Following is a brief summary of the Economic Substance Regulations (ESR), the revised version by the Ministry of Finance, and the latest legal compliance requirement for all UAE Entities.

Is ESR applicable to your business?

With reference to the guidelines, issued by MOF, the regulations are applicable to all the UAE entities carrying out relevant activities, please keep in view that there are some material changes in the revised Economic Substance Regulations, under which any previous classification needs to be reconsidered.

What are the Relevant Activities under ESR?

- Banking Business

- Insurance Business

- Investment Fund management

- Business Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (IP)

- Distribution and Service Centre Business

Once a UAE company has been identified as undertaking relevant activities, the ESR requires the company to satisfy the economic substance test which comprises three elements:

- It is directed and managed in the UAE in relation to that activity

- It conducts Core Income-Generating Activities (CIGA) in the UAE

- It meets the adequate requirements with regard to the level of relevant activity carried on in the UAE.

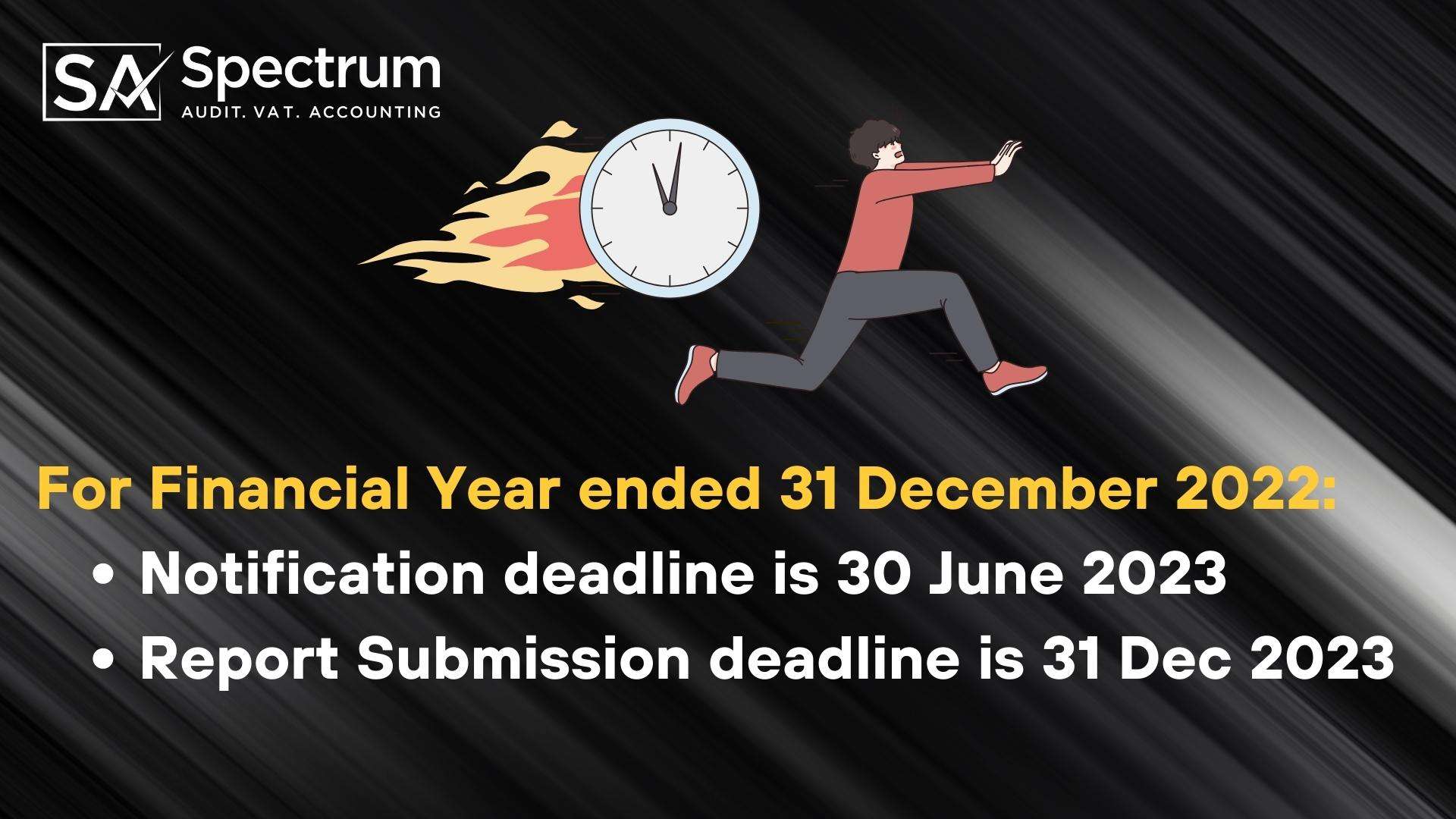

If your financial year is ended on 31 December 2022, the deadline for submission of the ESR Notification and Report?

- ESR Notification shall be submitted before 30 June 2023 and

- ESR Report should be submitted before 31 December 2023 to the Ministry of Finance Portal

What are the penalties for not complying with ESR?

Failure to comply with the Regulations can result in penalties ranging from AED 20,000 to AED 50,000 and other administrative sanctions such as the suspension, revocation, or non-renewal of the entity’s trade license or permit.

Failure to file ESR notification within June 30, 2023 – Penalty will be AED 20,000

Failure to file ESR Report within December 31, 2023 – Penalty will be AED 50,000

How can Spectrum help you in complying with ESR?

- Assess and file ESR Notification:Study your Business Activities in detail and assess the applicability of the Economic Substance Regulation for your business.

- Changes in business to comply with ESR: To provide guidance and support for compliance with the provisions of the Economic Substance Regulation, if your activity is falling under the regulation and to conduct an “Impact Study and Gap analysis” in order to assess whether your business meets the compliance test and to provide the recommendations.

- Submit ESR Report:Submit the ESR Report with Regulatory Authority before the Due Date.

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us