What is transfer pricing (TP) and why is it important under UAE Corporate Tax?

Transfer pricing relates to inter-company arrangements on transfer of goods or services, intangibles, loans and such other transaction between two or more related parties or connected persons.

To ensure that the price or terms of a transaction has not affected due to relationship between the parties transfer pricing rules will be applicable on such transactions.

We need to understand the following terms to understand the transfer pricing in detail:

- Related parties & connected persons

- Arm’s length price

- Documents required to be maintained by the parties

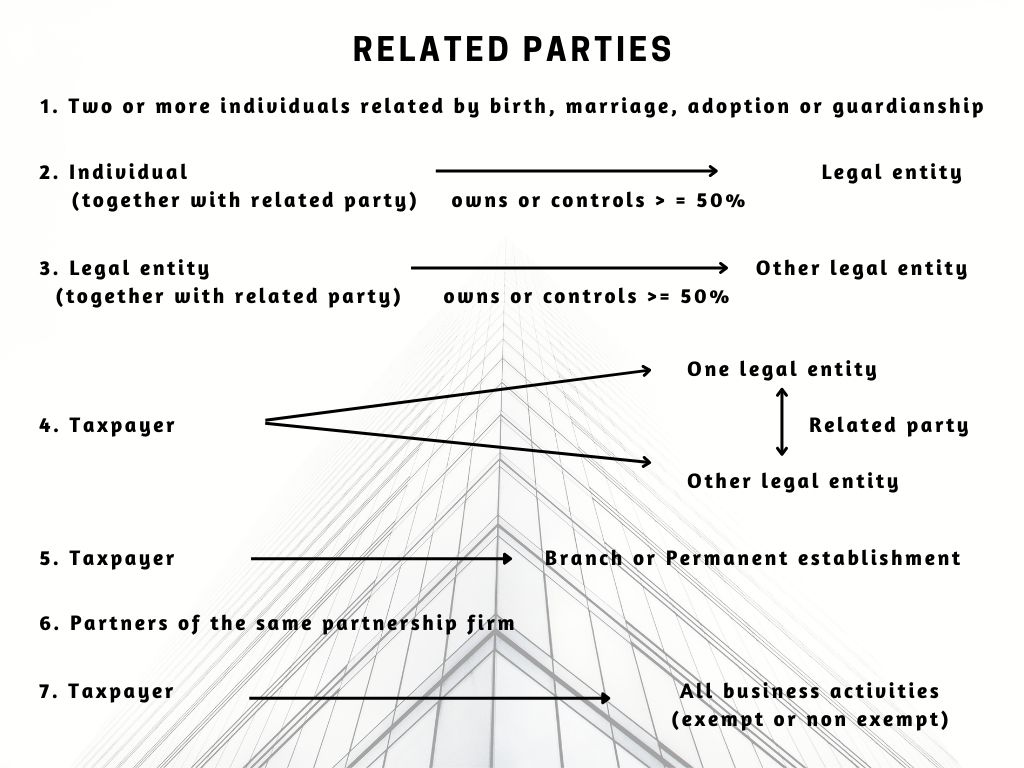

A) Related parties & connected persons

Following is the definition of the related parties and connected persons given in the public consultation document on UAE Corporate Tax:

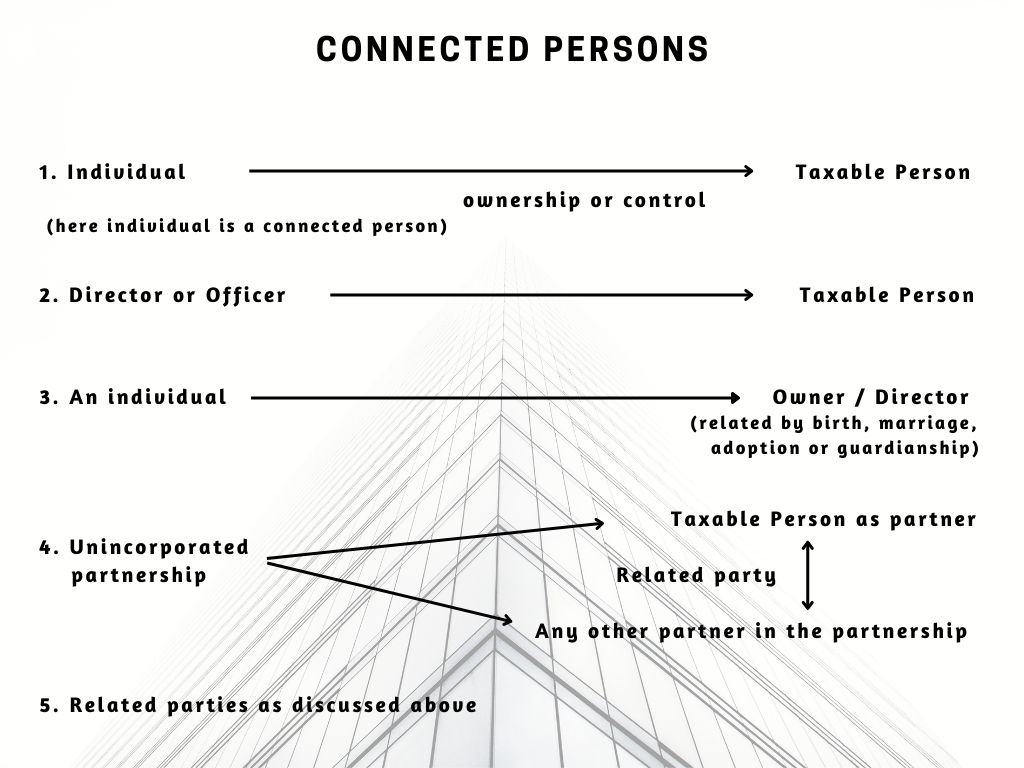

Connected persons

Q) Who is a connected person & what is the need to define it separately?

Ans: As personal income tax is not applicable there is a fair chance whereby the company may shift their profits by paying higher amount to themselves or connected persons.

B) Arm’s length price (ALP)

Q) What is Arm’s length price (ALP)?

ALP is a price which is applied in a transaction between persons who are unrelated to each other in uncontrolled conditions.

For e.g. Open market transactions

There are various methods prescribed by OECD for computation of ALP.

C) Documents required to be maintained by the parties

In order to ensure taxpayers give appropriate information to tax administrations they are required to maintain proper documentation.

Following files are required to be maintained:

- Master file

The master file should provide a brief overview of the group including the nature of global business operations, its transfer pricing policies, its allocation of income & economic activities.

The master file provides the blueprint of the group.

- Local file

Local file provides detailed information pertaining to inter-company transactions. Such information would include financial information of specific transactions, comparability analysis & application of most appropriate method.

- Country-by-country Report (CbC Report)

This report includes the aggregate allocation of income, taxes paid and certain indicators of the location of economic activity. It also includes the listing of the constituent entities for which financial information is reported along with the tax jurisdiction of incorporation.

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Senior Audit Executive

contact us

contact us