The following article is part 2 which is a continuation to our earlier article published on Tax Groups on 5th February 2024. You can read the article here: Tax Group & Other Relevant Provisions As Per UAE Corporate Tax Law.

How to determine the taxable income of tax group?

A tax group is treated as a single taxable person for purposes of Corporate Tax law.

The Parent Company shall calculate the Taxable Income after consolidating the financial results, assets and liabilities with all Subsidiaries and eliminating transactions between the Parent Company and any Subsidiary or between the Subsidiaries that are a member of the Tax Group.

Elimination of intra-group transactions:

Consolidation eliminates intra-group transactions between a parent company and its subsidiaries for the purposes of calculating the Tax Group’s taxable income.

The exception is where a member has recognized a deductible loss in a Tax period in respect of those prior to joining or forming a Tax Group.

- The exception can occur if a member of a tax group recognizes a loss on due to impairment of receivable due from another member of tax group before forming/joining the tax group. In this case there should not be elimination of intra-group transaction unless there is a reversal of the impairment previously recognized.

- Also, in case there is income related to this transaction it has to be included but would not allow the Tax group to claim additional deductible loss on such a transaction.

The exception is when there is a transfer of assets/ liabilities and there is a gain or loss on that transfer which was previously not taken into account, will be considered when the transferor or transferee leaves the tax group within 2 years from date of transfer.

Will we get the base rate exemption of AED 375,000 for every entity?

0% Corporate tax rate will only be limited to AED 375,000 regardless of number of entities included in Tax group.

Situations of Taxable income attribution between members of a Tax Group

Tax group is required to calculate Taxable income attributable to one or more members if its members in the following situations:

- A member has unutilized pre-Grouping Tax losses

- A member of Tax group can claim Foreign Tax Credit

- A member of Tax group has unutilized carried forward pre-Grouping Net Interest Expenditure

As previously mentioned after elimination of intra-group transaction the taxable income of the group is calculated, however the transactions between members of the Tax Group should also at Arm’s length principle (thereafter mentioned as ALP).

Are there any limitations on tax losses if one member of the Tax group is incurring tax losses?

Tax loss can be carried forward if the following are met –

- Ownership of Taxable person (in this case Parent company & its subsidiaries) hold alteast 50% ownership from start of period in which Tax loss is incurred to end of Tax Period in which the Tax Loss is used to offset against Taxable Income.

- There is a change in ownership of more than 50%, Tax Losses can still be carried forward provided the same or similar Business is carried on following the change in ownership.

In the situation that a new member has joined the Tax group and has losses being carry forward, then the Tax loss by the member can only be used to offset the taxable income of the tax group to the extent that the income is attributable to the new member.

Other points to note on tax loss of a tax group –

- Incase there is a tax loss during calculation of taxable income – that is tax loss of the group and not of any member of the group.

- If a subsidiary subsequently leaves tax group such a tax loss will remain with the tax group.

- If a tax group ceases to exist, then such a tax loss will remain with the parent company.

What if there are lending transactions between Tax Group members, how does Net interest expenditure affect the Tax Group?

If there is a loan given between members of the tax group and interest relates to a loan from a member of a Tax Group and if there are limitations due to Article 30 (General Interest Deduction Limitation Rule) and Article 31 (Specific Interest Deduction Limitation Rule) of CT law.

Then the corresponding interest income of the lender member of the Tax group will also be reduced when calculating taxable income.

What is the impact Foreign Tax Credit can have on a Tax Group?

Foreign tax credit as defined as per Article 47 of Federal Decree Law no. 47 of 2022: An amount of tax paid in foreign jurisdiction may be considered to be of a similar character to Corporate Tax where the amount is imposed by, and payable to, a non-UAE government, and the payment of such an amount is compulsory and enforceable by law in that foreign jurisdiction. In addition, the amount should be imposed on profit or net income.

When a member of tax group has a taxable income from foreign source which is subject to UAE corporate tax, such a person can claim a foreign tax credit by deducting such tax paid in when paying tax on such income in UAE.

In accordance with Double Taxation agreements between UAE & foreign jurisdictions, the amount of Foreign Tax Credit will be lower of –

- Amount of Corporate tax paid in foreign jurisdictions.

- Amount of Corporate tax due on foreign sourced income.

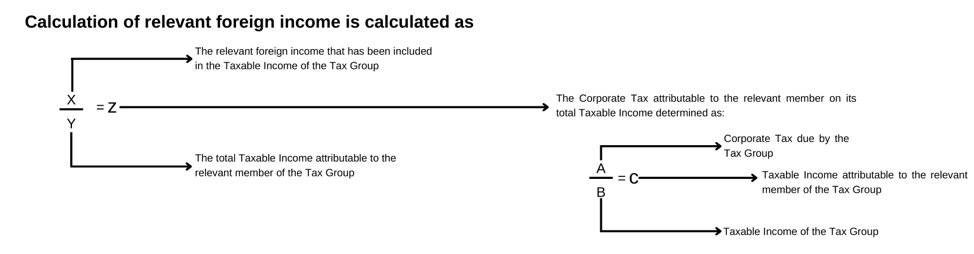

In such a case, the amount of taxable income attributable to that member of the tax group shall be calculated separately in the following manner:

What if members of the Tax Group have a foreign Permanent Establishment?

Taxable person can elect to exclude the net income of its Foreign Permanent Establishment (thereafter referred to as PE).

In case of Tax group –

- The Parent company is responsible for the election.

- For a new subsidiary joining the Tax group, election will still need to be made for any Foreign PE held by such subsidiary.

Since a Foreign PE is same as the head office, all income & expenses need to be allocated between PE and head office. Additionally, Arm’s length pricing has to be followed for transactions between the Taxable person and Foreign PE.

If the head office is in a Tax Group, then transactions with other members of the Tax Group will not affect the overall result of the Tax Group. Foreign PE profits are determined as if the Tax Group didn’t exist, considering transactions with other members based on the arm’s length standard.

When multiple Tax Group members have a Foreign PE in the same country, each establishment’s income or loss is calculated separately before aggregation. This approach avoids the need to eliminate and reintroduce transactions between Foreign PE and head offices of other establishments.

Why Spectrum Auditing?

Spectrum Auditing guides you with the laws and regulations of UAE, covering most compliances applicable as well as enable you deal with any queries pertaining to Risk Advisory, Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc., after reviewing your business.

As a pioneer in the field of auditing, accounting, taxation, and advisory services, we keep track of all the changes taking place in the UAE concerning laws, rules, and regulations. We keep our clients informed and regularly share the same information through our blog section or social media handles. Call us today for any kind of assistance at +971 4 2699329or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

With Spectrum Auditing’s expertise and tailored solutions, we empower businesses to navigate the complexities of corporate taxation, enabling them to thrive in the UAE’s dynamic business environment.

contact us

contact us