In today’s dynamic business landscape, effective payroll processing stands as a cornerstone of organizational success. The following article delves into ‘The Crucial Impact of Expert Payroll Processing in Organizational Excellence,’ exploring the pivotal role played by meticulous payroll management. From ensuring timely and accurate compensation to using payroll software effectively, this article navigates through the intricacies of payroll processing and sheds light on why it is important for sustained organizational excellence.

What is payroll processing?

The systematic process of calculating the earnings of all employees of an organisation for the month after consideration of the employees’ attendance, viz., working days, casual leaves, and paid leaves, by including his components of salary of Basic and other allowances, subject to the terms and conditions mentioned in the employee’s offer letter by an employer and pay the salary. Further one need to calculate the employees end of service benefits which include leave salary and gratuity to make a provision for them in the books of accounts and which will be paid to the employees whenever they leave the company.

Why the proper payroll process is essential?

- To avoid mistakes in the calculation of the optimal salary of an employee, both employer and employee should not lose out on their hard-earned money

- To avoid mistakes in compliance with UAE laws, viz., WPS Compliance, proper calculation of Pension, Gratuity, and leave salary or any other benefits accumulated to employees lawfully

- Record the proper expenses in the books of accounts

- Employee satisfaction and retention

- Valuable Timesaving to the HR Department

- To make the books of accounts ready for Audit

What are the components of Salary, or what is meant by Salary Structure

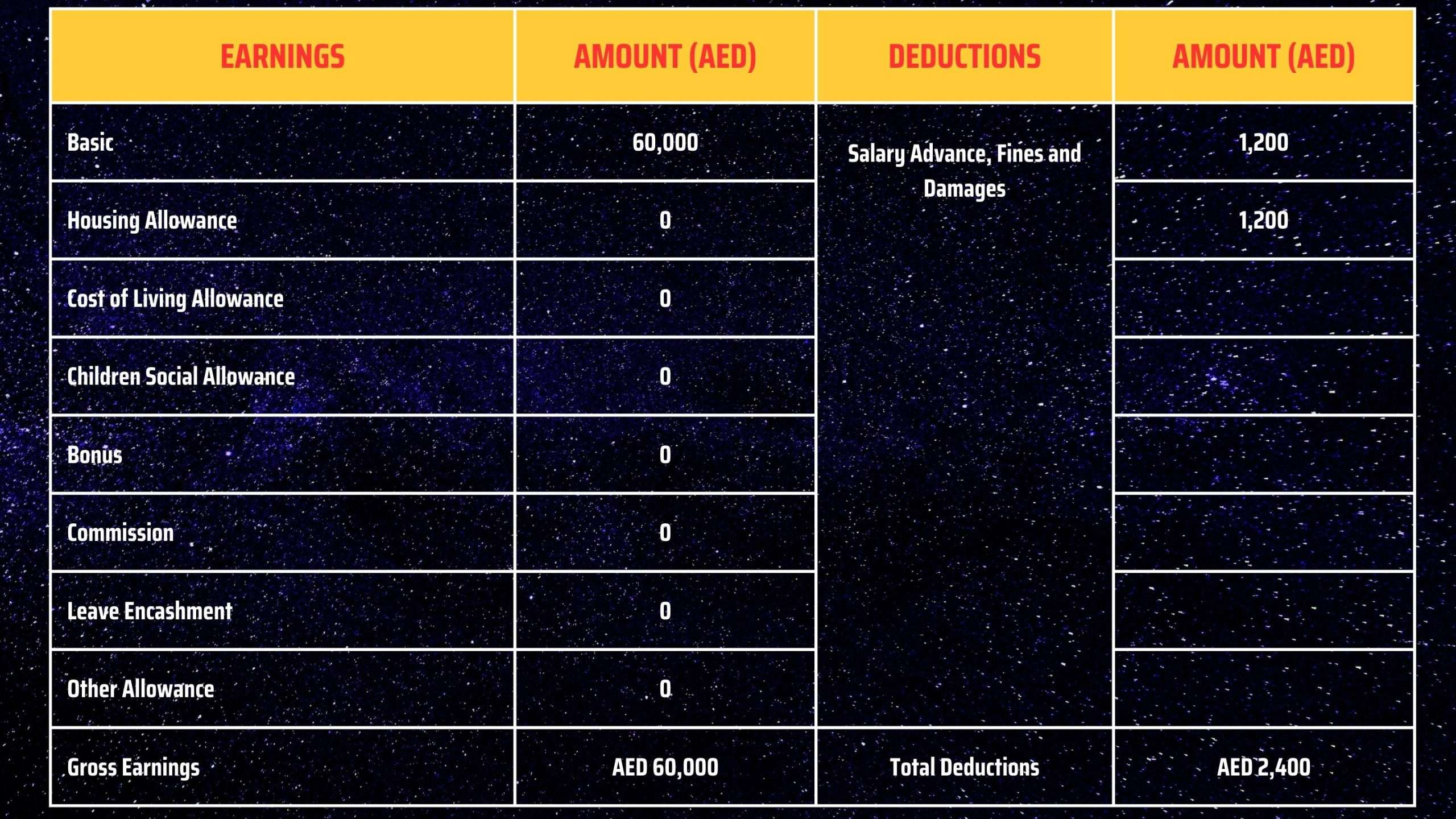

- It has mainly two components: earnings and deductions.

- One of the basic structures will be as follows:

General Pension and Social Security Authority (GPSSA):

The Social Security cover is offered for all working Emiratis against old age and disability/death due to work-related injury.

Employees Contribution: 5%

Employer’s Contribution: 12.5% (Public sector 15%)

What is meant by a payslip?

An authorised document from employer to employee with all the applicable components of salary for a particular month, as mentioned above, to let the employee know his salary break-up details; normally it will be issued every month.

Can we Outsource Payroll Processing?

Yes, we can outsource payroll processing based on a particular organisation’s cost & benefit analysis.

Pros: Professional Expertise, Time Saving, Accuracy, Compliance

Cons: Loss of control, Confidentiality Issues, Dependency. These Cons can be addressed by selecting the right outsourcing company. Spectrum can be one of the right outsourcing companies to take care of your payroll process outsourcing.

Can we use Payroll Software?

Yes, depending on the size of the organisation and the number of employees, it will be strongly recommended to go for payroll software. Zoho has come up with an updated version of Payroll application, we recommend you to opt for that for small to medium size organisations.

Why Spectrum Auditing?

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE concerning the changes in laws, rules, and regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it the Value Added Tax (VAT), Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us