Tax Agency Services

A Tax Agency is a legal entity that is licensed to operate as a Tax Agency and has registered with the FTA as a Tax Agency.

Spectrum Auditing, as a Tax Agency, can be appointed by any Taxableperson (individual or a company) to represent him before the FTA and assist him in the fulfillment of his tax obligations and also exercise his associated tax rights.

Following are some of our services offered as a Tax Agency:

Apart from carrying out the basic responsibilities as stated above as a Tax Agent, we also take care of you in the following services:

- VAT Registration Service (Individual / Company / Group)

- Filing VAT Returns on behalf of Taxable person

- Record and maintain tax transactions

- Application for VAT de-registration of a taxable person or company

- Tax Audit service

- Assist in any kind of Tax dispute or issue including compliance Review

- VAT Consultancy services

Spectrum Auditing provides Tax Advisory Services in Dubai, Abu Dhabi, Sharjah, and all other Emirates in UAE.

For more information on Tax Agent services, please contact us on +971 4 2699329 (or) +971 50 9866466 (or) email us at [email protected] now.

What We Do?

1. Tax Analysis

Navigate the complexities of tax laws and regulations with our expertise:

Our seasoned tax professionals are here to demystify the world of tax laws for you. We dive deep into your financial landscape, dissect current UAE tax regulations, and uncover opportunities for you to optimize your tax strategy. Whether it’s corporate taxes, personal taxes, or international tax intricacies, our team is your guide through the complex terrain of compliance and planning.

Our tax analysis services includes:

Thorough tax compliance reviews

- Strategic tax planning

- Techniques to minimize tax burdens

- Impact analysis of proposed transactions

- Representation before tax authorities

2. SME’s Tax

Empower your SME’s growth with our tailored tax solutions and expert guidance

Small and medium-sized enterprises (SMEs) face unique challenges in the world of UAE tax laws. Our dedicated team of tax professionals understands these challenges and offers comprehensive services designed to optimize your tax positions, minimize liabilities, and propel your financial goals forward.

Our SME tax consulting services include:

- Tax compliance reviews and planning

- Strategies to minimize taxes for SMEs

- Analysis of tax impacts on proposed business decisions

- Exploring tax incentives and benefits for SMEs

3. Corporate Tax

Don’t Let Tax Regulations Overwhelm You – Trust Our Experts:

The complexities of tax regulations shouldn’t be a source of stress. Rely on our experienced tax professionals to ensure your financial affairs are in order, making the most of your resources. Whether it’s corporate taxes, personal taxes, or international tax matters, our team provides comprehensive advisory and consulting services.

Our services encompass:

- Tax compliance reviews

- Strategic tax planning

- Techniques to minimize tax burdens

- Impact analysis of proposed transactions

- Tax structuring for mergers, acquisitions, and diversifications

4. Tax Advisory

Discover the transformative impact of tax optimization on your corporate financial performance

Our corporate tax advisors excel at crafting tax strategies aligned with your business goals. We meticulously analyse your financial data, tax structure, and industry dynamics to unearth hidden tax savings opportunities. Aligned with UAE CT Law, we provide tailored tax optimization solutions that:

- Maximize tax deductions and credits

- Minimize tax liabilities

- Enhance cash flow

- Strengthen your competitive position

- Safeguard your corporate assets and reputation with our expert tax compliance guidance, ensuring adherence to all relevant tax laws and regulations. Our comprehensive tax compliance services include a thorough review of tax filings, identification of potential compliance issues, proactive resolution of discrepancies, and representation before tax authorities.

5. Tax Consultants

Why Choose Spectrum as your tax consultant

At Spectrum, we understand that navigating the complex world of taxation can be overwhelming. Whether you’re an individual, a small business owner, or a corporation, our team of experienced tax consultants is here to provide you with reliable and personalized tax solutions.

We pride ourselves on our team of experienced tax professionals who are well-versed in the intricacies of tax regulations. With a proven track record of successful tax risk advisories and agency, we are dedicated to ensuring your financial stability and minimizing any potential tax-related hurdles.

6. Tax Risk Management

Why Tax Risk Management is Crucial

In today’s dynamic business and financial landscape, managing tax risks is not just wise but necessary. Neglecting tax risks can result in costly consequences – penalties, legal troubles, and damage to your reputation. Our Tax Risk Management services proactively address these challenges, providing peace of mind in your financial affairs.

What we offer:

Thorough tax risk assessment

Ensuring full compliance with tax regulations

Strategic tax planning

Expert support during audits and investigations

Training and workshops to keep you informed about the latest tax laws and regulations.

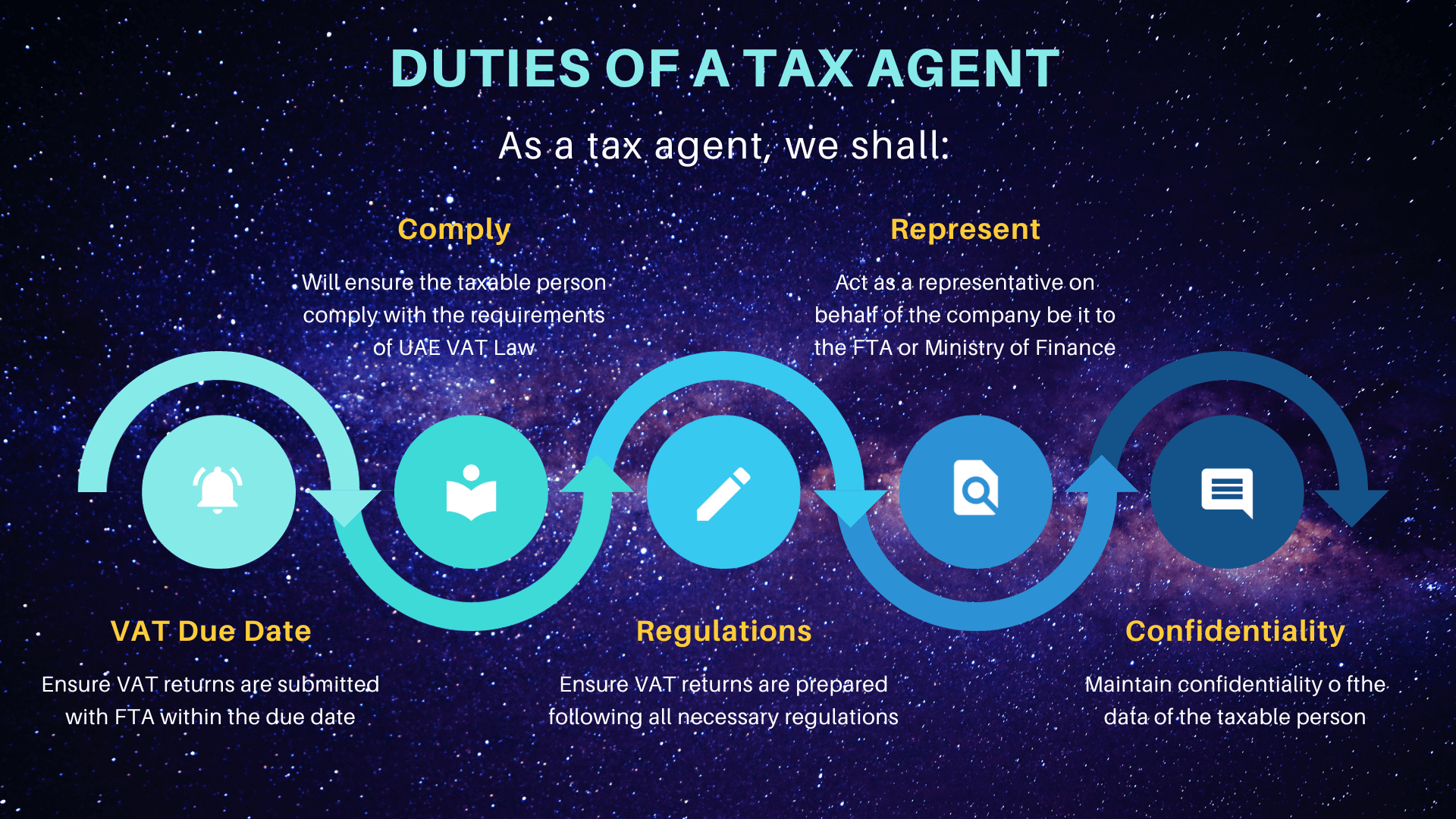

Duties of a Tax Agent:

Once a tar agent registers with a company and that company becomes a tax agency, such tax agency can provide the services to the taxable persons through the tax agent. Once the tax agency/agent agrees to provide the services to a taxable person, the following will be the duties of a tax agent/agency:

The tax agent shall:

→ Make sure that the taxable person complies with the requirements of UAE VAT law in terms of documentation and other compliances

→ Represent the company in front of the FTA Ministry of Finance or any other government authority or department

→ Make sure that VAT returns are submitted with FTA within the due date

→ Make sure that the VAT returns are prepared by following all the necessary regulations

→ Maintain confidentiality of the data of the taxable person

→ Refuse to participate in any work which may amount to a breach of any law

Benefits Section Addition:

- Benefits of Hiring a Tax Agent in UAE

- Expert Knowledge of UAE CT Law

- Optimized tax planning

- Efficient compliance management

- Interplay of UAE CT with other local regulations

- Customised tax planning solutions for individuals and business

- Tax Audit support

FAQs

Spectrum provides comprehensive tax agent services, including VAT registration, tax return filing, representation before the Federal Tax Authority, compliance checks, and advisory.

Spectrum assists with user registration, profile management, and tax return submission on the FTA's digital tax portal. We also facilitate tax payments and ensure their timely completion.

Yes, Spectrum conducts a comprehensive risk analysis to identify potential tax risks for your business and develops proactive strategies to mitigate these risks.

We employ stringent security measures for our document management system, ensuring secure storage and confidentiality of your business records.

We provide regular updates and detailed reports about your tax affairs. Our open communication channels encourage interaction and are always available for your questions and concerns.

We stay updated with regulatory changes and ensure our practices align with these changes. Our deep understanding of UAE tax laws allows us to guarantee full compliance.

Spectrum serves businesses across all industries. Our team of certified tax agents is equipped to handle the diverse tax requirements of businesses of various sizes and sectors.

At Spectrum, we believe that efficient tax management is integral to financial health. We strive to provide services that not only ensure compliance but also contribute to your business growth.

Yes, our team of qualified professionals can represent you before the FTA, easing the burden of dealing with complex tax issues.

We employ a robust record-keeping system that ensures your tax records are accurate, up-to-date, and compliant with the Federal Tax Authority's requirements.

Tax agent is an individual who is certified by the Federal Tax Authority (FTA) to provide the consulting services to various companies in relation to Value Added Tax (VAT), Excise Tax and Corporate Tax. An FTA approved Tax Agent can associate with an accounting and auditing services providing company to perform these services and that becomes a Tax Agency to provide those services to their clients. Spectrum Auditing is an FTA approved Tax Agency in UAE.

Tax agent is an individual who is certified by the Federal Tax Authority (FTA) to provide the consulting services to various companies in relation to Value Added Tax (VAT), Excise Tax and Corporate Tax. A Tax Agent can be officially assigned with the client’s tax matters compliances and the Tax Agent can represent the clients in front of FTA or any other authority with respect to Tax matters. On the other hand, Tax consultants, can you only provide consulting services to the client and cannot represent the companies/ clients in front of FTA or any other authority.

A Company/ individual who is eligible to get registered for VAT can apply for the same online through EMARATAX portal on UAE FTA website and get the Tax Registration Number (TRN) after clearance of the FTA review.

Salary in UAE is a tax free when that is paid to an individual when there is an employer and employee relationship and such amount is received towards the services provided as an employees of a company. Anything that is received by an individual in the capacity of an employee is considered to be Tax Free as of now.

A registered Taxable Person can submit the VAT returns online through EmaraTax portal of FTA and make the payments online by using various options provide by the FTA.

Federal Tax Authority (FTA) has been assigned with an authority to implement, administer and collect the Tax due amount from various Taxable Persons.

contact us

contact us