Two new decisions have been issued by the UAE Ministry of Finance, outlining the essential aspects of the Corporate Tax system for legal entities operating within the free zones of the UAE. These decisions comprise Cabinet Decision No. 55 of 2023, which defines Qualifying Income, and Ministerial Decision No. 139 of 2023, which outlines Qualifying Activities and Excluded Activities. Together, these decisions provide comprehensive guidelines for the Corporate Tax regime in relation to juridical persons in UAE’s free zones.

Qualifying Activities

Goods:

- Manufacturing of Goods or materials

- Processing of Goods or materials

- Distribution of imported goods or materials in or from a Designated Zone to reseller

Services & Others:

- Holding of shares and other securities

- Ownership, management and operation of Ships

- Reinsurance services (subject to regulatory oversight)

- Fund management services (subject to regulatory oversight)

- Wealth and investment management services (subject to regulatory oversight)

- Headquarter services to Related Parties

- Treasury and financing services to Related Parties

- Financing and leasing of Aircraft, including engines and rotable components

- Logistics services

- Any activities that are ancillary to the activities listed above

Excluded Activities (Non-qualifying revenue)

- Transaction with Natural Person, except

- Ownership/management of ship

- Fund management services

- Wealth & investment management services

- Financing & leasing of aircraft

- Banking activities

- Insurance activities (other than reinsurance)

- Financing and leasing activities, except

- Financing to related parties

- Related to aircraft

- Transaction with another free zone person related to immovable commercial property other than located in free zone

- Ownership/exploitation of intellectual property assets

- Any activities that are ancillary to the activities listed above

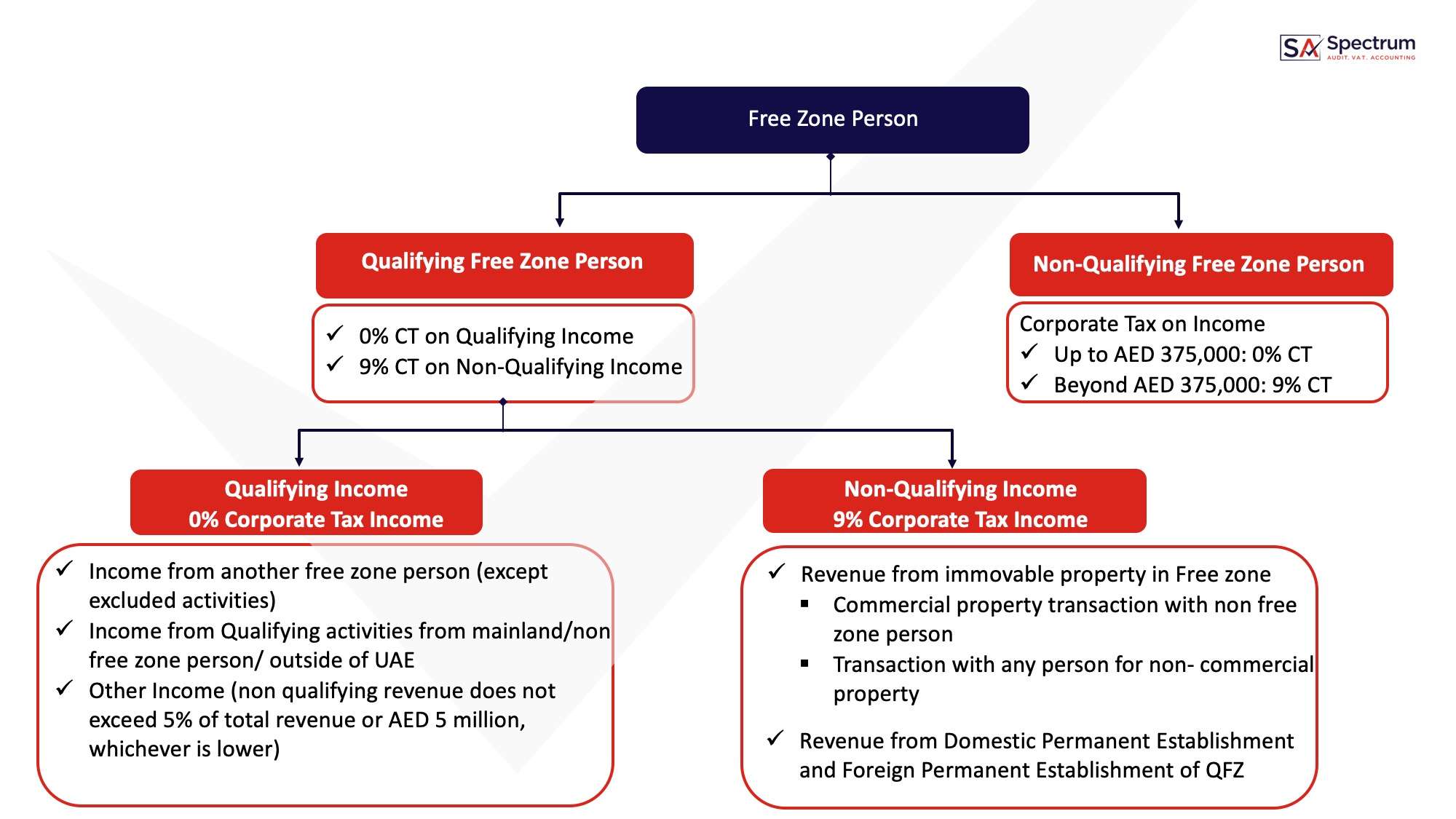

Criteria for Qualifying Free Zone (QFZ) Persons

- Maintaining Adequate Substance in Free Zone:

- Undertake its core income-generating activities in a Free Zone

- Regarding level of activities undertaken, have adequate assets, an adequate number of qualified employees, and incur an adequate number of operating expenditures in Free zone

- Derives Qualifying Income (non-qualifying revenue should not exceed 5% of total revenue or AED 5 million, whichever is lower)

- Not elected to be subject to normal rate of corporate tax, i.e. up to AED 375,000 income, 0% CT and beyond that 9%

- Complies with Arms length principles for related party & connected person transactions and transfer pricing documentation requirements

- Prepare & maintain audited financials

- Activities can be outsourced to a Related Party in a Free Zone or a third party in a Free Zone, provided QFZ person have adequate supervision of outsourced activity

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

#corporatetax #spectrumauditing #spectrum #auditing

contact us

contact us