Virtual License aims to foster global entrepreneurial talent without the need to live or work in any one place. It harnesses Dubai’s global reputation for business-friendly environment to create new opportunities for local and international companies.

Dubai, the city of future has opened up a new door in the world of business opportunities. Read below to find out more…

The first set of services offered under the VCC program, is the Virtual Commercial License through business registration, access to a regulated e-commerce platform DubaiStore.com and facilitation to access banking services. The Virtual Commercial License simplifies the work and life of entrepreneurs and freelancers through the provision of:

- Low costs and administrative burdens to start and grow your company

- Online access to your company

- Access to business opportunities in Dubai

- Access to new customers, markets and investment opportunities

- Participation in virtual companies’ directory

How do I qualify for a Virtual Company License?

The establishment of a virtual company in Dubai is suitable for legitimate business interests only.

- Virtual companies are registered in Dubai to individuals who do not reside in the UAE.

- The owners of virtual companies must be the nationals or tax residents of approved countries (See countries section below).

- Virtual companies can conduct location-independent business activities globally in pre-defined sectors in the below section.

- Virtual companies remain subject to corporate, individual income and social taxation in the country of incorporation and/or residence, depending on the location of economic activities and international tax agreements.

- Virtual companies operate in a transparent manner including a full public registry of the names of the owners, which will be shared with the tax authorities of relevant jurisdictions upon request.

- A Virtual Company License does not automatically guarantee physical access to the UAE be it in the form of a business or visitor or resident visa to any of the company’s partners, directors or employees. However, Dubai Government authorities are working on a simplified visa process for the holders of Virtual Company License.

- A Virtual Company License does not automatically guarantee a business bank account in the UAE. Bank account opening will be at the discretion of commercial banks. However, we can facilitate access to account opening processes.

- All applicants for a Virtual Company License are subject to background checks by Dubai Government authorities.

- Virtual companies that have the legal form of a sole proprietorship are not subject to local ownership, director, auditor, or qualified business service provider requirement.

- Tax registration with UAE’s Federal Tax Authority is required if the company’s revenue within the UAE exceeds USD 100,000 per annum. Tax registration is the obligation of the virtual companies. Value added tax (VAT) in the UAE is 5%, there is no income taxes on non-financial entities.

- Dubai Government has instituted measures against money laundering and tax evasion in line with international agreements and conventions that the UAE is party to.

Manage your virtual company

Dubai Department of Economic Development is the entity responsible for registering and licensing of companies operating in Dubai mainland. Business registration is subject to UAE and Dubai Government laws, as well as the regulations of the Department of Economic Development of Dubai.

The allowed legal form for virtual companies is sole establishment/ sole proprietorship (a business that is owned 100% by an individual. The owner will control all of its operations, keep all profits and be liable for debts and financial obligations).

Virtual companies can undertake selected businesses activities as detailed in next section. The entrepreneurs have to be the citizens or tax residents of the countries mentioned in countries list.

Allowed business activities for virtual companies

Computer programming, consultancy and related activities:

- Computer Systems & Communication Equipment Software Design

- Electronic Chips Programming

- Web-Design

- Social Media Applications Development & Management

- Cyber Security Architecture

- Public Networking Services

- Cyber Risk Management Services

- Auditing, Reviewing and Testing Cyber Risks

- Managed Cyber Security Services Provider

- Marketing Services Via Social Media

Design activities:

- Fashion Design

- Jewelry Design

- Design Services (interior design, garden design)

- Calligraphers & Painters

- Product Design

Service activities related to printing and advertising:

- Books Binding

- Typesetting Services

- Color Separation Services

- Design & Artwork Services

- Greeting Cards Production & Distribution Services

- Promotional Gifts Preparing

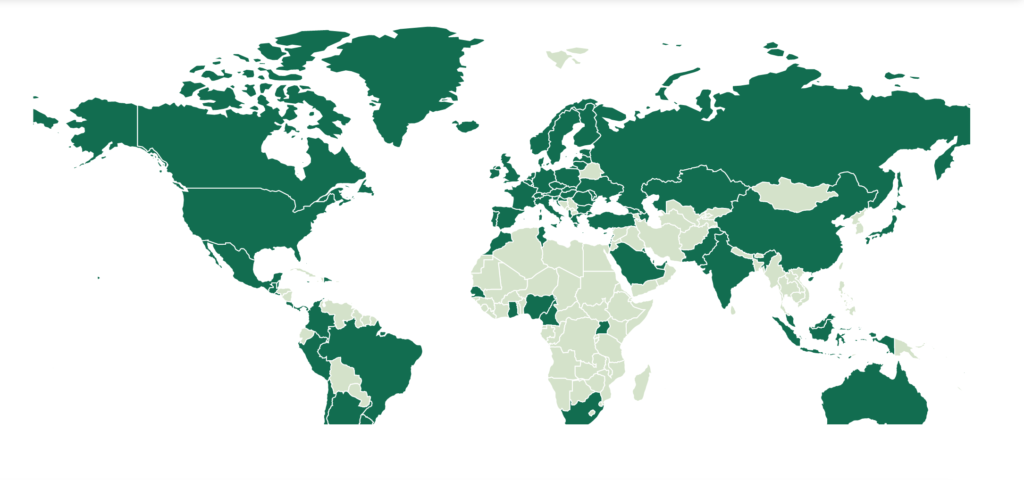

Countries allowed to avail virtual license section:

African continent nationals allowed countries – only South Africa, Morocco, Nigeria, Tunisia, Senegal, Ghana, Cameroon, Uganda. Rest of the countries including Egypt nationals are not allowed to avail this virtual license.

Middle East nationals allowed countries – only Saudi Arabia, Qatar, Lebanon, Palestine, Bahrain, Kuwait are approved currently. Syria, Jordan Iraq, Yemen, Oman nationals are not allowed.

Asian continent nationals not allowed countries – Nepal, Bangladesh, Bhutan, Myanmar, Thailand, Cambodia, Vietnam, Laos, Sri Lanka, Philippines, Taiwan, Mongolia, South Korea, North Korea, Afghanistan, Iran, Turkmenistan, Uzbekistan, Kyrgyzstan, Tajikistan, Armenia, Papua New Guinea. Nationals other than mentioned in Asia list are allowed to participate.

Central America nationals not allowed countries – Cuba, Haiti, Nicaragua, Honduras.

South America nationals not allowed countries – Venezuela, Suriname, Guyana, French Guyana, Ecuador, Bolivia, Paraguay. Rest all countries nationals can participate.

European Continent nationals not allowed countries – Belarus, Bosnia and Herzegovina, Serbia, Montenegro, North Macedonia, Kosovo. Rest all Europe including Russia can participate.

A detailed map is given below (available on this page: https://vccdubai.ae/countries_Map.aspx )

Have a word with your advisor and be compliant and less bothered for a life time. Spectrum Accounting & Auditing, your UAE experts in the field of Accounting, Auditing, Value Added Tax, Business and Advisory services. Reach us today @ +971 50 9866466 or +971 4 2699329.

contact us

contact us