The Ministry of Finance and Federal Tax Authority (FTA) has issued a new guidance on November 06, 2023, on which accounting standards are accepted in the UAE for Corporate Tax purposes.

As per Ministerial Decision no. 114 of 2023 –

- Taxable persons have to prepare their financial statements as per International Financial Reporting Standards (IFRS)

- If the Taxable Person has less than AED 3 million in revenue, then they can opt for cash basis of accounting

- If the Taxable Person has less than AED 50 million in revenue, then they can opt for preparation of their financial statements as per IFRS for SME’s

- If it is a Tax Group, then consolidated financial statements have to be prepared as per IFRS or IFRS for SME’s

Any accounts not prepared under IFRS or IFRS for SME’s will be treated as a violation of Corporate Tax and may result in administrative penalties.

Audit requirement for Financial Statements:

The following have to maintain an Audited Financial Statements –

- If a Taxable Person has more than AED 50 million during the relevant Tax Period

- If a Tax Group has cumulative more than AED 50 million, then the consolidated Financial statements need to be audited as well. However, CT law does not require the Parent Company and Subsidiary Company(‘s) of the Tax Group to be separately audited

- Any Qualifying Free Zone persons

Accounting methods:

Accrual Basis of Accounting: Revenue and expenditure are recognized when they are earned or incurred and not when payments are received or made.

Cash Basis of Accounting: Revenue and expenditure are recognized when they are received, or payment is made respectively.

In case during the Tax Period, the Taxable Person exceeds more than AED 3 million then they would have to switch from Cash basis of Accounting to Accrual Basis of Accounting since they longer meet the conditions for cash basis of accounting. However, there is a potential to qualify this as an ‘exceptional circumstance’ which is one the discretion of the Federal Tax Authority (FTA).

Realization basis of accounting – Definition & terms to know:

Realized gains: Gains that have been converted into consideration/cash by completion of a transaction.

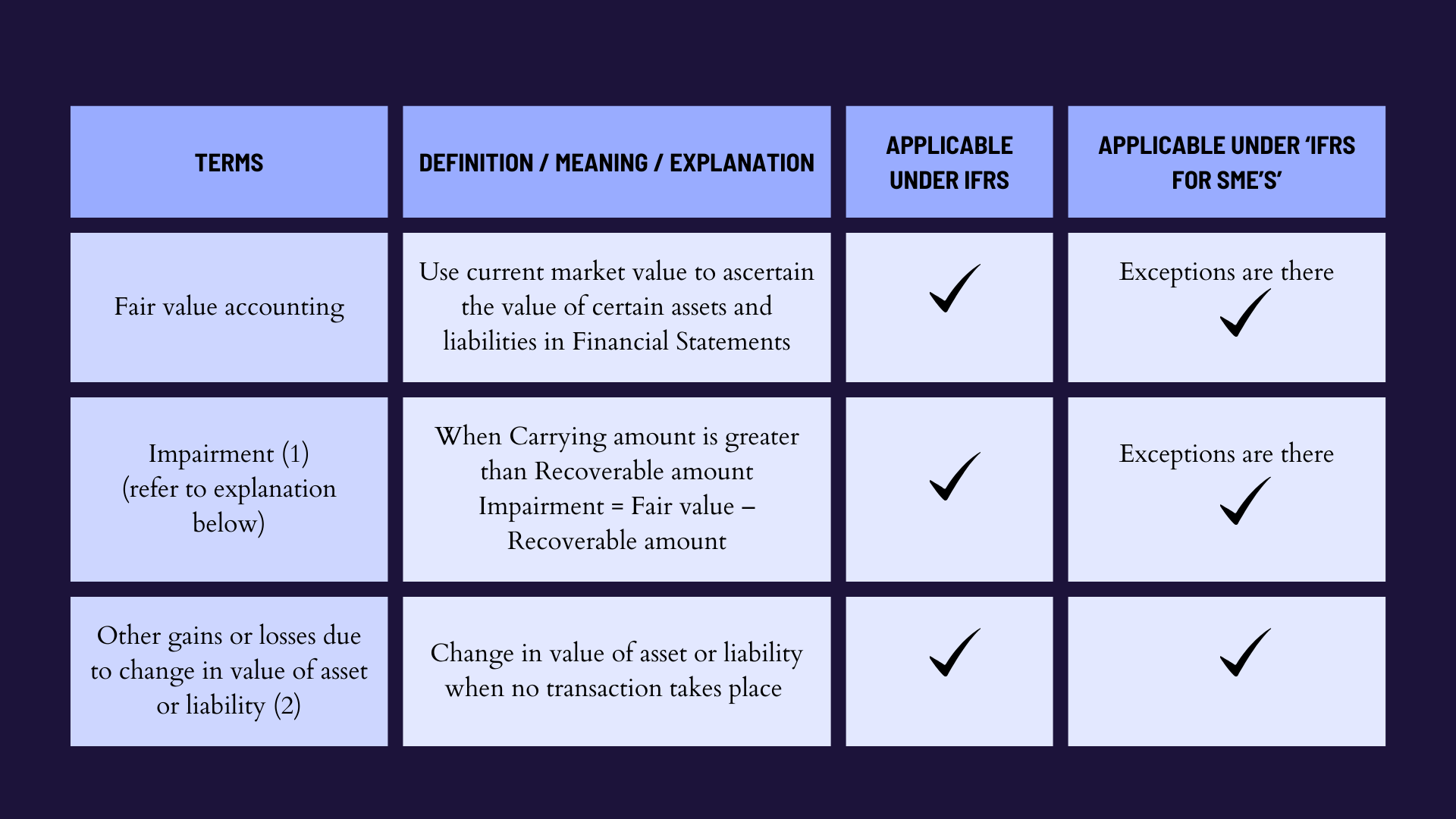

Unrealizaed gains: Gains not converted into any sort of consideration and can arise in respect of items such as fair value of accounting.

1Impairment – When you are valuing an asset or liability at fair value, the core principle is that it should not be carried in the Financial Statements of the entity at a value higher than the highest amount that can be recovered through its use or sale. In case the carrying amount is greater than recoverable amount, then the asset is said to be “impaired.”

Formula: Impairment = Carrying amount – Recoverable amount (If carrying amount > recoverable amount)

2For Corporate tax purposes – If there is a change in value of asset or liability even when no transactions take place, then there could be possible profits or losses arising from this even when no transaction takes place. An example could be the change in the exchange rate affecting the value of a foreign currency contract that is to be settled in future.

Hence, Taxable Persons who prepare their financial statements on an accrual basis can elect to consider gains and losses on a realization basis.

The timeline to make the election to use the realization basis – Must be made by the Taxable Person during the first tax period which will be at the time of submitting their first Tax Return. It is irrevocable once applying for it.

Effects of applying realization basis to Taxable income

When we take account of gains or losses on a realization basis then any unrealized gains or losses that would be recorded in the Taxable Persons financial statements are disregarded when calculation of Taxable income for Corporate Tax purposes.

If a Taxable Person has applied for realization basis, then they must make certain additional adjustments in respect to relevant aspects when calculating taxable income. The adjustments are as follows –

- Other than upon realization any depreciation, amortization, or other change in the value of an asset (other than a Financial Asset as defined under IFRS 9) should be excluded from the accounting income when calculating taxable income.

- Other than upon realization any change in value of a liability should be excluded from the accounting income when calculating taxable income.

Other Adjustments to Accounting income

1. Related Party transactions

Any transaction or arrangement between Related Parties (defined as per Article 34 of Corporate Tax law) must meet the arm’s length principle. If it exceeds or is lower than market value, then appropriate adjustments have to be made.

2. Consideration in excess of Market Value

The following adjustments apply an adjustment if amount of consideration paid is more than Market Value –

- Adjustment can be applied when asset is held and used by recipient. Excluding any depreciation, amortization or change in value related to Net Book Value (NBV) and Market Value. Recipients can choose to recognize excess amount as an adjustment in their taxable income.

- Adjustment is applied when recipient sells or realizes the asset. The recipient can add any difference between the net book value and the market value when calculating their gains or losses.

If the net book value of the asset or liability becomes equal to or less than the Market Value, or an election is made to recognize the excess amount derived from the difference between the net book value and the Market Value in Taxable Income the adjustments under paragraphs (a) and (b) above will no longer be required.

3. Consideration in lower of Market Value

The following adjustments apply an adjustment if amount of consideration paid is lower than Market Value –

- In cases other than when the asset or liability is sold: Exclude any changes in value that relate to the difference between the Market Value and the net book value of the asset or liability recognized by the recipient when it was transferred.

- When the asset or liability is sold by the recipient: Reduce the gain by the difference between the Market Value and the net book value at the time of transfer, except for any amount not included in taxable income as mentioned in paragraph (a).

If the net book value becomes equal to or higher than the Market Value, the adjustments in paragraphs (a) and (b) are no longer necessary for that asset or liability.

4. Cost Method of Accounting to replace Equity method of accounting

Parent companies (not in tax groups) apply special rules to account for investments in associates as per “IAS 28 – Investment in Associates.”

The parent company records its proportionate share of the equity accounted investment’s financial results in the income statement or statement of other comprehensive income and the profit distributions received reduce the carrying value of the investment.

The parent company should replace it with Cost method of accounting. This means that in its Taxable Income calculation, the Parent Company should not include the share of income or loss of the equity accounted investment.

5. Other deductions

Any expenditure that does not qualify under general tax deduction rules will not be allowed. (Article 28 to Article 33 of the Corporate Tax law)

Capital expenditure – As defined as per Article 7 (4) of Ministerial decision no. 134 of 2023 says that it is capital in nature is that which is treated as such under the Accounting Standards applied by the Taxable Person.

Arm’s length principle: Opening balance sheet amounts

Items in the opening balance sheet relating to transactions with Related Parties, such as other group companies, should reflect arm’s length market pricing, consistent with the arm’s length principle. 90 Where this is not the case, any deductible or taxable amounts in the first and subsequent Tax Periods (where relevant) should be adjusted to reflect the arm’s length basis.

Other matters that are mentioned in the guidance –

- Gains on disposal of Qualifying Immovable Property (meets definition of Article 2, Cabinet decision no. 56 of 2023)

- Gains on disposal of Qualifying Intangible Assets (meets definition of Article 3, Cabinet decision no. 56 of 2023)

- Computing gains or losses of Qualifying Financial assets and Qualifying Financial liabilities.

- Impact when relevant assets and liabilities are owned by another member of a Qualifying Group (meets definition of Article 26 of Corporate Tax law) or Tax Group (meets definition of Article 40 of Corporate Tax law)

Why Spectrum Auditing?

Spectrum Auditing guides you with the laws and regulations of UAE, covering most compliances applicable as well as enable you deal with any queries pertaining to Risk Advisory, Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc., after reviewing your business.

As a pioneer in the field of auditing, accounting, taxation, and advisory services, we keep track of all the changes taking place in the UAE concerning laws, rules, and regulations. We keep our clients informed and regularly share the same information through our blog section or social media handles. Call us today for any kind of assistance at +971 4 2699329or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

With Spectrum Auditing’s expertise and tailored solutions, we empower businesses to navigate the complexities of corporate taxation, enabling them to thrive in the UAE’s dynamic business environment.

Disclaimer: This material and the information contained herein, prepared by SPECTRUM AUDITING, are intended for clients and professionals to provide updates and are not an exhaustive treatment of the subject. We are not, by means of this material, rendering any professional advice or services. It should not be solely relied upon as the basis for any decision which may affect you or your business. This update provides certain general information as well as specific information regarding SPECTRUM AUDITING. This update should not be regarded as comprehensive or sufficient for the purposes of any decision-making.

#corporatetax #spectrumauditing #spectrum #auditing #uaect # #icfr #transferpricing #businesssetup #esr #aml #economicsubstance #accountingstandards #ifrs

contact us

contact us