Corporate Tax in UAE is implemented from 1st June 2023. FTA is accepting application for registration of Corporate Tax, through their EmaraTax Digital Tax Services.

For Corporate Tax Registration, you may call us at +971-4-2699329 or email [email protected], and we can assist you.

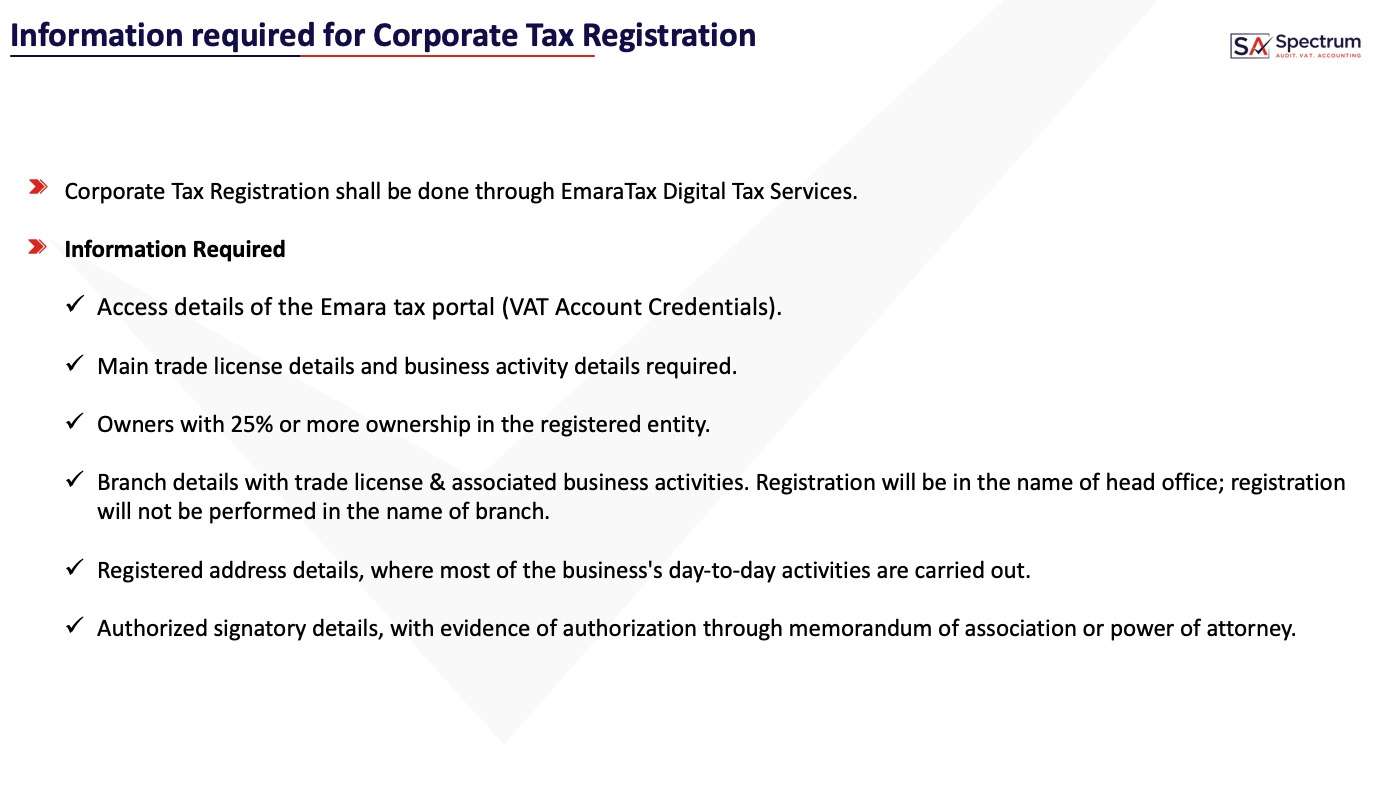

Below information is required for Corporate Tax Registration:

- Access details of the Emara tax portal (VAT Account Credentials).

- Main trade license details and business activity details are required.

- Owners with 25% or more ownership in the registered entity.

- Branch details with trade license & associated business activities. Registration will be in the name of the head office; registration will not be performed in the name of the branch.

- Registered address details, where most of the business’s day-to-day activities are carried out.

- Authorized signatory details, with evidence of authorization through a memorandum of association or power of attorney.

Screenshots of the registration pdf document:

contact us

contact us