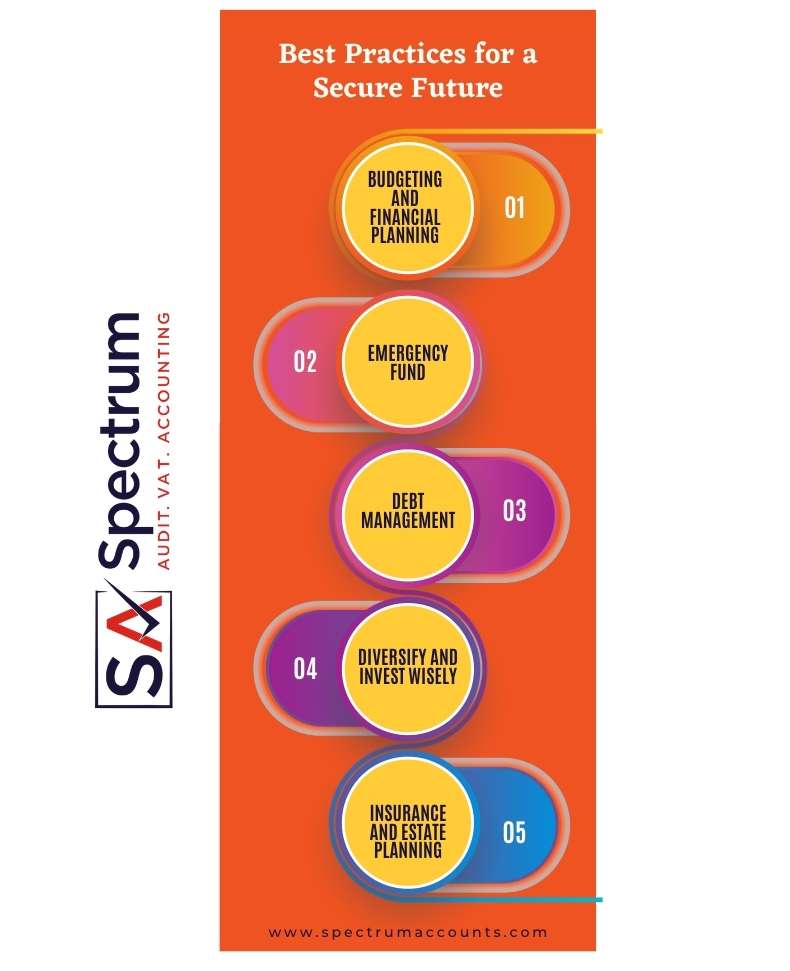

In an ever-changing and uncertain economic landscape, ensuring a safe and secure financial future has become a top priority for individuals and families. By adopting best practices and implementing smart financial strategies, you can lay a solid foundation for a stable and prosperous future. In this article, we will explore key practices that can help you achieve financial security and peace of mind.

- Budgeting and Financial Planning: One of the fundamental steps towards a secure financial future is creating a realistic budget and sticking to it. Start by tracking your income and expenses, identifying areas where you can reduce spending, and allocating funds towards savings and investments. Establishing clear financial goals is crucial; whether it’s saving for retirement, buying a home, or starting a business, having a plan helps you stay focused and accountable.

- Emergency Fund: Building an emergency fund is an essential component of financial security. Life is unpredictable, and unexpected expenses such as medical emergencies or job loss can occur. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This safety net will provide peace of mind and prevent you from relying on high-interest debt in times of crisis.

- Debt Management: Managing debt is vital for maintaining a healthy financial future. Start by prioritizing high-interest debt and developing a repayment plan. Paying off credit card balances and loans as quickly as possible will save you money in interest payments. Avoid accumulating unnecessary debt by distinguishing between wants and needs. Additionally, consider consolidating debts or seeking professional advice if you’re struggling to manage multiple obligations.

- Diversify and Invest Wisely: Investing is a powerful tool for growing your wealth over time. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to spread risk and optimize returns. It’s crucial to educate yourself about investment options or seek guidance from a qualified financial advisor. Regularly review and rebalance your portfolio to ensure alignment with your financial goals, risk tolerance, and changing market conditions.

- Insurance and Estate Planning: Protecting your financial well-being involves safeguarding against unforeseen circumstances. Acquire adequate insurance coverage, including health, life, home, and auto insurance, to mitigate risks. Additionally, consider creating a comprehensive estate plan that includes a will, power of attorney, and healthcare proxy. Regularly review and update these documents as your circumstances change.

Conclusion:

Achieving a safe and secure financial future requires discipline, planning, and informed decision-making. By adopting the best practices outlined in this article—budgeting, emergency funds, debt management, investing wisely, and insurance and estate planning—you can build a solid foundation for a financially stable and prosperous future. Start implementing these practices today, and reap the long-term benefits of financial security and peace of mind.

The Spectrum Accounts team is prepared to provide guidance and handle your needs for every type of advice you need. Contact Spectrum at +971 4 2699 329 or [email protected] in getting all your questions answered. Spectrum is your partner in your success.

contact us

contact us