A Holding Company Business is defined under Article 1 of the Regulations as a business that:

(a) Is a Holding Company in accordance with the law applicable to the Licensee carrying out such activity

(b) has as its primary function the acquisition and holding of shares or equitable interests in other companies

(c) does not carry on any other commercial activity

Equity interests include shares in a company and interests in an incorporated partnership, as well as any other instrument which gives the Licensee a beneficial ownership interest in a company.

A Licensee whose activities are limited to being engaged in a Holding Company Business would only be required to meet the reduced economic substance requirements under Article 6.4 of the Regulations.

A UAE business that does not meet the narrow definition of a Holding Company Business because it either:

(i) carries on another activity; and/or

(ii) owns other forms of investments or assets (e.g. interest-bearing loans)

may be required to meet the (full or increased) economic substance requirements under Article 6.2 of the Regulations if the other activity or asset brings the UAE business within the scope of a different Relevant Activity category (e.g. Lease-Finance), and the Licensee derives gross income from such other Relevant Activity.

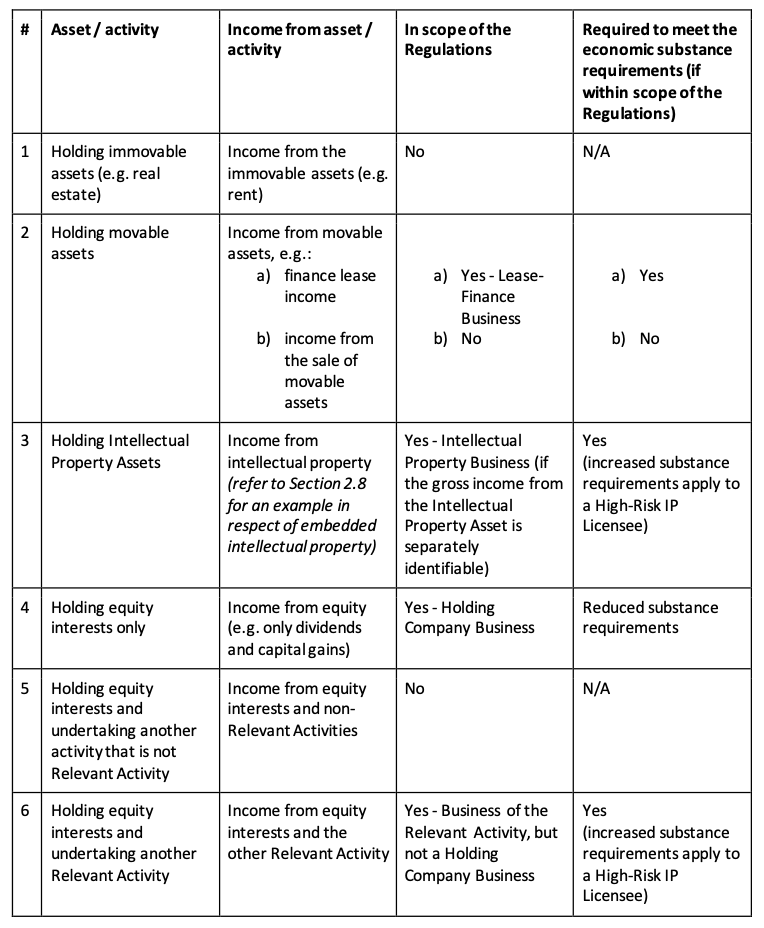

The following table provides examples of how a UAE business may assess its obligations under the Regulations in the above circumstances.

Core Income-Generating Activities of a Holding Company Business

The CIGAs of a Holding Company Business are all activities related to acquiring and holding shares or equitable interests in other companies, provided that such activities do not constitute another Relevant Activity, in which case, the CIGAs shall be those related to that other Relevant Activity.

Examples:

- ABC LLC’s only activity is the holding of shares in four subsidiary companies, and ABC LLC is itself held by the regional holding company of the group headquartered in France. The only gross income earned by ABCLLC are annual dividends from its subsidiaries.ABC LLC undertakes a Holding Company Business irrespective of its own shares being held by another holding company in the group.

- DEF LLC manufactures food products, and holds the shares in another company (GHI LLC) which operates a restaurant.Despite DEF LLC holding the shares of GHI LLC and earning dividend income, DEF LLC is not considered a Holding Company Business because its business is food production.Because the manufacturing of food products and the operation of restaurants does not meet the definition of any of the other Relevant Activities, neither DEF LLC nor GHI LLC are subject to the Regulations.

- GHI LLC holds 100% of the shares in two subsidiary companies, and has provided an interest bearing shareholder loan to one of these companies. GHI LLC earns annual dividends and interest income.GHI LLC will be considered as engaged in a Lease-Finance Business only, and not also considered as carrying on a Holding Company Business.

- Trustee LLC acts as trustee to a number of unconnected trusts, holding assets in its capacity as trustee. As Trustee LLC is in the business of providing trustee services and is not the beneficial owner of the assets, Trustee LLC will not be considered a Holding Company Business.

Reach out to Spectrum to know everything about ESR. Contact at +971 50 9866466 or email us at [email protected] now!

contact us

contact us