Accounting home

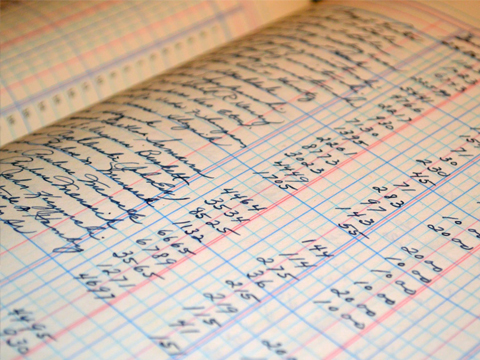

Accounting & Book Keeping

Business owners and managers often rely on accuracy of their financial numbers when they have to take a business decision. Which means there is a heavy reliance on the part of accountants or admins who play a crucial role in a typical organization, be it a SME or an Enterprise sector company or a proprietary ownership concern to provide the right information and gauge the accuracy in its business activity.

Accounting and bookkeeping play a vital role in the development of an organization, which can help in understanding the financial performance and financial position of the organization any given time. The professional expertise and vast knowledge resource of Spectrum helps any business in leveraging it to their advantage.

Our motto is to add value in addition to our expected services while maintaining relevant and required independence and integrity as core values.

contact us

contact us