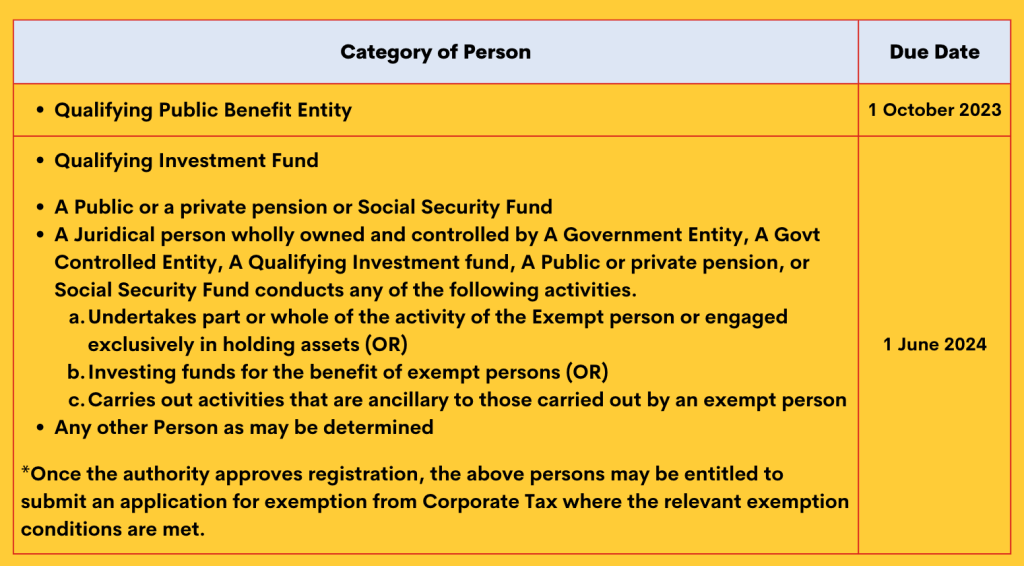

As per federal Tax Authority Decision No. 7 of 2023 Issued 7 April 2023 (Effective from 1 June 2023)

- The Corporate Tax Registration Timeline will be as follows for the Exempted Category of persons.

- The Authority may request the Exempt Person to file an annual declaration confirming that it still fulfills the exemption

- The Person shall apply for exemption within 60 business days from the end of the Tax Period in which the Person met the conditions for

- If the Authority approves the application for exemption outlined, the exemption shall be effective from the start of the Tax Period specified in the

- The Authority may determine an alternative date for the effective date of the exemption If the following scenarios, or other similar scenarios, takes place:

- If the Tax Period specified in the registration form is incorrect, the exemption shall be effective from the correct

- If the applicant is acquired during a Tax Period by Government Entity or Govt Controlled Entity or Qualifying Investment fund or A Public or private pension, the exemption shall not be granted from the start of the Tax Period if the conditions for exemption were not met at that time. The Authority shall determine another date from which the exemption shall be granted to ensure that the date of exemption starts after the fulfillment of all remaining tax

- If the Tax Period included in the application for exemption needs to be corrected and the Authority receives sufficient supporting information to evidence that the conditions have been met within the later Tax Period, the exemption shall be effective after the date of fulfillment of the

- Any other instances specified by a decision issued by the Cabinet

Any provisions contrary to or inconsistent with the provisions of this Decision shall be abrogated.

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us