The Ministry of Finance introduced (Federal Decree Law no. 47 of 2022) Corporate Tax, w.e.f 1st June 2023, in UAE on business profits. The corporate tax in UAE will be payable on the profits of UAE businesses as reported in their financial statements prepared in accordance with internationally accepted accounting standards. As per Article 51, Federal Decree Law no. 47 of 2022, taxable person needs to register for Corporate Tax with the authority.

Before you register for Corporate Tax, you need to have answers for the following questions?

- Are you aware of businesses which are exempted from CT registration (Ministerial decision no. 43 of 2023)?

- Do you know when to register for CT?

- Do you know your business Tax period as per Article 57, and are you aware of the conditions under which you can change your tax period, as per FTA decision no. 5 of 2023?

- Do you hold multiple Trade License, and are you aware of the requirement to register as a Tax Group as per Article 40? Have you assessed the impact of registering as Tax Group or as an individual registration for each Trade license?

- Are you aware that branch does not require separate CT registration, it’s part of Main Trade license?

- Is your company eligible for Small Business Relief?

- Is your financials chart of account complied with CT requirements?

- Is your business in Free zone, are you aware of the Qualifying criteria to be eligible for 0% Corporate Tax?

- Do you have transactions with connected person, related parties? Are you aware of the requirement of documentation under CT regulations for transactions with such person?

- Have you assessed the impact of Corporate Tax, in your business financials & cash flows?

For answers to above, you may call us at +971-4-2699329 or email [email protected] and we can assist you in finding the answers.

Or you can leave your contact details on our Contact Us page here: Contact Us

Spectrum Auditing, team comprises of Chartered Accountants with over 20 years of experience, worked in Big4 consulting firms. We will guide you in complying with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Country By Country Reporting (CBCR), Economic Substance Regulations (ESR), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc, based on your business requirement. Being a pioneer in the field of auditing, accounting, taxation, and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to rules and regulations and keep you posted so that you are equipped to comply with them.

Spectrum Group is UAE based firm incorporated in 2015 and operating at various parts of the world (UAE, Oman, India & other geographical regions through associate networks) offering assurance and non-assurance services with a global recognition.

Spectrum is your partner in your success.

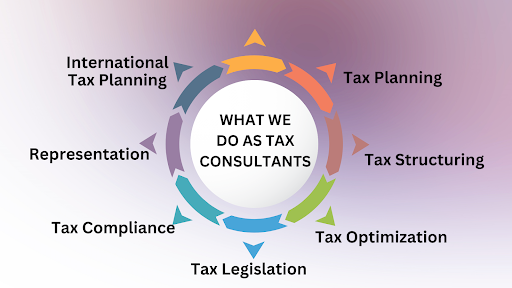

Why do you need Corporate Tax Services in UAE

Since corporate tax is applicable in UAE from June 1, 2023 & there are many complex provisions for which professional guidance is required such as applicability of transfer pricing provisions, qualifying free zone person & conditions to be fulfilled and so on.

- Tax planning

- Tax structuring

- Tax optimization

- Tax legislation

- Tax compliance

- Representation

- International tax planning

Requirements for Corporate Tax Registration

Following are the Corporate Tax registration requirements list you need to submit in order to initiate the registration process:

- Access details of the Emara tax portal (VAT Account Credentials)

- MOA

- Certificate of incorporation

- Financial Year of the entity(Generally mentioned over MOA or AOA)

- Main trade license details and business activity details are required

- Owners details with 25% or more ownership in the registered entity

- Branch details with trade license & associated business activities. Registration will be in the name of the head office; registration will not be performed in the name of the branch

- Registered address details, where most of the business’s day-to-day activities are carried out

- Authorized signatory details, with evidence of authorization through a memorandum of association or power of attorney

Procedure of Corporate Tax Services in UAE

- Corporate tax assessment & planning along with benchmarking

- Corporate tax implementation support

- Corporate tax registration

- Corporate tax computation & filing

- Corporate tax documentation

- Corporate tax compliance support with representation services

contact us

contact us