The UAE Ministry of Finance has issued a Ministerial decision No. 43 of 2023 Concerning Exception from Tax Registration for the Purpose of Federal Decree–Law No. 47 of 2022 on the Taxation of Corporations and Businesses.

Minister of State for Financial Affairs:

- Having reviewed the Constitution,

- Federal Law No. 1 of 1972 on the Competencies of Ministries and Powers of the Ministers, and its amendments,

- Federal Decree-Law No. 13 of 2016 on the Establishment of the Federal Tax Authority, and its amendments,

- Federal Decree-Law No. 28 of 2022 on Tax Procedures,

- Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses,

Has decided:

Article (1): Definitions: Words and expressions in this Decision shall have the same meanings specified in the Federal Decree- Law No. 47 of 2022 on the Taxation of Corporations and Businesses (referred to in this Decision as “Corporate Tax Law”) unless the context requires otherwise.

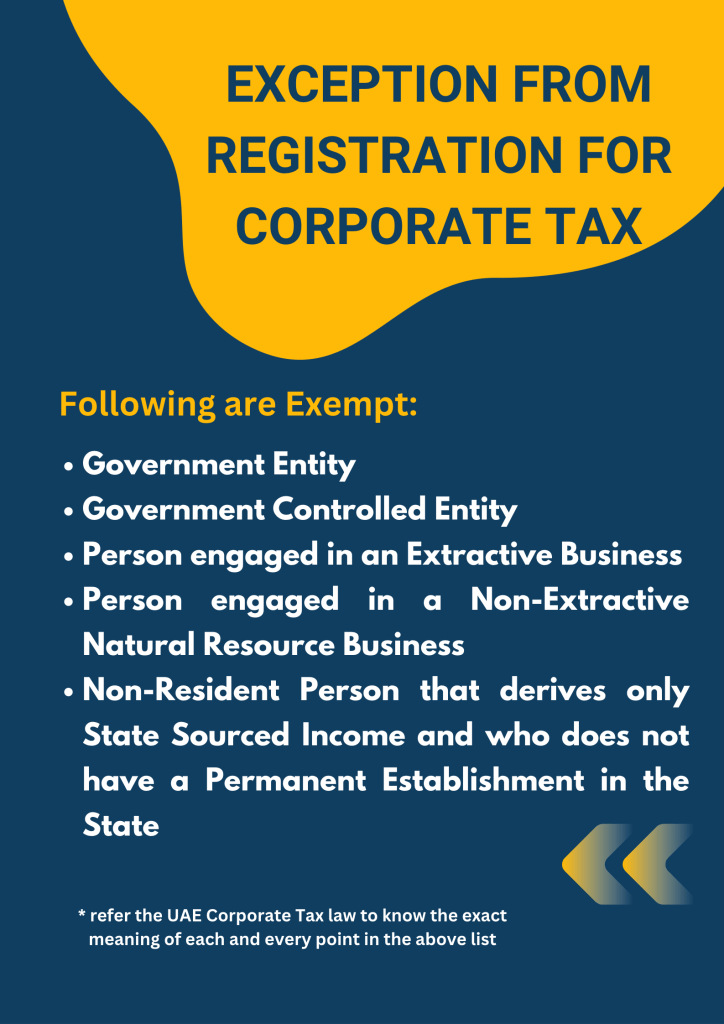

Article (2): Exception from Registration for Corporate Tax:

1. The following Persons shall not register for Corporate Tax with the Authority:

(a) A Government Entity.

(b) A Government Controlled Entity.

(c) A Person engaged in an Extractive Business that meets the conditions of Article 7 of the Corporate Tax Law.

(d) A Person engaged in a Non-Extractive Natural Resource Business, that meets the conditions of Article 8 of the Corporate Tax Law.

(e) A Non-Resident Person that derives only State Sourced Income under Article 13 of Corporate tax Law and that does not have a Permanent Establishment in the State according to the provisions of the Corporate Tax Law.

2. Paragraphs (a) to (d) of Clause (1) of this Article shall be without prejudice to the obligation of the Person to register for Corporate Tax in cases where the Person becomes a Taxable Person under the provisions of the Corporate Tax Law.

All Cabinet Decisions and Ministerial Decisions issued relating to the Corporate Tax Law are available on the Ministry of Finance’s website: www.mof.gov.ae.

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us