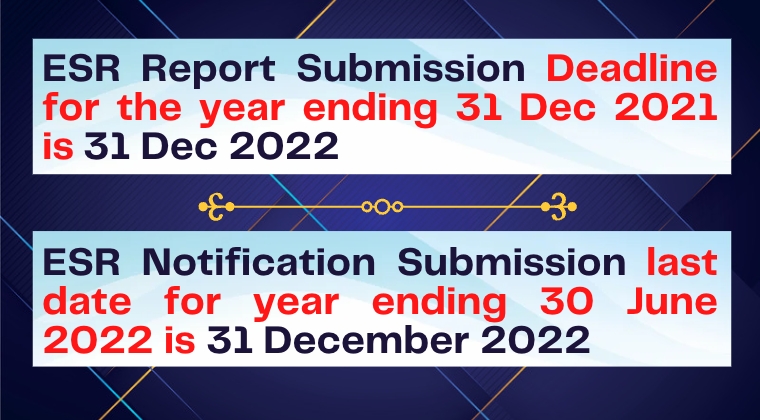

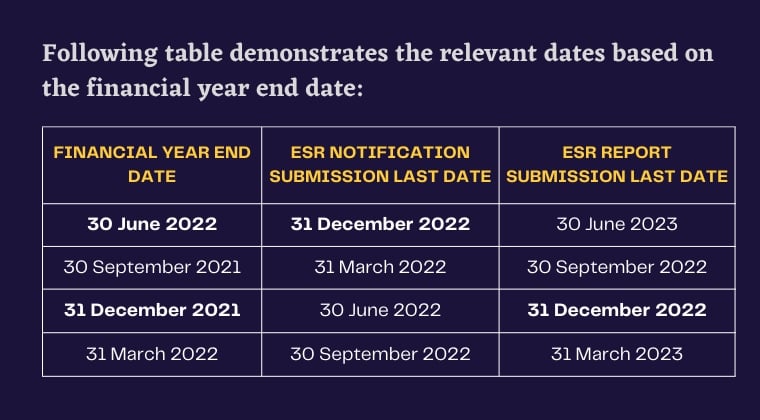

ESR Report submission for the financial year ending 31 December 2021 and ESR Notification submission for the financial year ending 30 June 2022 are to be filed by 31 December 2022.

The Economic Substance Regulations (ESR) is applicable to all the companies registered in the UAE, which includes Mainland companies, Free Zones etc, that carry out any of the following Relevant Activities during the financial year:

- Banking Business

- Insurance Business

- Investment Fund management Business

- Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (“IP”)

- Distribution and Service Centre Business

Once a UAE company has been identified as undertaking relevant activities, the ESR requires the company to satisfy the economic substance test which comprises three elements:

1) It is directed and managed in the UAE in relation to that activity

2) It conducts Core Income-Generating Activities (CIGA) in the UAE

3) It meets the adequate requirements with regard to the level of relevant activity carried on in the UAE

If you are carrying out the relevant activities and you are earning income out of it, you need to;

- Submit ESR notification

- Submit ESR report and

- Make sure to manage the business in the way it is needed as per the law and maintain the adequate documentation

ESR Notification shall be submitted within 6 months from the end of the financial year and ESR Report should be submitted within 12 months from the end of the financial year with the Ministry of Finance.

Non Compliance is going to attract following penalties:

| Non-compliance | Penalty Amount AED |

|---|---|

| Failure to submit an ESR Notification | 20,000 |

| Failure to submit an ESR Report | 50,000 |

| Providing wrong information | 10,000 to 50,000 |

| Failure to pass Economic Substance Test for 1st year | 50,000 |

How can Spectrum Auditing facilitate you in complying with ESR?

- Spectrum can assist you in assessing whether ESR is applicable to your business or not

- We can assist you in submitting the ESR notification

- We can assist you in bringing the necessary changes in organising your business to be able to comply with the requirements of ESR

- We can assist you in submitting the ESR return

- We can assist you in submitting an appeal against the penalties that are already levied in relation to ESR compliance

Let us know if you want us to help in complying with the above mentioned ESR requirements and avoid the risk of getting penalties levied on your business. Book an appointment today to know further.

Spectrum is your one stop resource to get all your queries pertaining to Economic Substance Regulations get addressed. You can reach us through following ways:

Phone call: +971 4 2699 329

WhatsApp: +971 50 9866 466

Email: [email protected]

contact us

contact us