Empowering Emirati Workforce: Key Highlights of Ministerial Resolution No. 455/2023 for Private Sector Establishments with 20-49 Employees.”

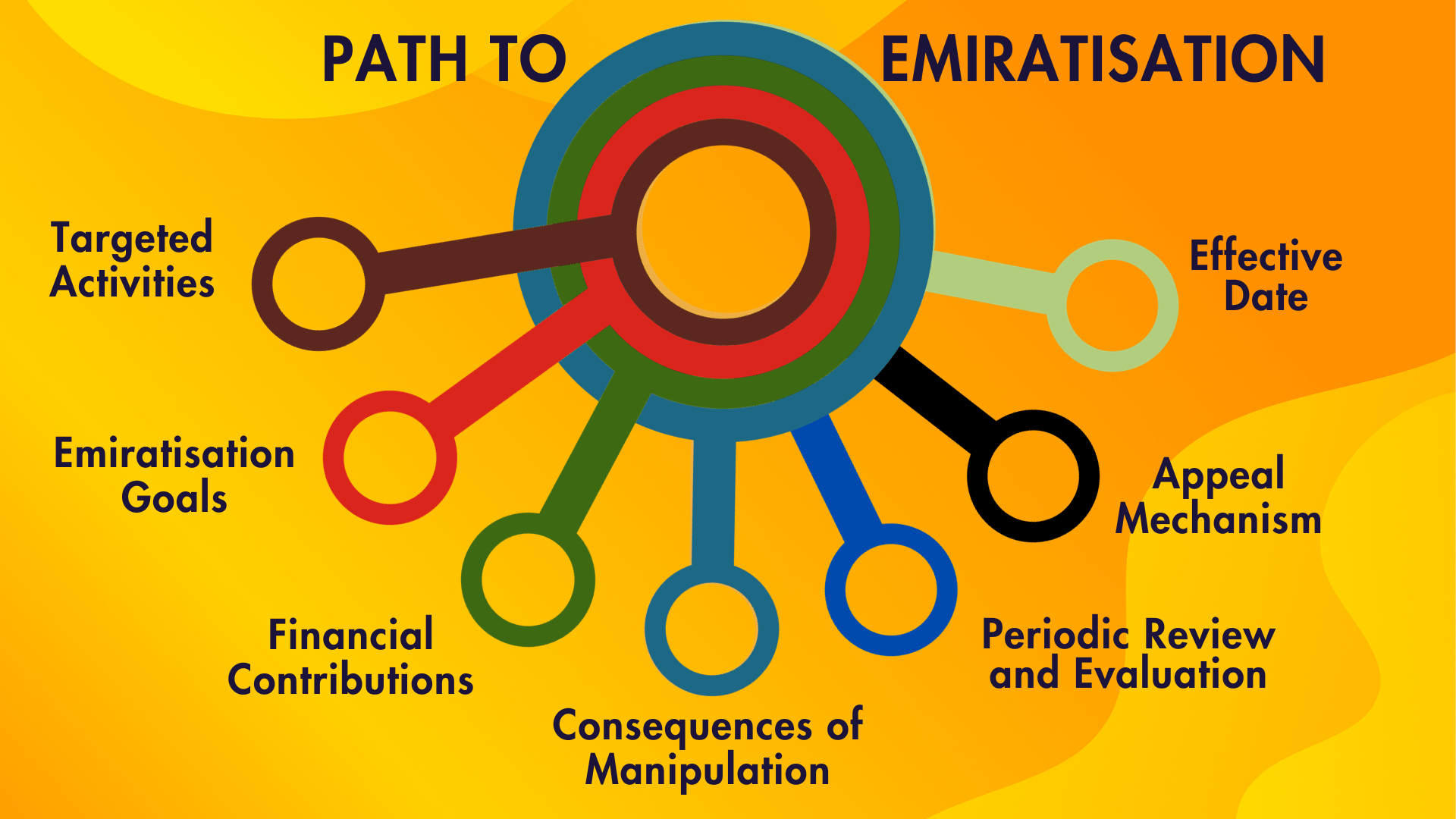

Emiratisation, the drive to boost local employment in the UAE, has taken a significant step forward with the introduction of Ministerial Resolution No. (455) of 2023. Let’s break down the key points of this resolution in plain language.

Article 1: Boosting National Employment

According to Cabinet Resolution No. (33/5) of 2023, private businesses with 20 to 49 employees are now under the spotlight. The goal? To increase the number of local employees. The specific economic activities listed in the attached schedule are considered, and the Ministry stays agile, responding to the needs of the private sector concerning Emiratisation. Establishments are then notified through the Ministry’s digital channels.

Article 2: Penalties for Non-Compliance

If businesses violate the Emiratisation targets set in Article 1, there are consequences. Starting from January 2025, they might have to pay a hefty sum (96,000 dirhams) if they haven’t hired any local employees in 2024. This contribution can be paid in monthly installments. The penalty increases if the trend continues, reaching 108,000 dirhams in January 2026 for non-compliance in 2025. If, after the target year, a business reduces its local workforce, it has two months to appoint another local employee or face the penalties mentioned. If contributions are not made, the procedure from Ministerial Resolution No. 279 of 2022 comes into play.

Article 3: Consequences of Misconduct

Engaging in manipulation, fraud, or providing inaccurate Emiratisation information is a serious offense. The fines specified in Cabinet Resolution No. 95 of 2022, along with any additional fines from existing legislation, will be applied if it’s proven that an establishment has committed such misconduct.

Article 4: Regular Check-ups

To ensure everyone is playing by the rules, establishments are subject to periodic review, control, and evaluation by specialized units within the Ministry. This ensures ongoing compliance with the implemented laws and decisions.

Article 5: Right to Appeal

In the spirit of fairness, establishments have the right to appeal decisions before the Ministry’s grievance committee, as outlined in Ministerial Resolution No. (45) of 2022.

Article 6: Implementation and Activation

The resolution gets its official stamp when published in the Official Gazette. From that moment, concerned authorities must kick into action, implementing the resolution within their respective jurisdictions.

In essence, this resolution aims to create a fair and robust system for Emiratisation in the private sector, encouraging businesses to actively contribute to the growth of the local workforce while maintaining transparency and accountability.

Expanding Horizons: Understanding Targeted Economic Activities

In conjunction with Ministerial Resolution No. (455) of 2023, a detailed table outlining primary and subsidiary targeted economic activities has been annexed. This adds another layer to the Emiratisation initiative, specifying sectors to receive focused attention for local employment growth. Let’s explore the diverse economic landscapes outlined in this document.

Primary Economic Activity and Subsidiary Economic Activity

- Information and Communication

- Computer Programming Activities

- Computer Consulting and Facilities Management

- IT and other computer service activities

- Data Processing, Web Hosting, and related activities

- Unclassified information service activities

- Financial and Insurance Activities

- Various Financial Brokerage Services

- Other financial services

- Securities and Commodities Brokerage Activities

- Associated activities with financial services

- Brokerage and Insurance Agents Activities

- Owned or Leased Real Estate Activities

- Real Estate Activities

- Activities and services related to Real Estate

- Professional, Scientific and Technical Activities

- Legal Activities

- Accounting, Bookkeeping, Auditing, and Tax Consultancy Activities

- Main Clerks’ Activities

- Management Consultancy Activities

- Architecture and Engineering Services

- Technical Tests and Analyses

- Advertising

- Market Research and Surveys

- Specialized Design Services

- Photography Activities

- Other professional, scientific, and technical activities

- Administrative and Support Services

- Temporary Employment Agencies Services

- Travel Agencies Services

- Tour Operators Activities

- Reservations and related services

- Integrated Office Management Services

- Photocopying, Document Preparation, and other office support activities

- Organizing conferences and trade exhibitions

- Other Administrative and Support Services

- Education

- Education Services

- Other types of education not elsewhere classified

- Education Support Activities

- Health and Social Welfare Activities

- Medical And Dental Clinics Activities

- Health-related activities

- Other social work activities

- Arts and Entertainment

- Creative, Arts and Entertainment Activities

- Operation of Sports Facilities

- Sports Clubs Activities

- Other Entertainment activities not elsewhere classified

- Mining and Quarrying Industry

- Oil and natural gas extraction support activities

- Mining and Quarrying Support Activities

- Manufacturing

- Printing-related services

- Basic Chemicals Industry

- Manufacturing of other chemicals

- Manufacturing generators, transformers, and distribution devices

- Manufacturing of mining, quarrying, and construction machinery

- Manufacturing of other products not elsewhere classified

- Construction

- Electrical installations

- Wholesale and Retail Trade

- Motor Vehicle Sales

- Wholesale

- Trading in textiles, garments, and footwear

- Trading in other household goods

- Computers and peripheral equipment for computers and software sales

- Electronics, communications equipment and spare parts sales

- Sale of machinery and other equipment

- Sale of solid, liquid, and gaseous fuels and related products

- Sale of metals and minerals

- Sale of building materials, metal construction materials, plumbing and heating equipment and supplies

- Retail sale of computers, computer peripherals, software, and communications equipment

- Retail sale of textiles

- Retail sale of pharmaceutical, medical, cosmetic and toiletry products

- Retail sale of other new commodities

- Electronic retail

- Transportation and storage

- Transportation of passengers by maritime vessels

- Storage

- Activities related to maritime transportation

- Cargo Handling

- Other transportation support activities

- Accommodation and Hospitality Industry Activities

- Hospitality activities for special events / occasions

Important Notes:

- The economic activities are classified according to the International Standard Classification of Economic Activities – Fourth Edition (ISIC4).

- The Ministry regularly updates these activities based on Emiratisation priorities in the private sector, ensuring adaptability to changing economic landscapes.

Conclusion:

Ministerial Resolution No. (455) of 2023 marks a significant step in the UAE’s commitment to enhancing Emiratisation in the private sector. By setting clear targets, introducing financial incentives, and ensuring consequences for non-compliance, the resolution aims to create a more inclusive job market and foster the growth of national talent in key economic activities. As businesses adapt to these new regulations, the impact on the employment landscape and overall economic development remains to be seen.

Why Spectrum Auditing?

Spectrum Auditing guides you with the laws and regulations of UAE, covering most compliances applicable as well as enable you deal with any queries pertaining to Risk Advisory, Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc., after reviewing your business.

As a pioneer in the field of auditing, accounting, taxation, and advisory services, we keep track of all the changes taking place in the UAE concerning laws, rules, and regulations. We keep our clients informed and regularly share the same information through our blog section or social media handles. Call us today for any kind of assistance at +971 4 2699329or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

With Spectrum Auditing’s expertise and tailored solutions, we empower businesses to navigate the complexities of corporate taxation, enabling them to thrive in the UAE’s dynamic business environment.

Disclaimer: This material and the information contained herein, prepared by SPECTRUM AUDITING, are intended for clients and professionals to provide updates and are not an exhaustive treatment of the subject. We are not, by means of this material, rendering any professional advice or services. It should not be solely relied upon as the basis for any decision which may affect you or your business. This update provides certain general information as well as specific information regarding SPECTRUM AUDITING. This update should not be regarded as comprehensive or sufficient for the purposes of any decision-making.

#corporatetax #spectrumauditing #spectrum #auditing #uaect # #icfr #transferpricing #businesssetup #esr #aml #economicsubstance #accountingstandards #ifrs

contact us

contact us