(Based on the public consultation document on corporate tax in the UAE released by the Ministry of Finance)

The United Arab Emirates (UAE) will introduce the federal Corporate Tax (CT) on business profits effective for financial years starting on or after 1 June 2023. As companies prepare for associating the corporate tax to their businesses, many will find it challenging to comprehend the process.

We at Spectrum Auditing assist our clients in incorporating the CT to their businesses. Here are some FAQs and their answers related to the computation and associated queries on corporate tax.

Q1) What is the basis of calculating taxable income?

Ans) The accounting net profit (or loss) as stated in the financial statements of a business is proposed to be the starting point for determining their taxable income. The financial statements are expected to be prepared based on the Generally Accepted Accounting Principles (GAAP) in UAE. International Financial Reporting Standards (IFRS) is what is generally followed across the companies in UAE, we need to see whether other GAAPs like US GAAP and others are also accepted when the law is published by the MoF.

Q2) What is the treatment of unrealised gains and losses?

Ans) The treatment of unrealised gains and losses depends on whether the gain or loss is related to capital items or revenue items. Unrealised gains or losses on capital items are not considered when calculating taxable income. Whereas unrealised gains or losses on revenue items will need to be considered when calculating taxable income.

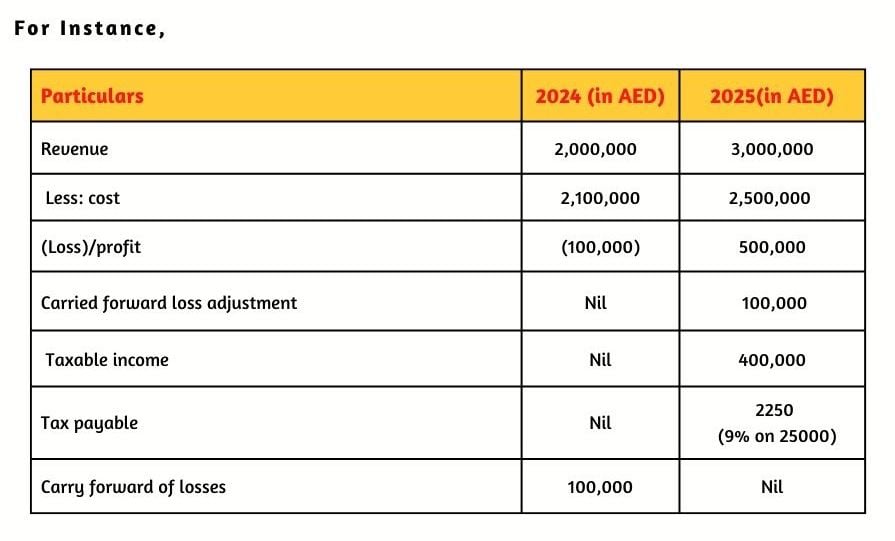

Q3) What is tax loss? How does a business set off such loss against future taxable income?

Ans) Tax loss for CT purposes is the excess of total deductions over the total income for the relevant financial period. A business will be able to offset a loss incurred in one period against the taxable income of future periods, up to a maximum of 75% of the taxable income in each of those future periods.

Tax losses can be carried forward indefinitely provided the same shareholder(s) hold at least 50% of the share capital from the start of the period a loss is incurred to the end of the period in which a loss is offset against taxable income. If there is a change in ownership of more than 50%, tax losses may still be carried forward provided the same or similar business is carried on by the new owners.

In the above-mentioned example, in 2024, the company had a tax loss of AED 100,000 which was eligible to be carried forward to 2025. In 2025, as the company had sufficient taxable profits, 2024 related carried forwarded tax loss of AED 100,000 is adjusted and tax is levied only on the net taxable amount after adjusting the carried forwarded tax loss from the previous year.

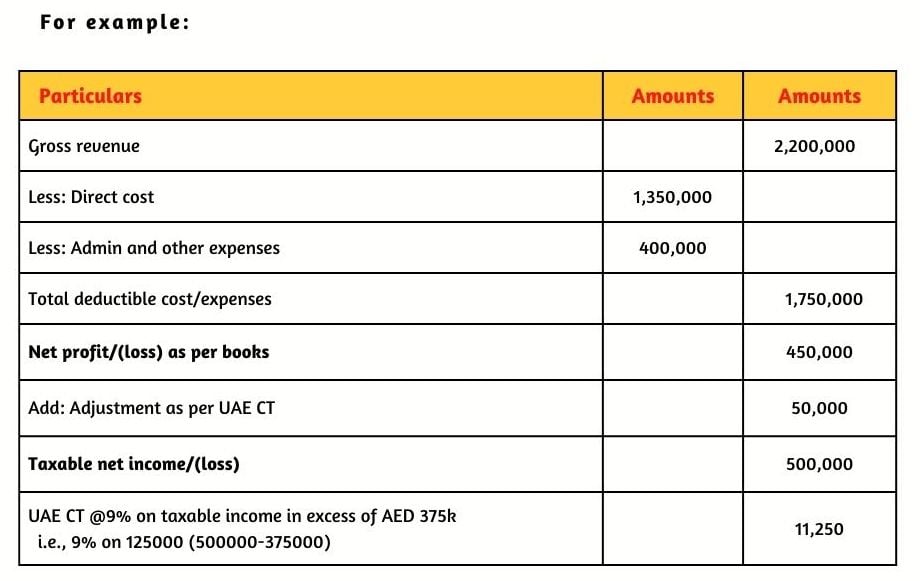

Q4) What is the rate of Corporate Tax?

Ans) The rate of corporate tax on the taxable income of a business will be as follows:

- 0%, for taxable income not exceeding AED 375,000; and

- 9%, for taxable income exceeding AED 375,000

(Besides, to support start-ups and small businesses, the UAE CT regime will provide relief for small businesses in the form of simplified financial and tax reporting obligations)

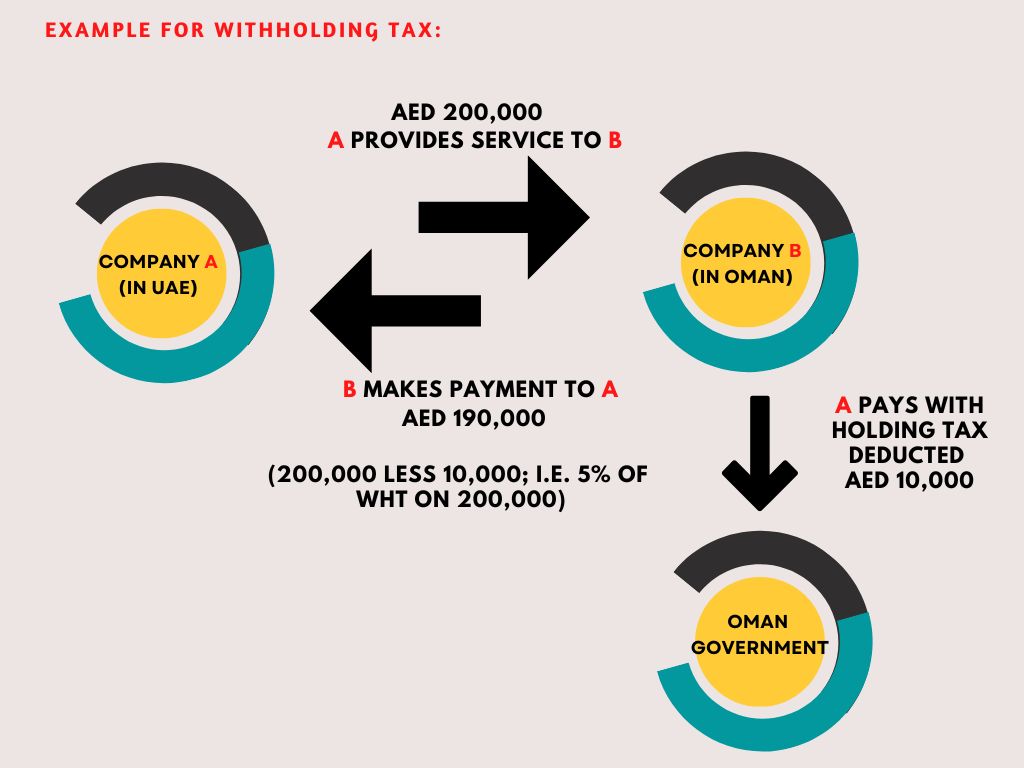

Q5) What is the rate of withholding tax applicable on domestic and cross-border payments made by UAE business?

Ans) Withholding tax is the tax collected at source by the payer on behalf of the recipient of the income. The rate of withholding tax is proposed to be at 0% and hence UAE businesses will not be required to make any deductions from payments made, nor will there be an obligation to file withholding tax returns.

The following income shall be subject to 0% withholding tax:

- UAE sourced income earned by a foreign company that is not attributable to a PE in the UAE of that foreign company

- Mainland UAE sourced income earned by a Free Zone person, unless the income is attributable to a mainland branch of that Free Zone person

- Dividends and other profit distributions made by a Free Zone person to a mainland UAE shareholder in the Free Zone person.

Note: since withholding tax rate is 0% in the UAE, example is based on Oman for understanding purpose.

Q6) Will foreign tax paid outside of the UAE be allowed as a corporate tax credit in the UAE?

Ans)Yes, the UAE CT regime will allow credit for the tax paid in a foreign jurisdiction against the UAE CT liability. The maximum foreign tax credit available will be the lower of:

- The amount of tax that paid in the foreign jurisdiction; or

- The UAE CT payable on the foreign sourced income.

For example-

| Particulars | Amount |

| Income | 3,000,000 |

| Less: cost | 2,200,000 |

| Profit | 800,000 |

| Tax on the above | 38,250 |

| Less: WHT paid @5% | 10,000 |

| Net tax payable | 28,250 |

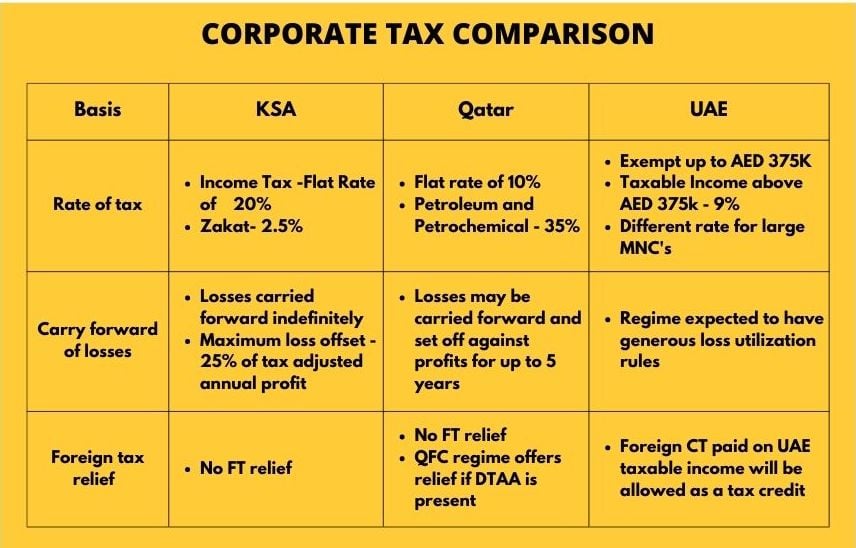

Since the corporate tax has already been introduced in the GCC region, let’s have a look at the key comparisons between some of the GCC peers:

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Audit Intern

contact us

contact us