In this article, let’s delve deeper into understanding the International Financial Reporting Standards for Small Medium Enterprises.

Definition of SME’s as per Corporate Tax law:

As per Ministerial Decision no. 114 of 2023 on the Federal Decree Law no. 47 of 2022 states that –

“A taxable person that does not exceed AED 50 million may apply for International Financial Reporting Standards for small and medium-sized entities (IFRS for SME’s).”

Definition of SME’s as per the Small & Medium Enterprises Report (SME’s) in Dubai – 2019:

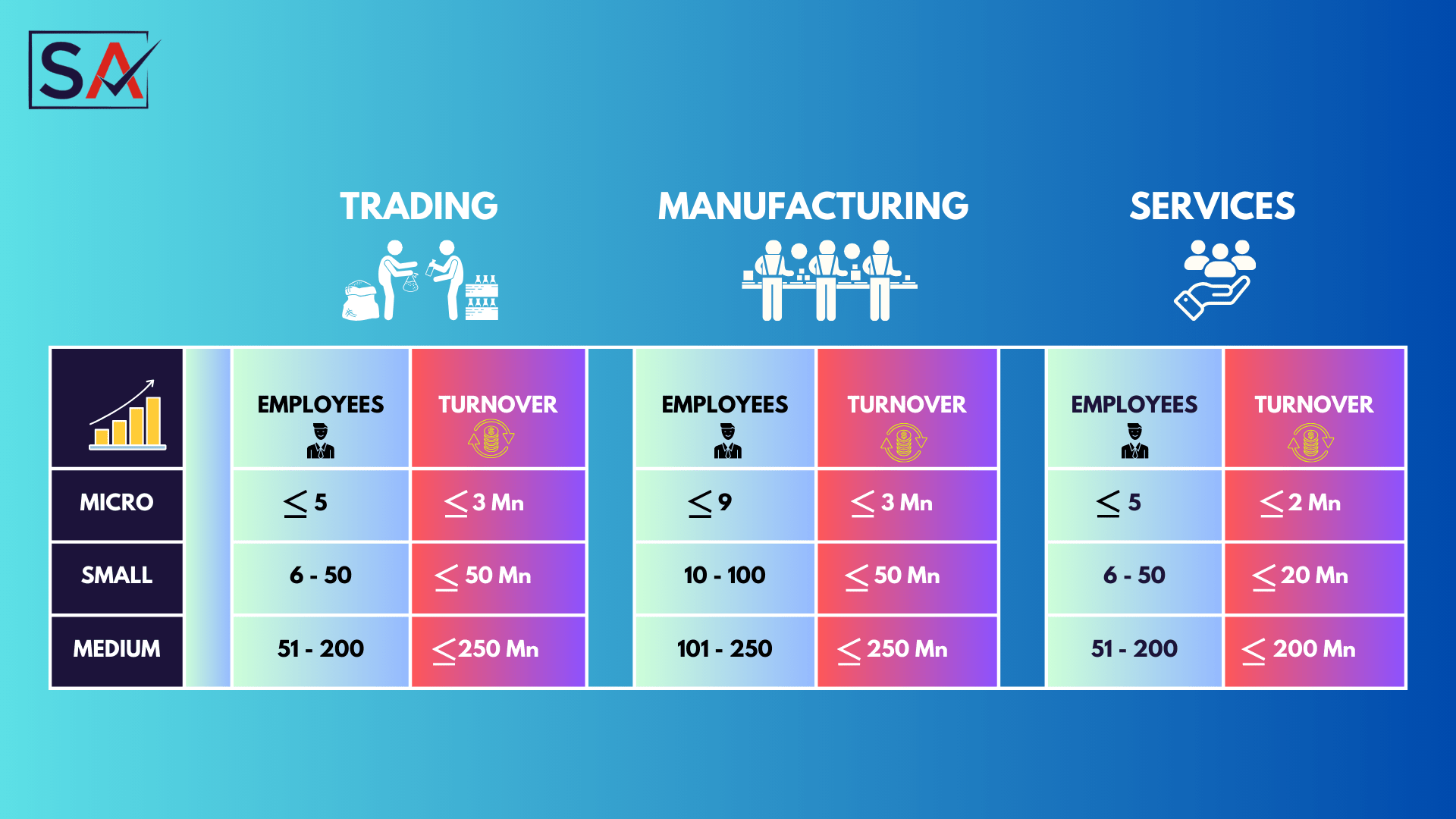

“An SME in the UAE is defined as any enterprise which meets the thresholds of ‘Employee Headcount’ and ‘Turnover’, as applicable to the Segment it belongs to (i.e., Trading, Manufacturing or Services).”

The classification of Enterprise Size (Micro, Small and Medium) is based on unique thresholds for each Segment as shown below:

What financial information is required for small and medium-sized enterprises (SMEs) to include in their financial statements?

Answer:

An Entity shall maintain complete set of financial statements that include the following –

- Statement of financial position as at reporting date

- Statement of comprehensive income which includes statement of profit or loss.

- Statement of changes in equity

- Statement of cash flows

Along with the above complete set of financial statements the entity must also present the prior period numbers along with the current reporting period and the related accounting notes.

What are the key differences between Full IFRS vs IFRS for SME’s and what items are affected?

The following has been omitted from IFRS for SME’s:

- earnings per share (IAS 33)

- interim financial reporting (IAS 34)

- segment reporting (IFRS 8)

- assets held for sale. (IFRS 5)

The following are key differences between Full IFRS vs IFRS for SME’s:

1. Goodwill

When acquiring a business, any goodwill arising will be valued at Cost of Business combination and fair value of net assets required. In other words, if there is any non-controlling interest in the business then Fair Value method of measuring will not be allowed.

2. Investment properties

- What is the definition of Investment property?

Investment property is defined as property that is held by the owner or by the lessee to earn rentals or for capital gains or both.

- How should an Entity recognize Investment property initially under IFRS for SME’s?

Entity will initially recognize investment property at cost less any transaction cost or legal/brokerage fees.

- What is the key difference for investment property under IFRS for SME’s?

Investment property will be remeasured at Fair Value at year end and any gain or loss arising is recorded in the Statement of Profit or loss.

- What happens if an Entity cannot measure Investment property at Fair Value?

Cost model can be used fair value cannot be measured reliably without undue cost or effort.

3. Intangible assets

- What is the definition of Intangible asset?

As per IAS 38 – Intangible assets, an intangible asset is defined as an identifiable non-monetary asset without physical substance.

- What is the key difference for intangible asset under IFRS for SME’s?

Any revaluation of intangible assets is prohibited and should be measured at cost less accumulated amortization or impairment. Therefore, the revaluation model is not permitted for intangible assets.

Also, there is no recognition of internally generated intangible assets as all expenditure on research and development costs will always be expensed to profit or loss.

- What if an Entity cannot determine the useful life of the intangible asset to amortize it?

Under IFRS for SME’s, since we are not allowed to revalue our intangible assets as there is no concept of indefinite lived intangible assets. If an Entity cannot determine useful life, then useful life is assumed to be 10 years.

Other Key Differences Full IFRS vs IFRS for SME’s

Borrowing costs:

We would usually capitalize borrowing costs and development costs are recognized completely as expense.

Depreciation and amortization:

Depreciation or amortization doesn’t need to be reviewed annually. Change in estimate are only required if there is any indication there is a change in use of asset.

It is however important to note that those entities that apply for IFRS for SME’s must follow the standard in its entirety and cannot cherry pick between the requirements of the SME’s standards and those of full IFRS Standards.

Why Spectrum Auditing?

Spectrum Auditing guides you with the laws and regulations of UAE, covering most compliances applicable as well as enable you deal with any queries pertaining to Risk Advisory, Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc., after reviewing your business.

As a pioneer in the field of auditing, accounting, taxation, and advisory services, we keep track of all the changes taking place in the UAE concerning laws, rules, and regulations. We keep our clients informed and regularly share the same information through our blog section or social media handles. Call us today for any kind of assistance at +971 4 2699329or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

With Spectrum Auditing’s expertise and tailored solutions, we empower businesses to navigate the complexities of corporate taxation, enabling them to thrive in the UAE’s dynamic business environment.

Disclaimer: This material and the information contained herein, prepared by SPECTRUM AUDITING, are intended for clients and professionals to provide updates and are not an exhaustive treatment of the subject. We are not, by means of this material, rendering any professional advice or services. It should not be solely relied upon as the basis for any decision which may affect you or your business. This update provides certain general information as well as specific information regarding SPECTRUM AUDITING. This update should not be regarded as comprehensive or sufficient for the purposes of any decision-making.

#corporatetax #spectrumauditing #spectrum #auditing #uaect # #icfr #transferpricing #businesssetup

contact us

contact us