Spectrum Auditing offers comprehensive Risk Advisory services to help organizations proactively identify, assess, and manage risks. Our team of experienced professionals leverages industry expertise and cutting-edge techniques to develop tailored strategies for risk mitigation. From risk assessments and regulatory compliance to cybersecurity and business continuity planning, we provide practical solutions to safeguard your organization’s financial performance, reputation, and operational resilience. Trust Spectrum Auditing for effective risk management that supports your strategic objectives.

Risk Advisory

Spectrum Risk Advisory Services

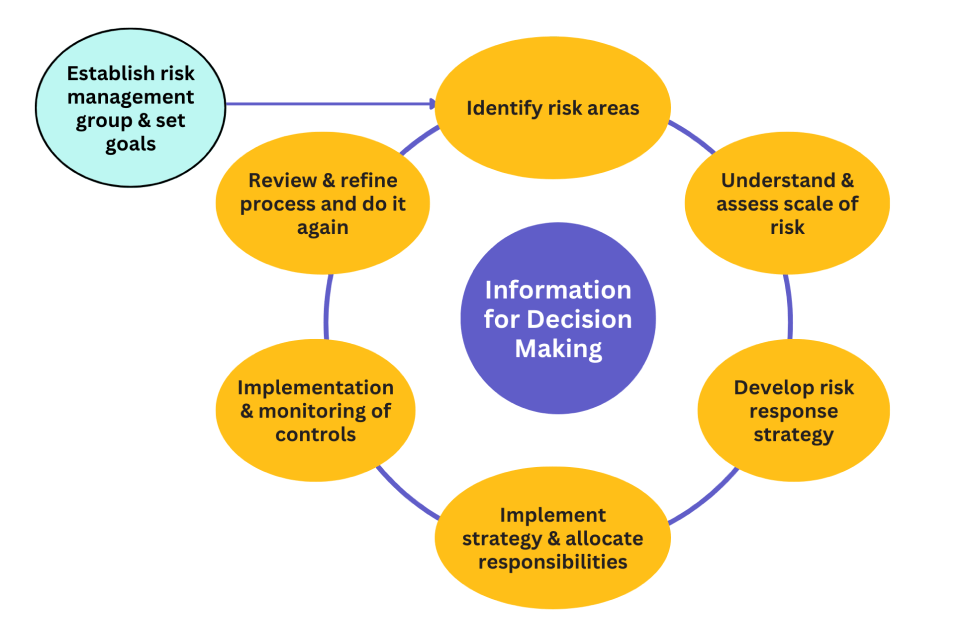

1. Enterprise Risk Management (ERM) Services

Risk is intrinsic to business. With empirical evidence showing that 50 % of small and medium-sized enterprises (SMEs) close down before completing their fifth year, it is clear that operating a business can be a risky endeavor.

Enterprise Risk Management (ERM) is a comprehensive, systematic approach that helps organizations identify, assess, priorities and respond to risks proactively in order to meet its most critical objectives and related initiatives and day-to-day operations.

Benefits of Enterprise Risk Management

Increasing the range of opportunities

By considering all possibilities—both positive and negative aspects of risk—management can identify new opportunities and unique challenges associated with current opportunities.

Identifying and managing risk entity-wide

Risk can originate in one part of the entity but impact a different part. Consequently, management identifies and manages these entity-wide risks to sustain and improve performance.

Increasing positive outcomes and advantages while reducing negative surprises

ERM allows entities to improve their ability to identify risks and establish appropriate responses, reducing surprises and related costs or losses, while profiting from advantageous developments.

Reducing performance variability

ERM allows organizations to anticipate the risks that would affect performance and enable them to put in place the actions needed to minimize disruption and maximize opportunity.

Improving resource deployment

Every risk could be considered a request for resources. Obtaining robust information on risk allows management, in the face of finite resources, to assess overall resource needs, prioritize resource deployment and enhance resource allocation.

Enhancing enterprise resilience

An entity’s medium- and long-term viability depends on its ability to anticipate and respond to change, not only to survive but also to evolve and thrive. This is, in part, enabled by effective enterprise risk management.

2. Internal Audit Services

Our Internal Audit Services, utilizes a risk-based approach to identify areas for evaluation. Provides greater scrutiny of emerging and strategic risk areas, adding value to the business and providing meaningful insights to management.

Our experienced professionals shall carry out Internal Audit Services as per Internal Audit Methodology & Approach in line with Institute of Internal Auditor (IIA)’s standards and the UAE Federal Internal Audit methodology issued in the Cabinet resolution #3 of 2019. We provide below different services offerings:

Internal Audit Outsourcing, to independently manage the internal audit function for clients.

Internal Audit Co-Sourcing, to work with client’s Internal Audit function to carry out internal audit services.

Staff Augmentation, to provide Internal audit staffs to client for specific engagement or period.

Setting up Internal Audit Function by documenting internal audit policy, guidelines, charter, Initial Risk Assessment, hiring of internal audit team and provide training

Quality Assurance Review of client internal audit approach, documentation as per IIA standards.

Training Internal Audit Function on internal audit approach, quality standards and on auditing different business process of client.

3. Internal Control Over Financial Reporting (ICFR)

ICFR means a process which is implemented by those charged with governance and management to provide reasonable assurance that a mechanism of Internal Control is in place for the reliability of financial statement.

Misstatements in a financial statement may occur, for example, due to mathematical errors, misapplication of Accounting Standards, or intentional misstatements (fraud). A system of ICFR should address these possibilities. The risk of fraudulent, financial reporting is a key consideration in the design and operation of ICFR.

Our experienced professionals shall carry out assessment of Internal Control over Financial Reporting (ICFR), covering the following:

Framework Development

We develop entity specific ICFR framework based on financial reporting standards and leading control practices.

Operation Assessment

For reporting risks and their mapping with financial statements.

Control Design Review

Assess design adequacy of existing controls related to financial reporting.

Improving Internal Practices

Brings value to business through re-engineering existing processes and introducing leading digital practices to strengthen control design.

Effectiveness Testing

To ensure that transactions executed during the period comply with the financial reporting requirements.

Documentation and Reporting

Provide an effective governance culture identifying clear roles, timelines, templates and other requirements.

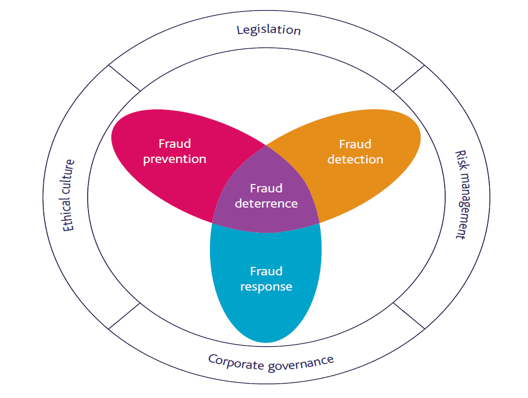

4. Fraud Risk Management

Reputation for integrity is crucial to safeguarding market confidence and public trust. Fraud and misconduct can seriously undermine such efforts, exposing an organisation to legal, regulatory, or repetitional damage.

We work with client in variety of situations.

- Company experiences a problem, and you want to take steps to reduce the likelihood of recurrence.

- Internal audit or compliance functions would benefit from heightened levels of objectivity or specialisation in assessing your program.

- Management team needs to identify fraud and misconduct risks when performing due diligence on acquisition targets or business partners.

Fraud Risk Management Approach

5. Process Manual & Standard Operating Procedures (SOP’s)

Policies & procedure, helps in streamline the business activity and standardize the procedure with clarity in roles & responsibilities.

We help improve business process by providing the following services:

Standard Operating Procedures

It standardizes the process, serves to instruct process owners and clarifies doubts within a process. We review the existing process in detail, identifying relevant internal controls to mitigate the gaps. We prepare Internal Control Systems for companies in order to ensure that SOPs are properly implemented. We review systems, forms and MIS reporting templates, and re-design the reporting formats as per the business requirements.

Preparation of Policy Manuals

We create policy manuals that ensure smooth operations across different functions & levels. Such policy manuals cover all departments such as; HR, Sales, Procurement, IT, Finance, Internal Audit, etc. We help companies prepare their Corporate Governance Manuals and Delegation of Authority Matrix.

Preparation for ERP Implementation

We identify tasks that need to be automated based on the business processes mapped and help organizations to prepare a process flow understanding for different ERP vendors. Respective ERP capabilities are then evaluated, and we can help clients to identify the best options.

6. Corporate

Governance Services

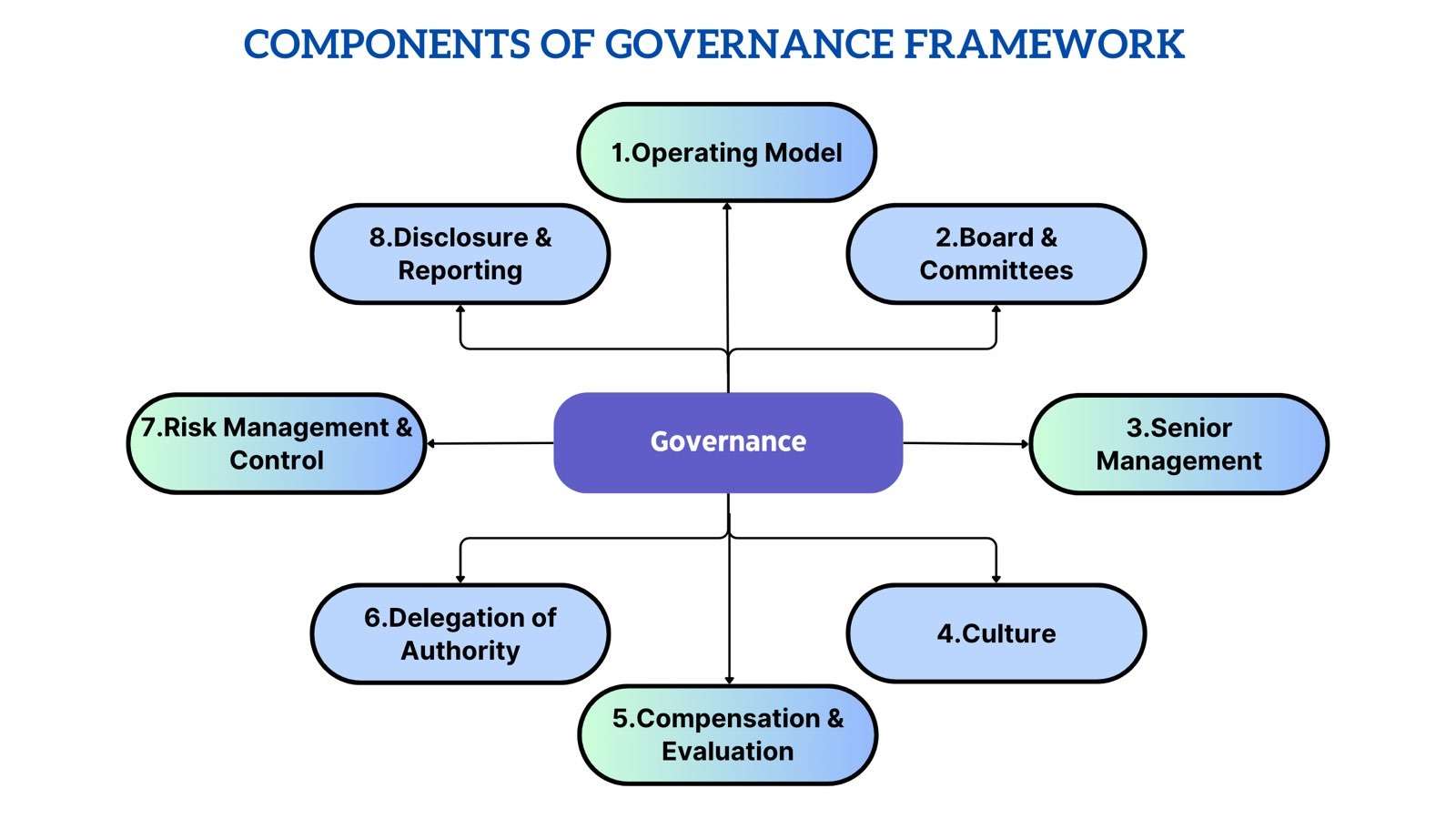

What is Corporate Governance

- It is the system of rules, practices, and processes by which companies are directed and controlled.

- It is fundamentally about improving transparency and accountability within existing systems.

- Facilitate effective, entrepreneurial and prudent management that can deliver the long-term success of the company.

- Boards of directors are responsible for the governance of their companies.

Corporate Governance in SME

Corporate Governance Code for Small Medium Enterprises (SME) in UAE is released by Dubai SME (Agency of Department of Economic Development, Government of Dubai) & Hawkamah (The Institute of Corporate Governance).

Spectrum experienced team, shall provide below services in Governance framework

- Board training

- Governance framework design

- Assessing governance structure in the context of the business environment and business risks, focusing on such areas as improving board operations, embedding governance principles in corporate culture, monitoring and evaluation, and stewardship

- Board self-assessment frameworks

- Design and implementation of internal control systems meeting both business and, if applicable, regulatory requirements (i.e. for each function – compliance, risk management and internal audit)

contact us

contact us