(Based on the public consultation document on corporate tax in the UAE released by the Ministry of Finance)

The United Arab Emirates (UAE) will introduce the federal Corporate Tax (CT) on business profits effective for financial years starting on or after 1 June 2023. As companies prepare for associating the corporate tax to their businesses, many will find it challenging to comprehend the process.

We at Spectrum Auditing assist our clients in incorporating the CT to their businesses. Here are some FAQs and their answers related to the upcoming Federal Corporate Tax in the UAE.

Q1) When will Corporate Tax come into effect?

Ans) Corporate Tax will apply in the country for financial years starting on or after June 1, 2023.

For example: –

Businesses whose financial year begins on July 1,2023 and ends on June 30, 2024 will be subject to corporate tax in the UAE from July 1,2023 (which is the start of the first financial year starting on or after June 1, 2023).

Businesses whose financial year begins on April 1, 2023 and ends on March 31,2024 will subject to corporate tax in the UAE from April 1, 2024 (which is the start of the first financial year starting on or after June 1, 2023).

Q2) Who will be subject to the UAE corporate tax?

Ans)

- A legal entity incorporated in the UAE.

- A legal entity that is not incorporated in the UAE but is effectively managed and controlled in the country (such businesses will be treated as if they were UAE incorporated entities).

- A foreign legal entity having permanent establishment in the UAE or that earn UAE sourced income.

- A natural person who is engaged in a business in the UAE. (This will include sole establishments or proprietorships and individual partners in an unincorporated partnership that conducts business in the UAE).

Q3) What determines whether a foreign company has Permanent Establishment (PE) in UAE?

Ans) The idea behind PE concept is to check whether a company has established their sufficient presence in UAE to attract Corporate Tax for their business profits. Following are the two main tests that determines whether the activities of a foreign company trigger permanent establishment for them in the UAE:

- Fixed place of business test

- Dependent agent test

If a foreign company meets both the above test, then such foreign company is considered as having PE in UAE and may become subject to UAE Corporate Tax.

Q4) What is fixed place of business test?

Ans) Any foreign business having any of the following in UAE will be considered as having fixed place of business:

- Foreign company will have a PE in the UAE if it has a fixed place of business in UAE through which their business is wholly or partly carried on.

- Fixed place of business may be a place of management, a branch, an office (including a temporary field office or an employee’s home office, a factory, a workshop, real property or building site where activities are carried on for more than 6 months.

- If the activities carried out through fixed place in the UAE are preparatory or auxiliary in nature, PE won’t get triggered in such a case. Eg: attending seminars, performing market research etc.

- If a fixed place in the UAE is used only to store, display and deliver foreign company’s goods in order to make them available to another person for processing, the same won’t be considered as permanent establishment in the country.

Q5) What is dependent agent test?

Ans) If a foreign company doesn’t have fixed place of business in the UAE, sometimes activities of their dependent agent determines whether it has PE in the country. This test may be met when business travellers or UAE based persons act on behalf of the foreign company and habitually exercise the authority to conclude contracts in the name of the company.

Q6) What determines whether a natural person engaged in a business is subject to UAE CT?

Ans) This would generally depend on whether the activity engaged requires the individual to obtain a commercial license or equivalent permit from the relevant competent authority (e.g., the relevant department of economic development or registration authority of a free zone) in the UAE.

Q7) Do employment income and other personal income earned by individuals fall within the scope of the proposed UAE CT regime?

Ans) No. Employment income and other personal income earned by UAE and foreign individuals such a dividend, rental receipts from UAE real estate investments and other investment income will not be within the scope of the proposed UAE CT regime.

Q8) How does the UAE CT align the tax treatment of unincorporated partnerships in a cross-border context?

Ans) Unincorporated partnerships are treated as transparent entities in the UAE CT regime. This means Partnerships will not be taxpayers in their own right, but their income will instead flow through and be taxed in the hands of the partners or members. Investing in and through unincorporated partnerships in a cross-border context can create difficulties when the other country taxes the partnership as if it were a company. To align this tax treatment, the UAE CT treatment of foreign unincorporated partnerships would generally follow the tax treatment of the partnership in the respective foreign jurisdiction.

Q9) Who is exempt from the UAE corporate tax?

Ans)

- The UAE Federal/Emirate Government and their department, authorities or other public institution.

- A wholly Government-owned UAE company that carries out a sovereign or mandated activity and that is listed in a cabinet decision.

- A business engaged in the extraction and exploitation of UAE natural resources that is subject to Emirate-level taxation.

- A charity or another public benefit organisation that is listed in a Cabinet Decision.

- A public or regulated private social security or retirement pension fund.

- A regulated investment fund that has applied for an CT exemption.

Q10) Would commercial activities conducted by Government be subject to UAE CT?

Ans) Yes, any business activity carried out directly by the Government under a trade license will be within the scope of the UAE CT regime.

Q11) How does charities and public benefit organisations avail exemption from UAE CT?

Ans) Through an application made to the Ministry of Finance to be exempted from UAE CT. Although this exemption is at the discretion of the Ministry of Finance. If the application is approved, the organisation will be listed in a Cabinet Decision to be issued at the request of the Minister of Finance.

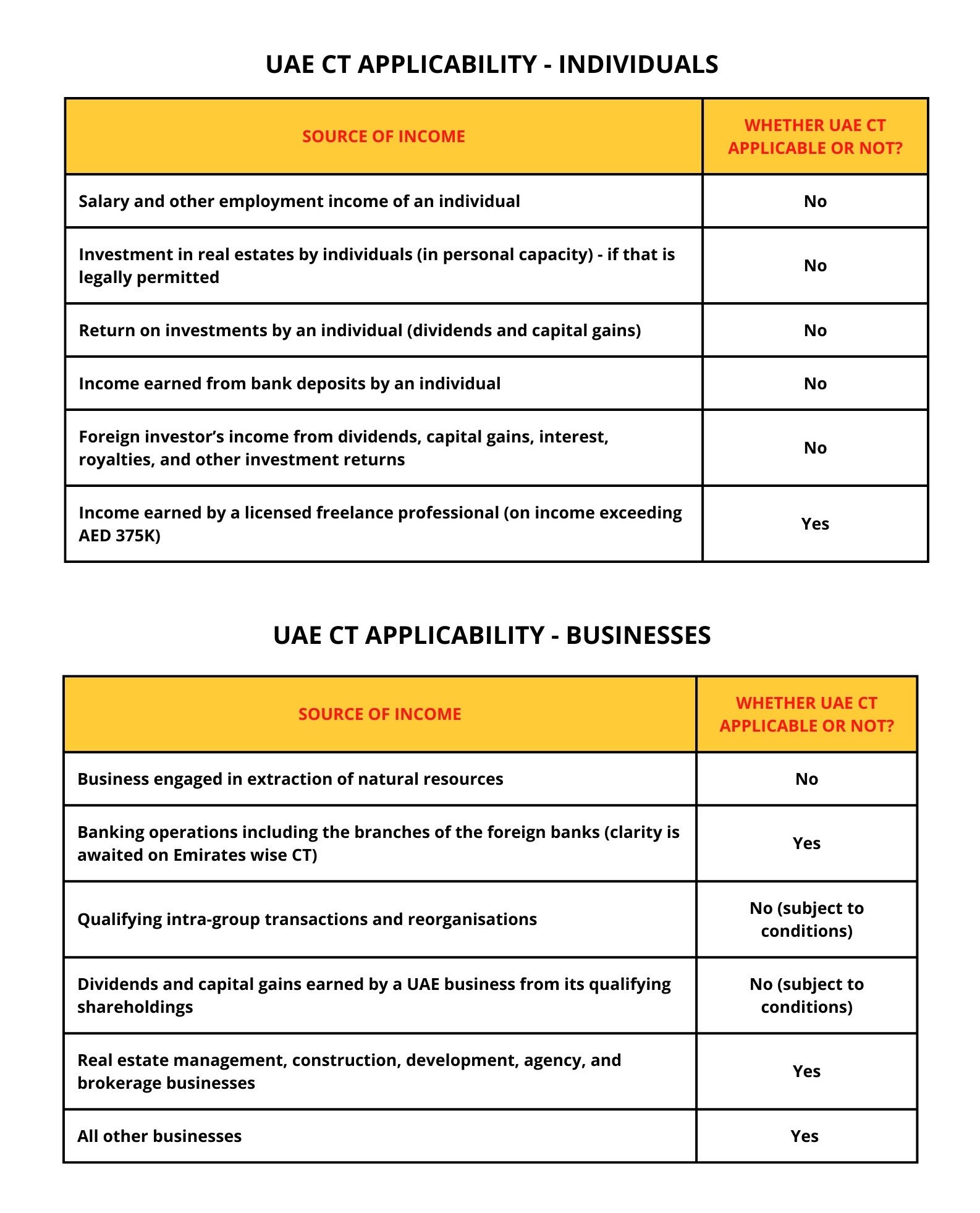

A quick summary on the applicability of the UAE CT on Individuals and businesses:

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Audit Intern

contact us

contact us