In order to ensure taxpayers give appropriate information to tax administrations they are required to maintain proper documentation.

Following are the objectives of transfer pricing documentation:

- To ensure that taxpayers give appropriate treatment to transfer pricing requirements

- To provide information to conduct an informed transfer pricing risk assessment and selection of cases for audit.

- To provide information to conduct a thorough audit of transfer pricing practices of entities subject to tax under their jurisdiction.

Maintenance of documents for transfer pricing is a three tiered approach. Following documents are required to be maintained as per OECD guidelines:

- Master file

- Local file

- Country- by- country reporting

-

Master file

A master file provides an overview of the MNE group business. A master file gives idea about its global business operations, its transfer pricing policy & global allocation of income & economic activity.

When providing information in master file taxpayers should provide information of essential list of agreements, intangibles and transactions to provide a high-level overview of the MNE’s group business.

Applicability

The applicability of master file depends on the threshold limit set by the tax authorities. Most of the jurisdictions have aligned the applicability of master file with country – by – country reporting. i.e. an entity will have to prepare master file if he is required to prepare country – by – country report.

Main contents of master file

- The group organizational structure of MNE

Chart showing the MNE’s group legal and ownership structure along with geographical and operating entities

- Description of MNE’s group business

- Important drivers of profit

- A chart or a diagram depicting the supply chain of group’s five largest products and/or services by turnover. Also, a product or service amounting to more than 5% of group turnover

- Description of main geographic markets for products & services mentioned above

- A description of important service arrangements between members of the MNE with regard to allocation of research & development (R&D) cost & its pricing

- A brief written FAR (functions performed, assets employed & risk assumed)

- Description on business restructuring transactions, acquisitions, divestment

- Description of MNE’s group intangibles

- Description of the MNE’s group overall strategy for the development, ownership & exploitation of intangibles including location of principal R&D facilities & locations

- A list of intangibles under the group

- A list of important agreements under the group

- Description of important transfers among the entities in the group along with their jurisdictions

- MNE group’s intercompany financial activities

- A general description on financing of group companies, including financing arrangements with unrelated parties

- Identification of the member in the group who provides central financing function for the group, including its jurisdiction

- A general description of MNE’s general transfer pricing policies relating to financing

- MNE group’s financial and tax position

- The MNE group’s annual consolidated financial statement for the financial year

- A list and description of the group’s existing advance pricing agreements (APA’s) and other tax rulings

-

Local File

In contrast to the master file, which provides overview of the MNE group the local file on the other hand provides detailed information on the specific intercompany transactions. The information in the local file helps to understand that the entity has complied with the requirements of arm’s length price (ALP).

The local file provides more specific information relating to the transactions between the local affiliate & the associated enterprise. This information may comprise of comparability analysis, selection & application of most appropriate method.

Local file should include following information:

- Description of the local entity

- A detailed information about the management structure of the local entity having the local organization chart. It should also include the information about the individuals to whom the local management reports.

- A description of the business & business strategy pursued by the local organization. It should also include information about the restructurings or intangible transfers that has affected the entity.

- Key competitors

- Controlled transactions

For all the controlled transactions the following information is required:

- Description of controlled transactions

- The amount of intra-group payments & receipts

- Identification of associated enterprise in each controlled transaction and relationship amongst them

- All intercompany agreements concluded by the local entity

- Detailed comparability and functional analysis of the taxpayer and relevant associated enterprises with respect to each controlled transactions, including any changes as compared to prior years.

- The most appropriate method used for transfer pricing with regard to category of transaction.

- Summary of assumptions in applying the most appropriate method.

- An indication of which associated enterprise is selected as tested party along with the explanations.

- A list & description of selected comparable uncontrolled transaction

- A description of adjustments performed with the comparable uncontrolled transaction.

- Justification for concluding that the relevant transactions were priced at arm’s length price using most appropriate method.

- Summary of financial information used in applying the transfer pricing methodology.

- A copy of the existing unilateral, bilateral/multilateral APAs and other tax rulings

- Financial information

- Annual financial accounts of the fiscal year.

- Information showing how the financial data is used in applying transfer pricing methodology.

- Summary of relevant financial information for comparable used in analysis and the sources from which the data was obtained.

-

Country- by Country Reporting

A country-by- country report provides aggregate tax jurisdiction wide information pertaining to global allocation of income & taxes paid. It also includes of all the constituent entities for which the financial information is reported including the tax jurisdiction of incorporation.

Applicability

As per OECD guidelines, the CBCR applies to the MNE group with an annual consolidated group revenue equal or higher than EUR 750 million for the preceding previous year. OECD also prescribes the due date of filing the CBCR as within 12 months from the end of the financial year of the group.

CBCR should be filed by whom?

The CBCR should be filed by the ultimate parent of the group or an alternative entity appointed by the group.

The tax authority with which CBCR is filed shall exchange the CBCR with the other tax jurisdictions where the group has operations under bilateral or multilateral tax treaties.

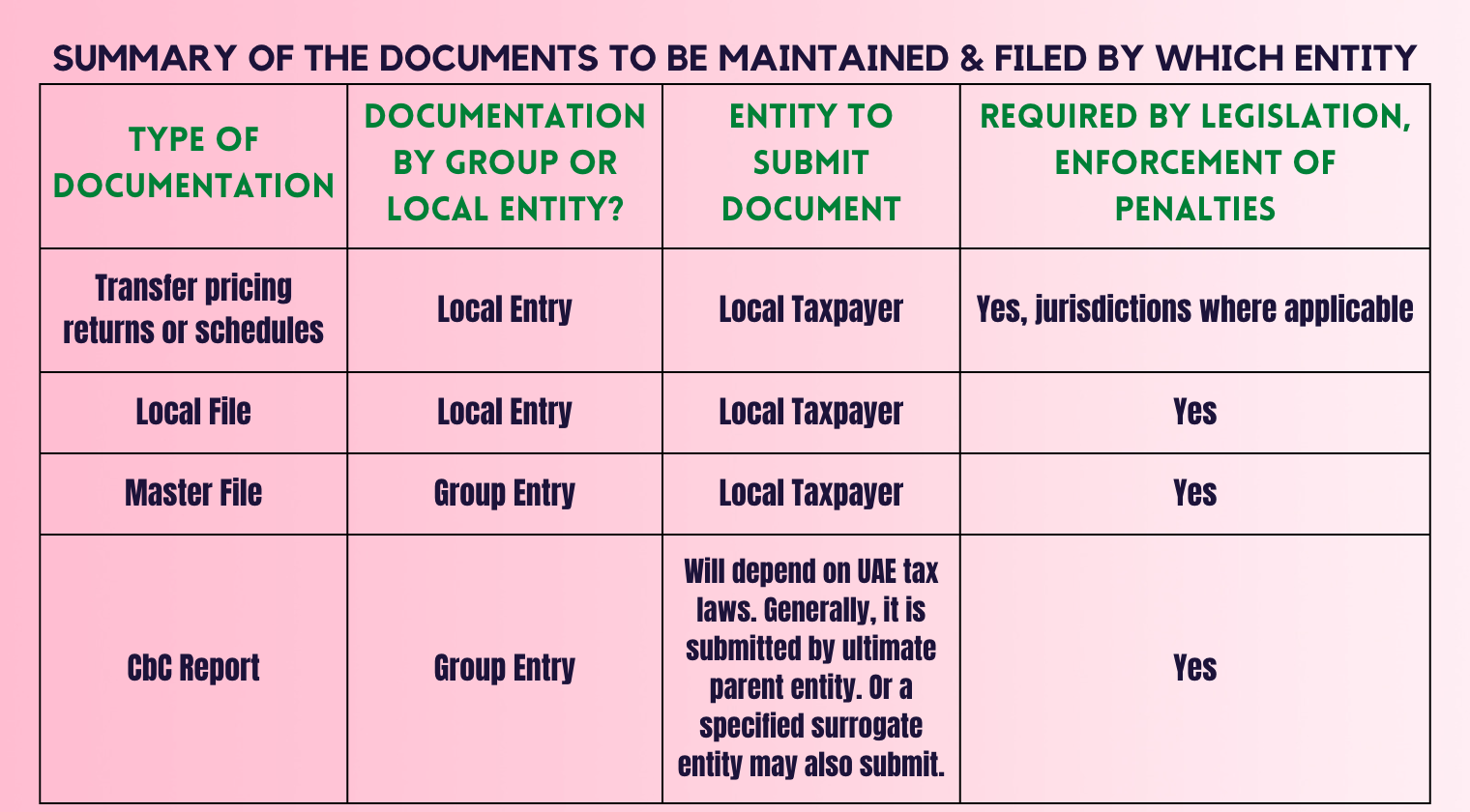

Summary of the document to be maintained & filed by which entity

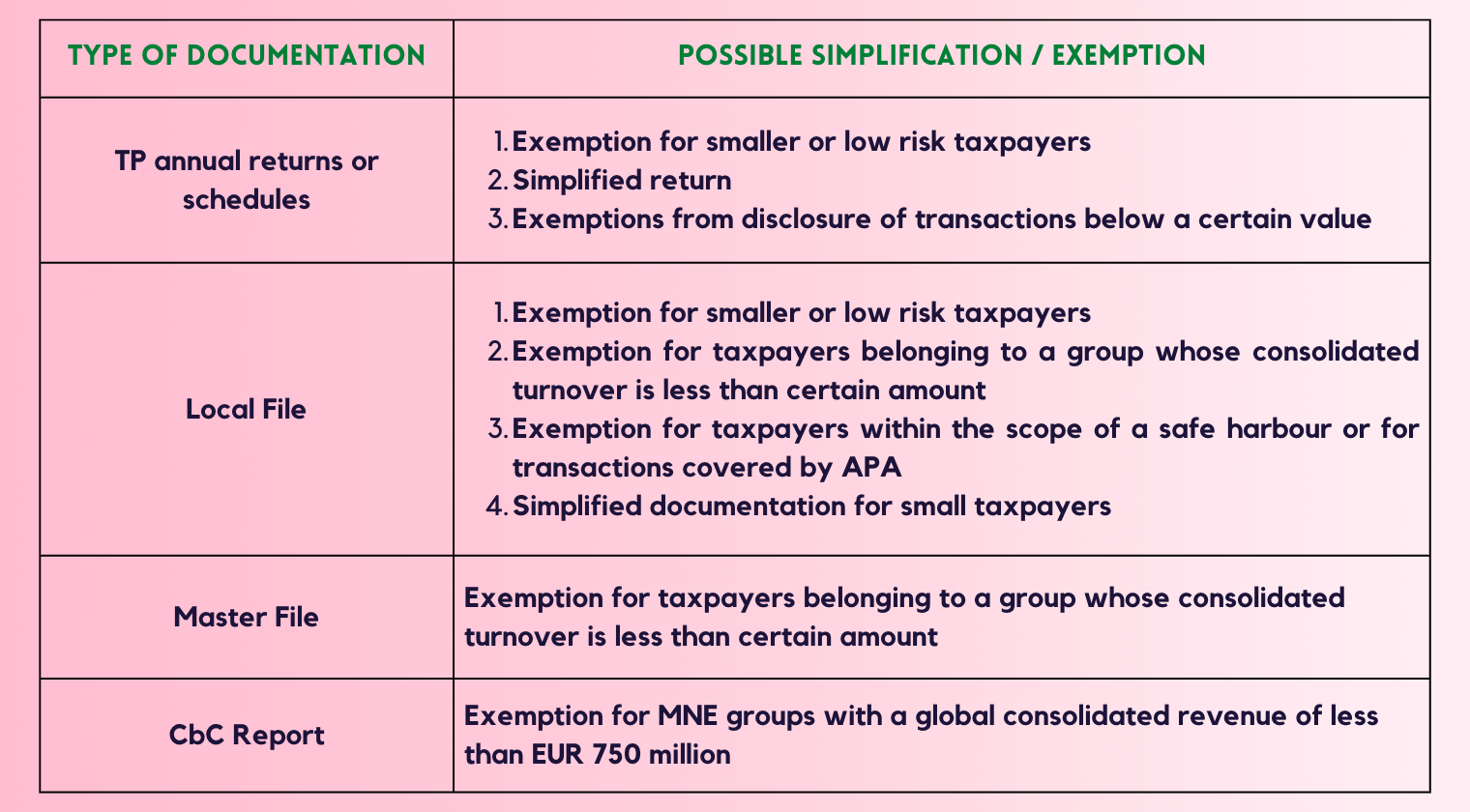

Simplification and exemptions:

The costs of compliance with transfer pricing rules can be very significant for taxpayers. It is important that measures are taken to avoid unnecessary or disproportional compliance costs when designing a transfer pricing documentation regime. Countries may exempt such taxpayers from the documentation rules (but not necessarily the transfer pricing rules). In such cases, the exemption would not cover a requirement, under general information powers, to submit information about cross-border transactions during the course of an audit.

These measures require the term ‘smaller taxpayer’ or ‘low risk taxpayer’ to be defined. There are several possibilities:

- Small taxpayer or low risk taxpayer can be defined on the basis of value of transactions. But this will give small taxpayers a chance to undervalue it’s related party transactions

- This can be defined on the basis of related party transaction with third party. The value of related party transactions to third party non-related transactions can be compared. This may be problematic if the taxpayer undervalues related party transactions;

- This an also be done for purely domestic transactions between local related entities, where both parties to the transactions are subject to the same rate of taxation

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Senior Audit Executive

contact us

contact us