We are delighted to inform you about an upcoming webinar titled “UAE Corporate Tax – Awareness Session on Tax on Free Zone Companies”

Some of the topics covered during the session include: Computing Taxable Income, Tax on Free Zone, Tax Group, Losses & Carry Forward Losses, Related Parties, Documentation, Compliances & Reporting, Small Business Relief etc.

Seize the chance to acquire valuable insights into the intricate realm of Corporate Tax laws from esteemed experts CA Balaram Vuchidi and Manish Saraf, CA, CIA.

Register for free here: Google Form

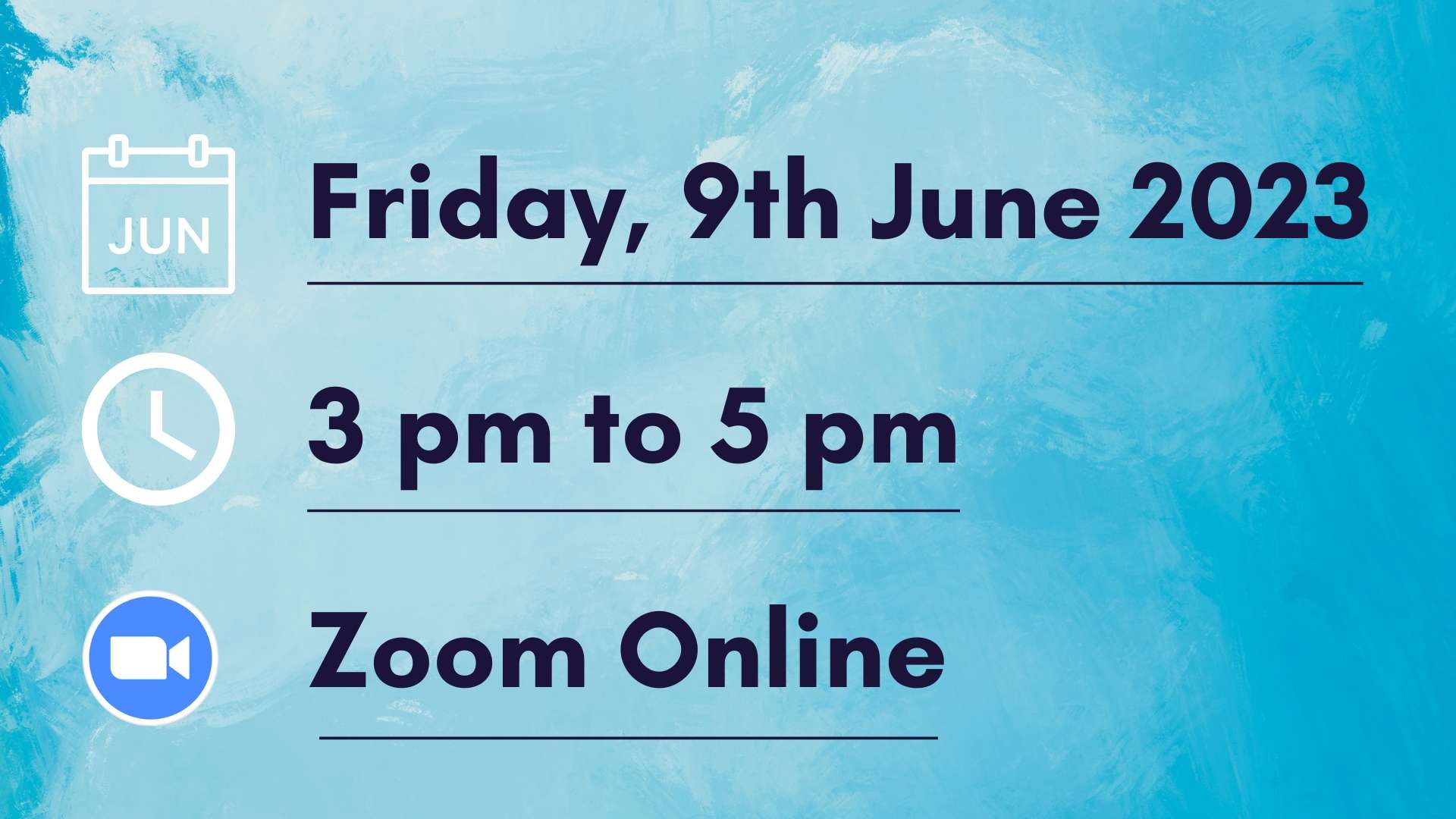

You will receive Zoom meeting link after your registration.

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us