IMPORTANT:

-

The Ministry of Finance has issued a new Cabinet Decision no. 100 of 2023 which replaces Cabinet Decision no. 55 of 2023.

-

The Ministry of Finance has issued a new ministerial decision no. 265 of 2023 which replaces ministerial Decision no. 139 of 2023.

The important things to note in the new cabinet decision no. 100 of 2023

The definition for Designated Zone has been slightly amended: A designated zone according to what is stated in Federal Decree-Law No. (8) of 2017 on Value Added Tax, and which has been included as a Free Zone in accordance with the Corporate Tax Law.

Qualifying Income

Qualifying income of a Qualifying Free Zone person shall include the following under Article 7 (2) –

- Income generated from doing transactions with a Free Zone person, except for income derived from excluded activities.

- Income generated from transactions with Non-free zone person but only if they are qualifying activities.

- Any other income of the Qualifying Free Zone Person that satisfies the de minimis requirements.

- Income derived from the ownership or exploitation of Qualifying Intellectual Property. (New amendment)

Now the income derived from Qualifying Intellectual Property is a new clause added to the Qualifying Income of a Qualifying Free Zone Person.

What is Qualifying Intellectual Property?

Qualifying Intellectual Property is defined as any Patent, Copyrighted Software, and any right functionally equivalent to a Patent that is legally protected and subject to a similar approval and registration process to a Patent.

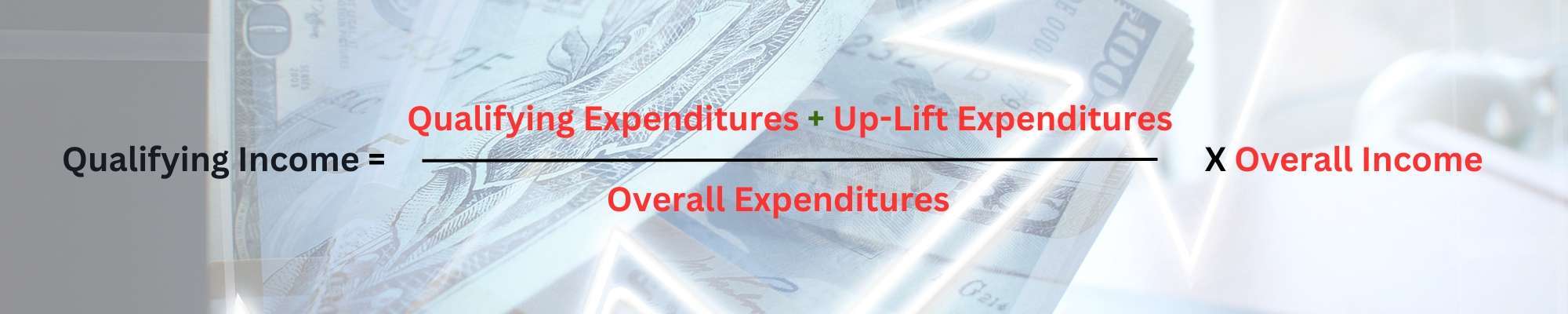

A formula is provided to calculate the amount of Qualifying income derived from Intellectual Property which aims to calculate the portion of income that qualifies for a 0% tax rate.

The formula provided is –

Where –

Qualifying expenditure – Expenditures incurred to fund Research & Development activities conducted by QFZP person or outsourced to person outside state that is not Related Party where the activities are directly connected with the creation, invention, or significant development of Qualifying Intellectual Property.

Overall Expenditures – Total expenditures incurred to fund Research & Development activities which include acquisition costs and qualifying expenditures.

Overall income – means royalties or any other income derived from QIP as determined according to the provisions of the CT Law, including embedded IP income derived from the sale of products and the use of processes directly related to the QIP as determined in accordance with the arm’s length principle.

Uplift Expenditure – means the qualifying expenditure increased by 30%. It should be ensured that the amount of qualifying expenditure after up-lift does not exceed the amount of overall expenditure.

De Minimis requirement

De minimis requirements shall be considered satisfied where income derived from non-qualifying activities is less than 5% of total revenue or AED 5 million whichever is lower.

Non-Qualifying revenue is Revenue derived from –

- Exclude activities.

- Activities that are not Qualifying activities where the other party of the transaction is non-free zone person.

- Transactions with Free Zone person where the person isn’t the beneficial recipient which means that doesn’t consume or enjoy the goods or service provide (New amendment).

Also, the following revenue will not be included in the calculation of non-qualifying revenue and total revenue –

- Revenue derived from immovable property.

- Revenue attributable to domestic Permanent Establishment or foreign Permanent Establishment. These permanent establishments will be treated as if it is a separate independent Person.

- Revenue derived from ownership or exploitation of Intellectual Property (New amendment)

Income derived from permanent establishment of a Qualifying Free Zone Person, or an immovable property located in a Free Zone will be taxed at 9% straight (without any minimum 0% threshold).

As income from Qualifying Intellectual Property is a new amendment in Cabinet decision no. 100 of 2023. So, there are additional clauses for Income derived from Qualifying Intellectual Property which are –

- Qualifying income derived from ownership or exploitation of Qualifying Intellectual Property shall be calculated in accordance with a decision issued in the future by the Ministry of Finance.

- Income derived from the ownership or exploitation of intellectual property that is not Qualifying Intellectual Property and income in excess of Qualifying Income calculated shall be taxed at 9% straight (without any minimum 0% threshold).

Adequate Substance

- A Qualifying Free Zone Person shall undertake its core income generating activities in a Free Zone or Designated Free Zone depending on where such activities are required to be conducted.

They should also have adequate number of assets, qualified full-time employees and also incur adequate number of operating expenditures.

- This core income generating activities can be outsourced to another Person in a Free Zone or Designated Free Zone depending on where such activities are required to be conducted.

- For Qualifying Intellectual Property, it can be outsourced to another Person in UAE or another Person who is not a Related Party outside UAE.

The important things to note in the new ministerial decision no. 265 of 2023

As mentioned in cabinet decision no. 100, Article 3, there is an exhaustive list of activities that are considered as qualifying activities.

Any income earned from these qualifying activities will be considered as qualifying income. The activities that have been added or amended in the new ministerial decision are –

- Trading of Qualifying Commodities (Definition of Qualifying Commodities – Metals, minerals, energy and agriculture commodities that are traded on a Recognized Commodities Exchange Market in raw form)

- Distribution of goods or materials in or from a Designated Zone

- Reinsurance services

- Fund management services

- Wealth and investment management services

- Financing and leasing of Aircraft

Why Spectrum Auditing?

Spectrum Auditing guides you with the laws and regulations of UAE covering most compliances applicable in the UAE. We enable you to deal with any queries pertaining to Value Added Tax (VAT), Risk Advisory, Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc., after reviewing your business.

As a pioneer in the field of auditing, accounting, taxation, and advisory services, we keep track of all the changes taking place in the UAE concerning laws, rules, and regulations. We keep our clients informed and regularly share the same information through our blog section or social media handles.

With Spectrum Auditing’s expertise and tailored solutions, we empower businesses to navigate the complexities of corporate taxation, enabling them to thrive in the UAE’s dynamic business environment. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

Disclaimer: This material and the information contained herein, prepared by SPECTRUM AUDITING, are intended for clients and professionals to provide updates and are not an exhaustive treatment of the subject. We are not, by means of this material, rendering any professional advice or services. It should not be solely relied upon as the basis for any decision which may affect you or your business. This update provides certain general information as well as specific information regarding SPECTRUM AUDITING. This update should not be regarded as comprehensive or sufficient for the purposes of any decision-making.

#corporatetax #spectrumauditing #spectrum #auditing #uaect # #icfr #transferpricing #businesssetup #UAEVAT #UAEFreezone

contact us

contact us