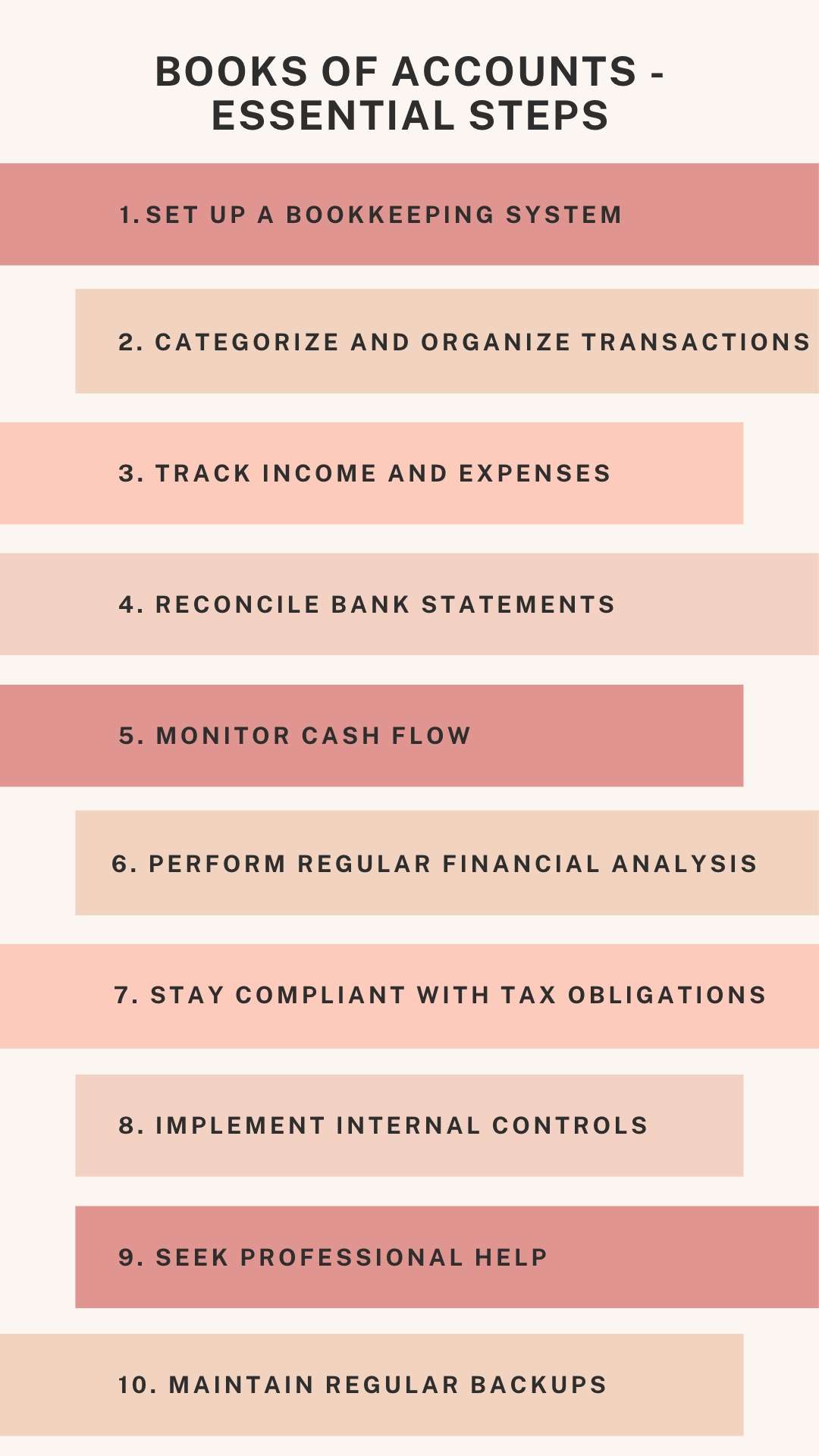

Keeping accurate and organized books of accounts is crucial for the smooth operation and long-term success of any business. Proper bookkeeping provides a clear picture of your financial health, helps in making informed decisions, ensures compliance with tax regulations, and enhances your credibility with stakeholders. In this article, we will guide you through essential steps to maintain your books of accounts effectively.

- Set Up a Bookkeeping System: Start by establishing a reliable bookkeeping system that suits your business needs. Choose between manual or digital methods, depending on the size and complexity of your operations. Digital accounting software, such as Zoho, QuickBooks or Xero, can streamline the process and offer automated features for efficient bookkeeping.

- Categorize and Organize Transactions: Create well-defined categories for income, expenses, assets, liabilities, and equity. Regularly classify and record transactions under the appropriate categories to maintain accuracy and facilitate financial analysis. Keep all physical and digital documents organized and easily accessible for reference and audit purposes.

- Track Income and Expenses: Record all sources of income and track expenses meticulously. Maintain separate accounts for different revenue streams, such as sales, services, or investments. Categorize expenses by type (e.g., rent, utilities, supplies) to analyze spending patterns and identify areas for cost optimization.

- Reconcile Bank Statements: Regularly reconcile your bank statements with your books of accounts. Compare the transactions and balances to ensure accuracy and identify any discrepancies or errors. This process helps uncover potential issues, such as missing payments, bank errors, or fraudulent activities.

- Monitor Cash Flow: Maintain a clear understanding of your cash flow by monitoring inflows and outflows. Prepare cash flow statements regularly to evaluate your business’s liquidity and forecast future financial needs. This analysis enables you to make informed decisions regarding investments, credit management, and operational expenses.

- Perform Regular Financial Analysis: Review and analyze your financial statements, such as the balance sheet, income statement, and statement of cash flows. Identify key performance indicators (KPIs) relevant to your business and track them consistently. This analysis provides valuable insights into your business’s profitability, growth, and financial stability.

- Stay Compliant with Tax Obligations: Adhere to tax regulations and maintain accurate records to ensure timely and accurate tax filing. Keep track of tax-deductible expenses, update tax rates, and stay informed about changes in tax laws. Consider consulting with a tax professional to maximize deductions and minimize the risk of penalties or audits.

- Implement Internal Controls: Establish internal controls to safeguard your financial data, prevent fraud, and maintain the integrity of your books. Implement segregation of duties, perform regular audits, and restrict access to sensitive financial information. Regularly review and strengthen your internal control procedures to adapt to your business’s growth and evolving risks.

- Seek Professional Help: Consider engaging a qualified accountant or bookkeeper to assist with complex accounting tasks or during periods of high growth. Their expertise can provide valuable insights, ensure compliance, and free up your time to focus on core business activities.

- Maintain Regular Backups: Regularly backup your digital accounting data to prevent the loss of critical financial information due to system failures, cyber-attacks, or accidental data loss. Use secure cloud storage or external hard drives to store backups off-site and ensure quick recovery in case of emergencies.

So, properly maintaining your books of accounts is an essential aspect of running a successful business. By implementing a robust bookkeeping system, organizing transactions, monitoring cash flow, and staying compliant with tax regulations, you can have accurate financial records that help you make informed decisions, improve profitability, and ensure long-term sustainability. Remember, seeking professional guidance and continuously updating your bookkeeping practices will contribute to the growth and success of your business.

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us