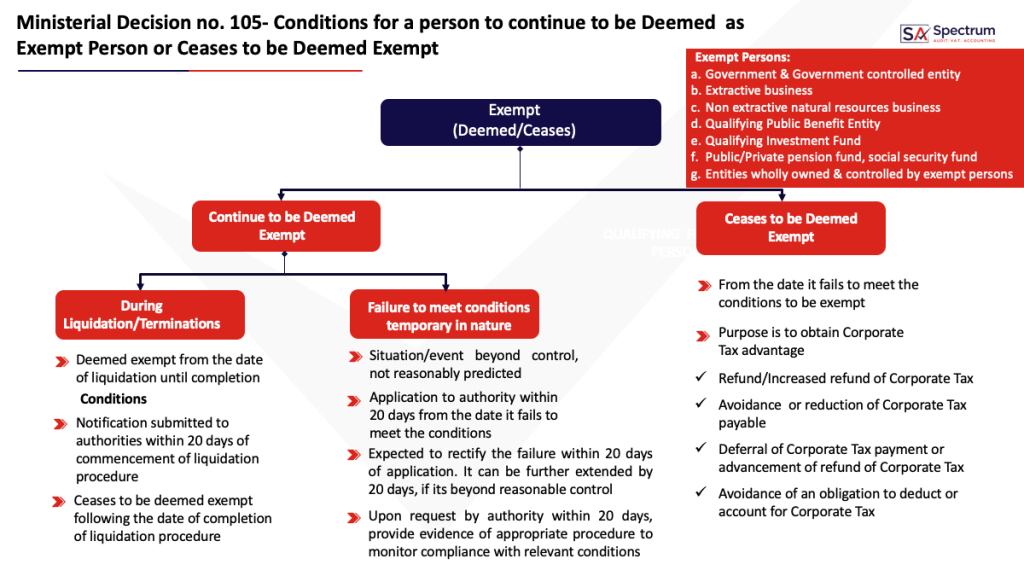

The UAE Ministry of Finance has issued Ministerial Decision No. 105 of 2023 on the Determination of the Conditions under which a “Person may Continue to be Deemed as an Exempt Person, or Cease to be Deemed as an Exempt Person” from a Different Date for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses.

Here we have simplified the whole document in an understandable format.

Exempt Persons:

- Government & Government controlled entity

- Extractive business

- Non extractive natural resources business

- Qualifying Public Benefit Entity

- Qualifying Investment Fund

- Public/Private pension fund, social security fund

- Entities wholly owned & controlled by exempt persons

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us