Following are some of the frequently asked questions and answers to them relating to UAE Corporate Tax:

Q) Whether Dividend and rental receipts are taxable in the hands of UAE Nationals and Foreign individuals under UAE Corporate Tax (CT)?

No. Dividend and rental receipts are not taxable in the hands of UAE Nationals and Foreign individuals and they are out of scope of UAE CT.

Q) Is UAE CT applicable to foreign legal entities?

CT applies to foreign legal entities that have a permanent establishment in UAE or that earn UAE Sourced income.

Q) How is the income of Limited and General Partnerships, Unincorporated JV and AOP taxed?

They are not taxed in their own right but their income will be taxed in the hands of the partners or members only.

Q) Whether the activities of Government are within the scope of CT?

Non-commercial nature activities conducted by the Government does not fall under UAE CT regime, but any business/ commercial activity carried out directly by the Government under a trade license will be within the scope of CT. However, Government owned UAE companies that carry out a sovereign or mandated activity are outside the scope of UAE CT.

Q) Is income earned by a Non-resident from operating aircraft or ships taxable?

Income earned by a Non-resident from operating or leasing aircraft or ships is exempt from CT provided the same tax treatment is granted to UAE business in the relevant foreign Jurisdiction under the Reciprocity principle.

Q) What is the tax treatment if income is earned from UAE real estate and other investments held through private or Family trust?

It is not subject to Corporate Tax.

Q) What are the partnerships that are subject to CT?

Limited Liability partnerships, Partnerships limited by shares and other types of Partnerships where none of the partners have unlimited liability will be subject to CT.

Q) What are the conditions to claim exemption from CT by the companies engaged in the extraction and exploitation of Natural resources?

The CT regime intends to exempt the income earned by companies engaged in extraction and exploitation of natural resources that are subject to Emirate-level taxation at the moment.

Q) Is foreign Branch subject to CT?

Foreign Branch would constitute a PE in foreign country and be subject to CT on its profits in that foreign country.

Q) Whether UAE companies can claim exemption for their foreign branch profits?

UAE companies can either claim

- foreign Tax credit for taxes paid in foreign country

Or

- Exemption for branch profits

Exception:

An exemption for Branch profits may not be available where the foreign branch is not subject to sufficient level of tax in foreign Jurisdiction.

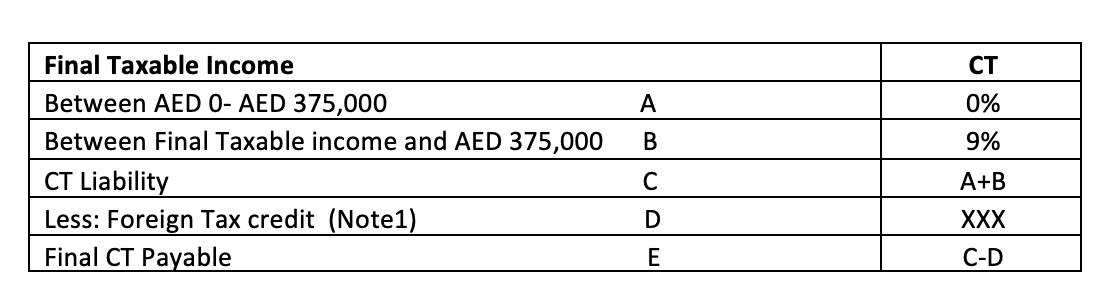

How to calculate Corporate tax payable as per UAE Corporate Tax law?

Note 1: Foreign Tax credit

Lower of

- Tax paid in Foreign Jurisdiction

Or

- CT Payable on Foreign sourced income

Unutilized Foreign Tax credit will not be able to be carried forward or will not be refunded.

Why Spectrum Auditing?

Reach out to Spectrum Auditing for further details. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us