The new standard, which lays out the general requirements for presentation and disclosures in the financial statements and responds to investors’ demand for better information about companies’ financial performance. IFRS 18 Presentation and Disclosure in the Financial Statements will affect all companies applying IFRS and is anticipated to be issued in April 2024 with an effective date of January 01, 2027 (early application permitted).

IFRS 18 arises from IASB’s work on the primary financial statements project. It will improve how information is communicated in financial statements and give investors a better basis for analyzing and comparing companies’ performance by increasing comparability, transparency, and usefulness of information.

IFRS 18 will replace IAS 1 Presentation of Financial Statements but will not change how companies recognise and measure items in financial statements. However, most companies will expect changes in the presentation of the statement of profit or loss and disclosure in the notes. International Accounting Standards Board (IASB) has mentioned that IFRS 18 will replace IAS 1 – Presentation in Financial Statements and has also mentioned that it will also have limited amendments to other IFRS Accounting Standards, including the IAS 7 -Statement of Cash Flows.

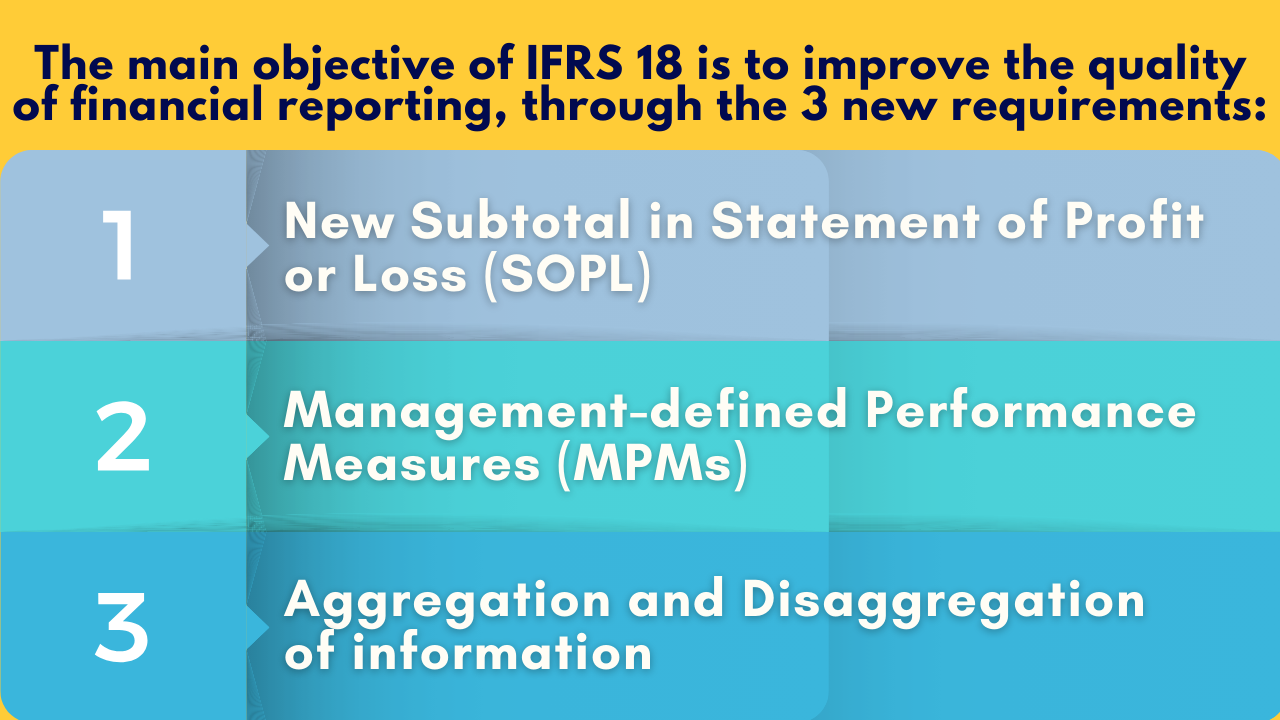

The main objective of IFRS 18 is to improve the quality of financial reporting, through the 3 new requirements:

- Presentation of defined subtotals in statement of profit or loss to improve comparability.

- Disclosures about Management Defined Performance (MPM’s) measures for transparency.

- Enhanced requirements for aggregation and disaggregation to provide useful information.

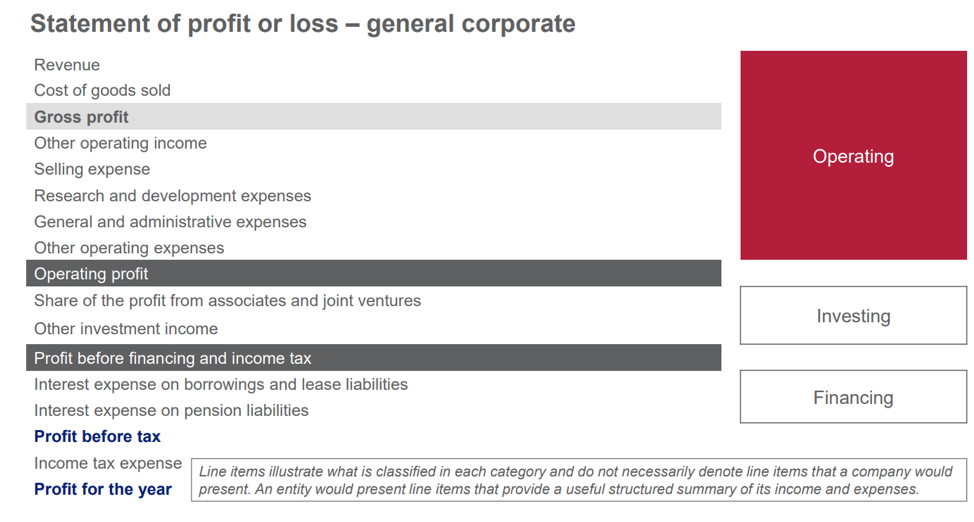

I – New Subtotal in Statement of Profit or Loss (SOPL)

The newly defined categories provide a consistent structure in the SOPL–

- Operating

- Investing

- Financing

Companies with financing and investing activities as their main business will include specific income and expenses in their operating profit that for other companies would be included in the investing or financing categories.

There are two new required subtotals as per IFRS 18 which enable analysis of –

- Operating profit

- Profit before financing and income taxes.

The below is an illustration of a company applying IFRS 18 –

The operating category would be the default category. So, the subtotal would provide a complete picture of the company’s operations.

The investing category would include income and expenses from investments accounted for using the equity method as per IAS 28 allowing investors to separately analyze the income and expenses of investments made by the company.

The financing category would include all income and expenses from liabilities from transactions that involve only the raising of finance such as bank loans. This category would also interest expense and the effects of changes in interest rates from other liabilities.

II – Management-defined Performance Measures (MPMs)

Many companies use non-GAAP or alternative performance measures in their communication with capital markets.

However, these measurements are not always transparent and can change from period to period without prior notification or explanation.

Hence, IFRS 18 defines a subset of such measures defined as MPMs and will be required to be disclosed in the financial statements. And now as they will be disclosed in the financial statements, they will also be subject to audit.

Things such as adjusted profit or loss or adjusted EBITDA will be considered as MPMs, basically subtotals of incomes & expenses which are not already required by IAS or IFRS standards.

So now as per IFRS 18, the requirement will be to disclose in a single note for MPMs would be –

- Reconciliation back to IFRS-defined subtotals

- Why the MPM was reported

- How the MPM was calculated

- Any changes to MPM in the current period

III – Aggregation and Disaggregation of information

This is also known as grouping in financial statements. As per IFRS 18 will provide guidance & enhance requirements for grouping and presenting operating expenses.

The guidance will determine whether operating expenses will be required to be disclosed in the primary financials or should be disclosed in notes.

Additionally, IFRS 18 will require disclosures for items labelled as ‘other’.

Why Spectrum?

Spectrum Auditing is a duly registered auditor authorized by the Ministry of Economy in the UAE. Furthermore, Spectrum holds accredited auditor status within multiple free zones and enjoys recognition as an approved auditor by prominent UAE banks. This solidifies Spectrum Auditing’s reputable standing in the industry.

Spectrum Auditing guides you with the laws and regulations of UAE, covering most compliances applicable as well as enable you deal with any queries pertaining to Risk Advisory, Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc., after reviewing your business. We specialize in conducting audits adhering to International Standards on Auditing (ISA), International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS).

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us