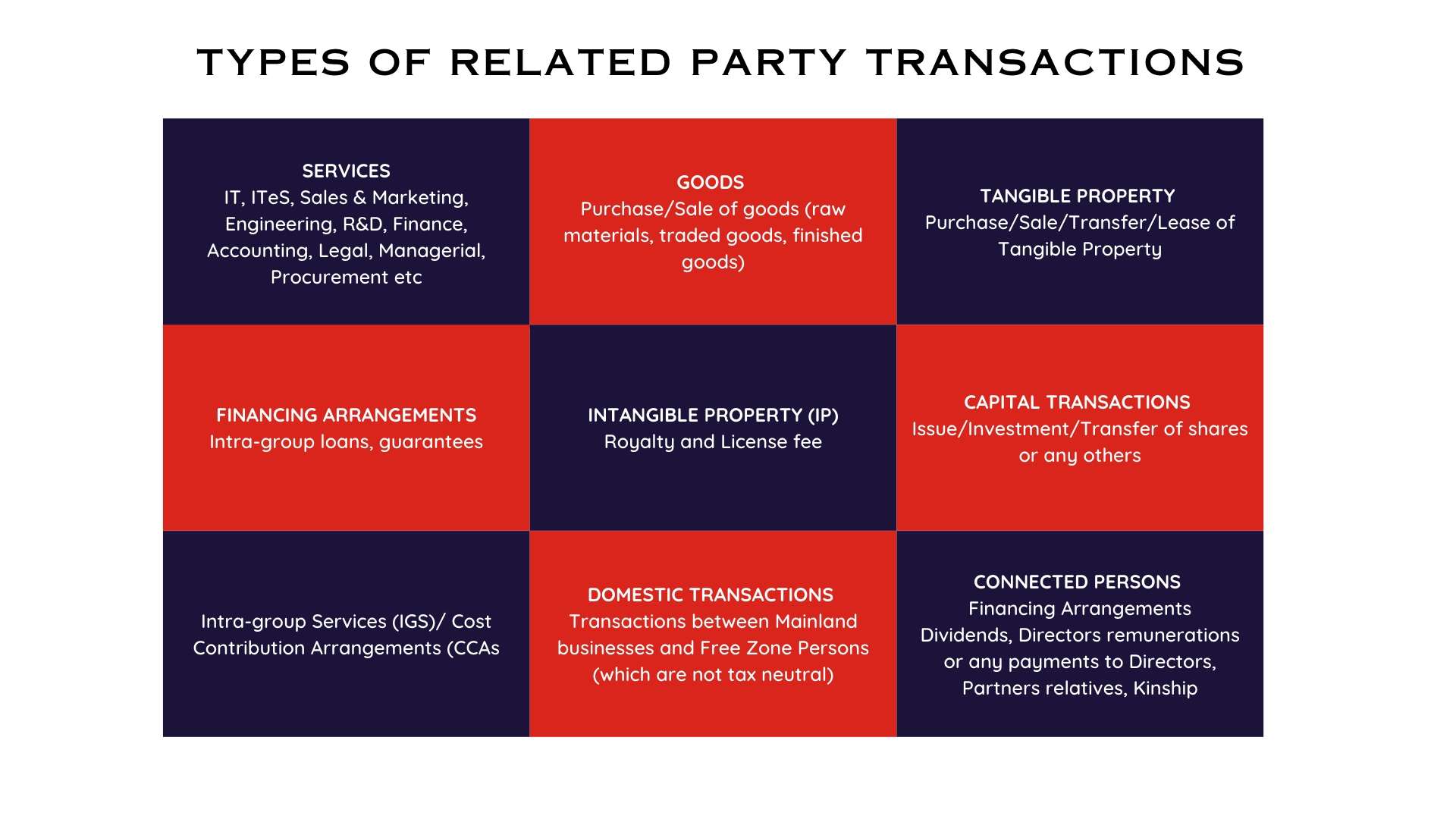

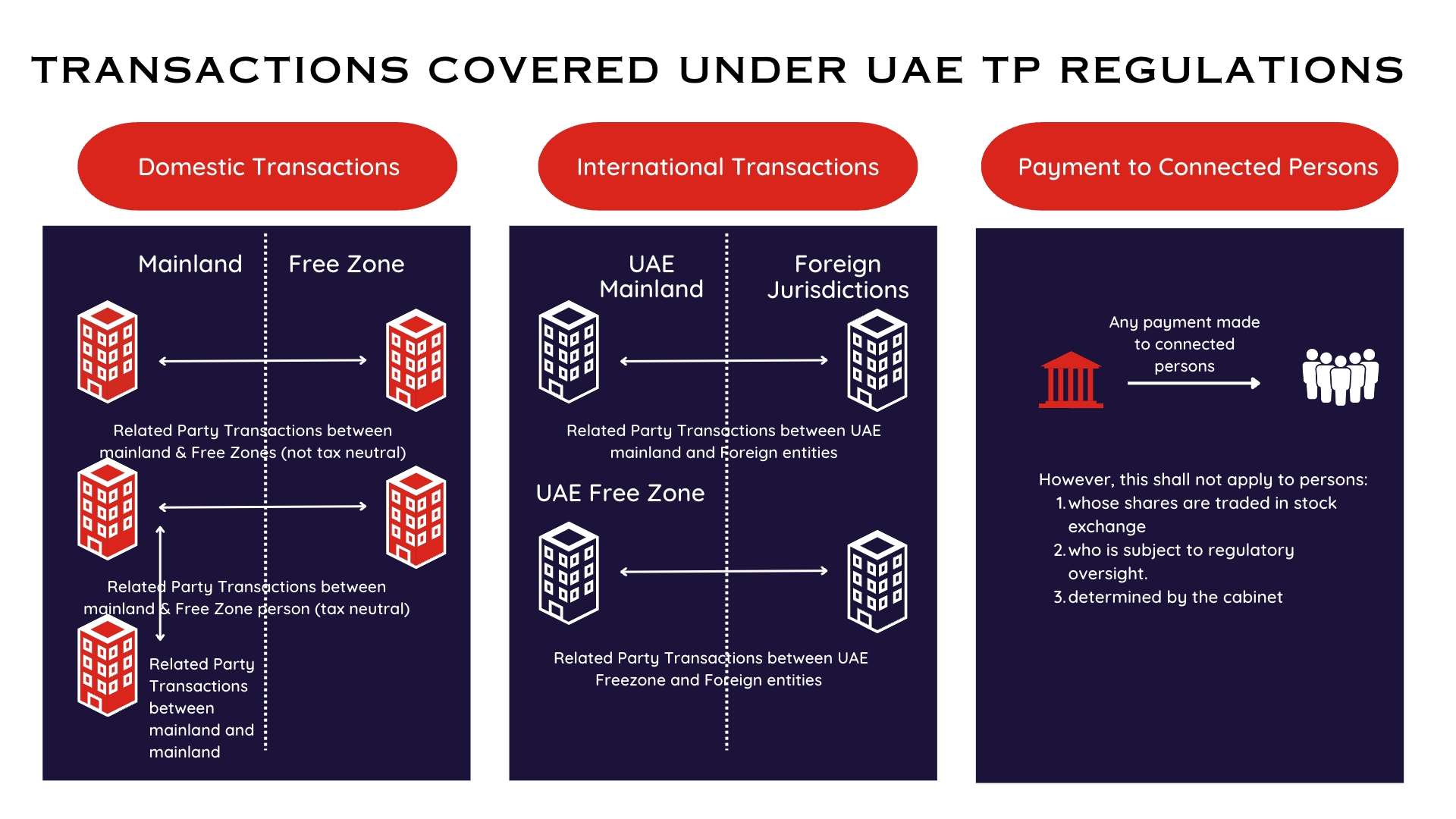

Transfer Pricing (TP) refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control.

![]()

The arm’s length price (ALP) of a transaction between two associated enterprises is the price that would be paid if the transactions had taken place between two comparable independent and unrelated parties, where the consideration is only commercial.

![]()

Taxpayers should apply the arm’s length principle to ensure that the transactions between related parties reflect independent pricing. Such arm’s length price is fairly a market price of such commodity or service

UAE Transfer Pricing Rules

On 9 December 2022, the UAE Federal Tax Authority released Federal Decree-Law No. 47 of 2022 (Taxation of Corporations and Businesses). The following Articles of that Decree-Law form the UAE Transfer Pricing Regulations.

ARTICLE 34 –

ARM’S LENGTH PRINCIPLE

This article defines the arm’s length standard where the results of the transaction between the related party and that of independent parties has to be similar.

ARTICLE 35 – RELATED

PARTIES AND CONTROLS

This article defines related parties i.e., the analysis of different transactions performed with related parties is discussed further in detailed.

ARTICLE 36 – PAYMENT

TO CONNECTED

PERSONS

This article delineates that the payments made to connected parties are deductible only if:

- The transactions are performed at arms length

- The transactions are made at market value

ARTICLE 55 –

TP DOCUMENTATION

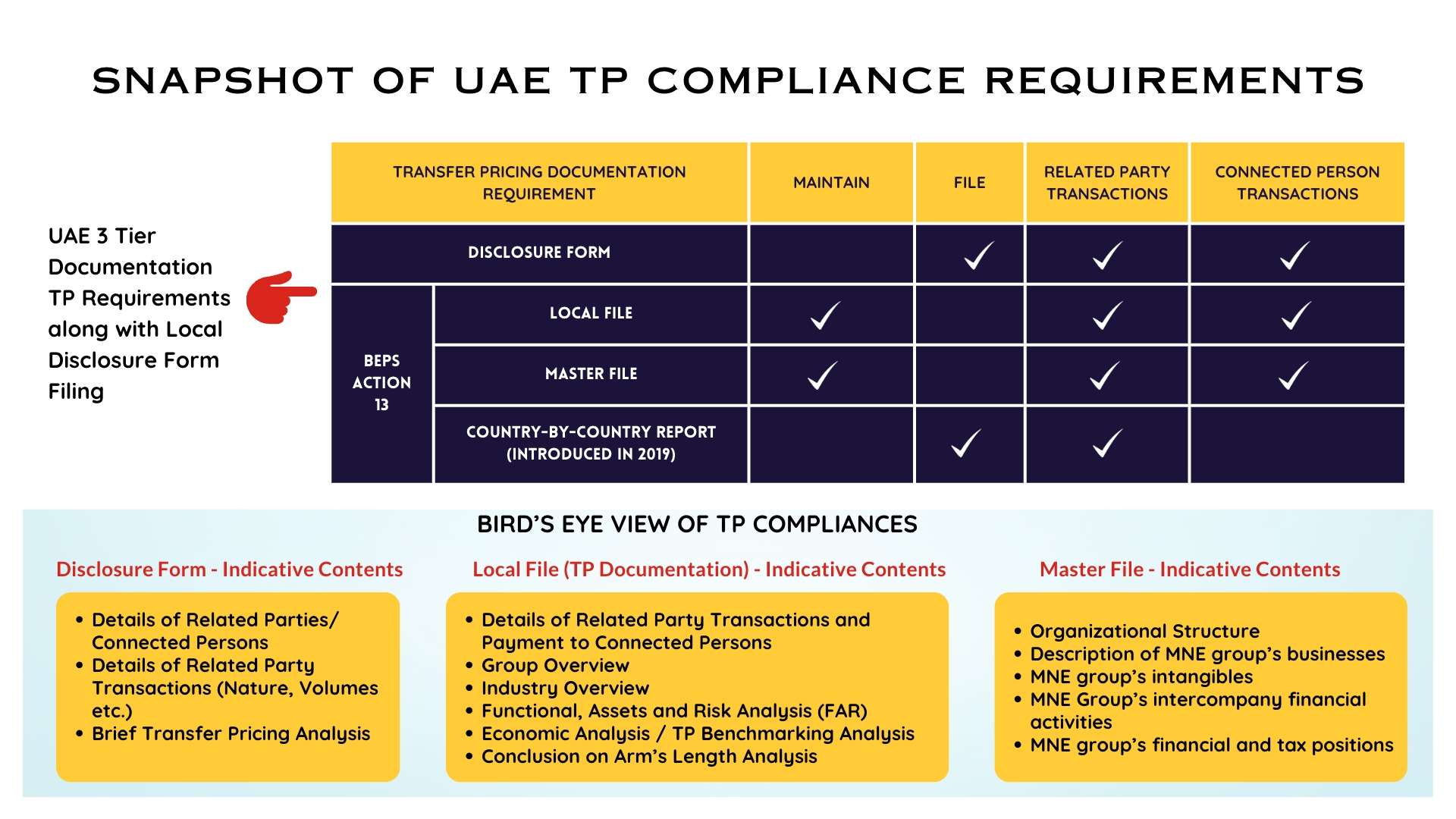

The taxable person (exceeding turnover of AED 200 million & MNE group entity) needs to maintain TP documentation (namely

Local file, Master file) and file disclosure Form

Any information sought by Authority supporting the arm’s length range needs to be submitted within 30 days of request.

Transfer Pricing Services

01

Identify Related Parties & Connected Persons.

02

Analyze related party & connect person transaction flows

03

Review of existing TP policies & intercompany agreements, TP documentation (Local File & Master File)

04

Advising on supporting TP documentation to be maintained for all related party and connected person transactions to substantiate TP & Tax positions.

05

Advising on TP Compliance readiness (Disclosure Form, Local File, Master File and CbCR to the extent applicable)

06

Characterization of entities based on Functional, Assets and Risks (FAR) Analysis.

07

Advise on application of most appropriate TP method for related party transactions & connect person payments.

08

Evaluation of Internal and External Comparable.

09

Advising on TP remuneration models.

10

Advise on supporting documentation to be maintained for substantiating ALP from TP standpoint.

11

Undertake TP benchmarking analysis and recommend arm’s length prices. Issue TP benchmarking reports.

12

Setting of robust TP polices & SOPs. Assist in drafting of Inter-company agreements.

FAQ's

The UAE did not have a federal corporate income tax for general businesses upto May 31, 2023. However, taxes were applicable to foreign banks and oil companies. Corporate tax is applicable on general businesses from the financial years commencing after June 01, 2023.

As per the rules applicable, foreign banks operating in the UAE are subjected to a 20% corporate tax on their profits.

Oil and gas companies in the UAE are taxed at rates stipulated in the respective concessions agreements, which could be as high as 55% on their UAE-sourced profits.

Yes, tax agencies in the UAE offer services related to tax planning and compliance. They can provide advice on minimizing tax liabilities and ensure that your business complies with all relevant tax regulations. You can reach out at [email protected] for any help in tax planning & compliance for corporate tax.

Corporate tax has been introduced in UAE on business profits exceeding AED 375,000/- from financial years commencing from June 01, 2023.

We can answer to this question two segments:

1. Dividend received by companies - Dividend received by companies are exempt income, as tax on profits of the same are paid by the company distributing dividend.

2. Dividend received by individuals - Corporate tax is not applicable to individuals hence dividend received by them is not taxable.

Yes, the UAE has entered into double tax treaties with numerous countries to prevent double taxation of income earned in any of the two countries.

The main purpose of these treaties is to promote and facilitate trade and investment between the two countries. They do this by preventing double taxation, where an individual or corporation would be taxed in both countries on the same income.

As of September 2021, businesses in the UAE were subject to Value Added Tax (VAT) at a standard rate of 5%. There were also excise taxes on certain products like tobacco and carbonated drinks.

The UAE and the United States does not have a tax treaty.

Reach us for transfer pricing & international taxation services from experienced professionals, served beyond borders spanning multiple industries.

contact us

contact us