One of the main attractions for the investors to set up their businesses in UAE is the wide variety of the free zones and the benefits they offer to the investors. It is very clear that Free Zones are an important part of the UAE economy and have been central to achieving the country’s aim of encouraging foreign direct investment and enhancing the ease of doing business.

Applicability of UAE Corporate Tax to the companies in UAE Free Zones or not

The Public consultation document on UAE Corporate Tax issued by the Ministry of Finance clearly mentions that “the companies and branches that are registered in a Free Zone (“Free Zone Persons”) will be within the scope of the UAE CT and subject to tax return filing requirements”. And it further mentions that “UAE CT regime will honour the tax incentives currently being offered to Free Zone Persons that maintain adequate substance and comply with all regulatory requirements”.

Which means, the UAE Corporate Tax will be applicable to the entities in Free Zones also in general, however there are certain rules to be complied with to get the benefit of 0% of UAE for the eligible companies.

0% of UAE Corporate Tax to be levied on UAE Free Zones

The public consultation documents mentioned that to be in line with the original intention and purpose of Free Zones, a Free Zone Person can benefit from a 0% CT rate on the following income earned from:

- transactions with businesses located outside of the UAE, or

- trading with businesses located in the same or any other Free Zone.

The 0% CT rate may also apply to income from certain regulated financial services directed at foreign markets.

Impact of UAE CT on a mainland branch of a Free Zone entity

Some of the companies in UAE Free zones may have a branch in the mainland and conduct business through that in the mainland. In which case the Public Consultation document mention that “A Free Zone Person that has a branch in mainland UAE will be taxed at the regular CT rate on its mainland sourced income, whilst continuing to benefit from the 0% CT rate on its other income”.

In this event, it is need less to say that both the branch in the mainland and the entity in the Free Zone need to have separate set of accounts and compute the UAE CT separately and if there are any transactions between these two entities, they need to make sure that they comply with Arm’s Length Pricing (ALP) under the Transfer Pricing guidelines.

UAE CT treatment for the passive income generated by a Free Zone person from mainland

It is further mentioned that, where a Free Zone Person transacts with mainland UAE but does not have a mainland branch, the Free Zone Person can continue to benefit from the 0% CT rate if its income from mainland UAE is limited to ‘passive’ income. As the term suggests, passive income means, income derived from investing in assets, rather than from activities carried on in the normal course of a trade or business. This would include interest and royalties, and dividends and capital gains from owning shares in mainland UAE companies.

UAE CT applicability to the payments made by mainland entity to a related Free Zone entity

The UAE wishes to maintain its status as the leading regional hub and headquarter location and, therefore, the 0% CT regime will also apply to transactions between Free Zone Persons and their group companies located in mainland UAE. However, to ensure the CT neutrality of such transactions, payments made to the Free Zone Person by a mainland group company will not be a deductible expense. And for the payments made by the free zone entity to its mainland related party will have to comply with the transfer pricing guidelines to make sure that the rates are at Arm’s Length at all the times.

Special UAE CT rules for the entities in a Designated Zone as per VAT Law when they sell goods to a mainland entity

Finally, a Free Zone Person located in a Designated Zone for Value Added Tax (VAT) purposes can benefit from the 0% CT rate on income from the sale of goods to UAE mainland businesses that are the importer of record of those goods. Which means, the public consultation document mentions that the persons in designated zones entities can continue to enjoy the 0% of CT even if they do business with the mainlined entities by following certain conditions when they sell goods.

When does a Free Zone entity loses the benefit of 0% of CT advantage?

To prevent Free Zone businesses from gaining an unfair competitive advantage compared to businesses established in mainland UAE, any other mainland sourced income will disqualify a Free Zone Person from the 0% CT regime in respect of all their income.

A Free Zone Person will at any point in time be able to make an irrevocable election to be subject to the regular CT rate.

Withholding tax (at 0%) on the mainland sourced income in the hands of the free zone entities

Where a Free Zone Person benefits from the 0% CT regime in respect of mainland sourced income, such income will be within the scope of withholding tax (to be applied at 0%)

UAE CT applicability for the entities which are part of the large MNCs

The entities those are part of large MNCs and are situated in Free Zones may still have to pay Corporate Tax higher than 9% if those large MNCs total turnover exceeds Euros 750 million in a year.

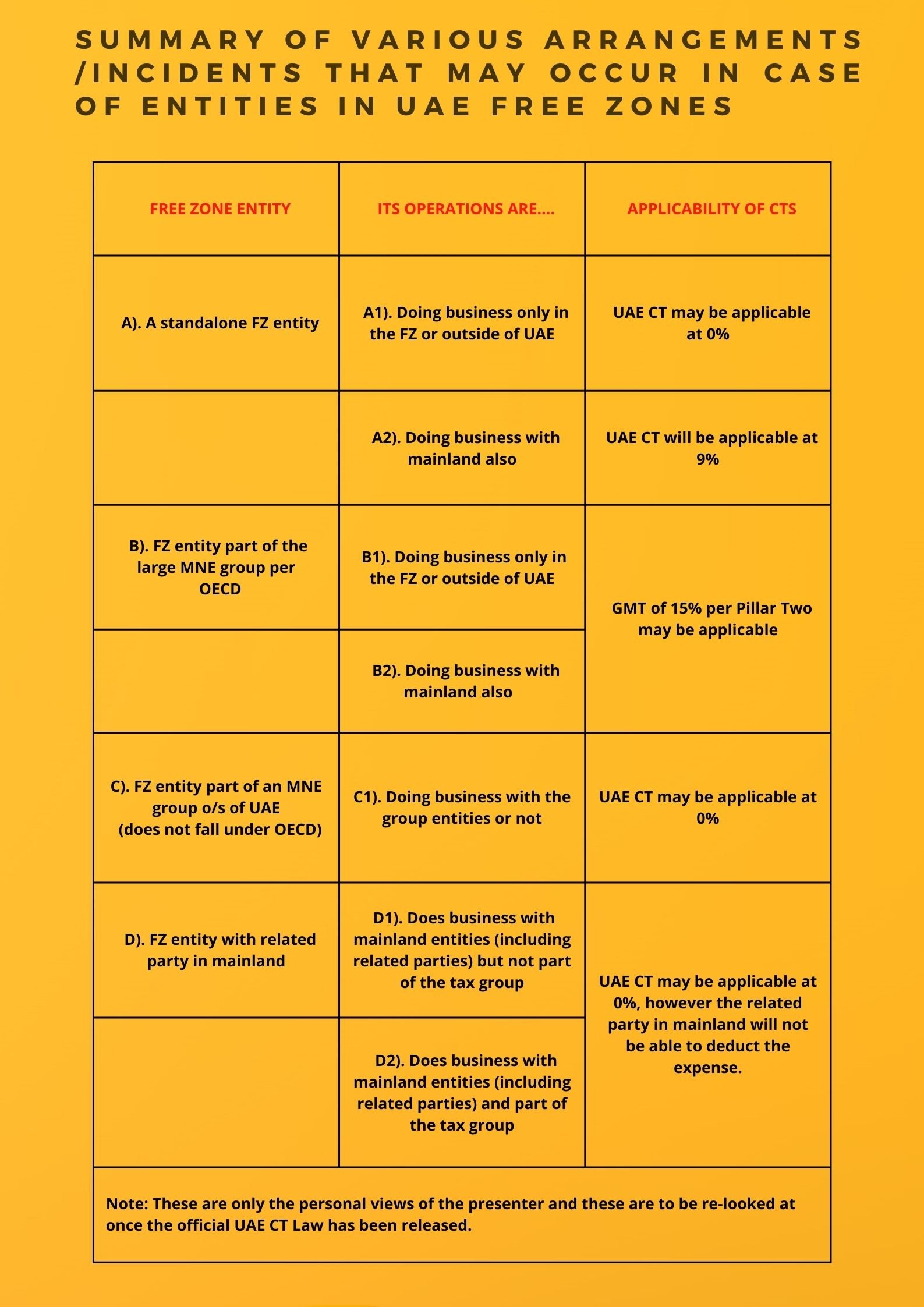

Following is a summary of various kinds of arrangements/ incidents that may occur in case of the entities in UAE Free Zones

The way forward for the Free Zone entities before the UAE Corporate Tax comes into effect

The Free Zone companies and the group of companies who have the free zone entities as part of their group shall re-look at the business arrangement and the corporate structure from the point of view of UAE Corporate Tax and plan for necessary changes in the business and corporate structure to minimize the tax impact by way of a proper tax planning. Spectrum Auditing can be handy for you to understand the UAE Corporate tax and guide you and your organization/ group to plan the structure and business arrangements in advance to minimize the Corporate Tax impact on your business.

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Managing Partner

contact us

contact us