Dubai Maritime City was established according to the vision of his Highness Sheikh Mohammed Bin Rashid Al Maktoum. It is the first worldly built center indulged in the entire maritime industry, commerce and trade. This iconic City, 249 hectares, strategically located between Port Rashid and Dubai’s Dry-docks World. It aims to capitalize Dubai’s strengths and position as a regional and global maritime hub in order to create a dynamic urban life style for maritime community.

Dubai Maritime City Free Zone (DMC) is focused on enduring international marine rules while forming strategic alliances with various governmental organizations and commercial firms. It is the only specialized maritime cluster in the UAE and the GCC that provides all the services the marine sector requires, such as marine suppliers, engineering and technical know-how, ship maintenance, and yacht building, with less than one roof. Dubai Maritime City is located in the very heart of Dubai- a business center of the world, and most attractive destination for international investment. It lies a man-made peninsula near the creek area business district, between Port Rashed & the Dubai Drydocks. It is surrounded by the Arabian Gulf with an easy access to the sea, airport and public transportation.

Unique features of Dubai Maritime City Free Zone (DMC):

- Dubai Maritime City is the sole specialized maritime cluster in all UAE and GCC that covers A to Z marine industry needs under one umbrella e.g. ship repair, yacht manufacturing, marine suppliers, engineering and technical expertise.

- DMC is an exceptional integrated cluster that covers industry, regulation and infrastructure all together to magnify the role of maritime industry development.

- It provides an entire infrastructure that includes shiplifts, workshops, warehouses, Shops and offices.

- DMC industrial precinct operates under DMCA and Trakhees regulation and guidelines to maintain the working environment.

Benefits of Business in Dubai Maritime City Free Zone (DMC):

- 100% foreign ownership

- Tax exemption on corporate and personal income

- No restriction on repatriation of capital and profits

- Exemption from import/export duties

- Cost effective

- Companies can operate 24/7 in the Freezone

- Ample financial incentives

Dubai Maritime City Free Zone (DMC) is made up of 6 strategic locations:

- Industrial Precinct: A hub for ship repair facilities, yacht repair, manufacturing, yacht charter, and workshop units.

- Dubai Maritime City Campus: A center for universities relating to maritime studies.

- The Maritime Center: Serves as an international hub for maritime business.

- Harbor Office: Provides office space for maritime business.

- Marina District: A place for entertainment and other recreational activities.

- Harbor residence: A zone for residential facilities.

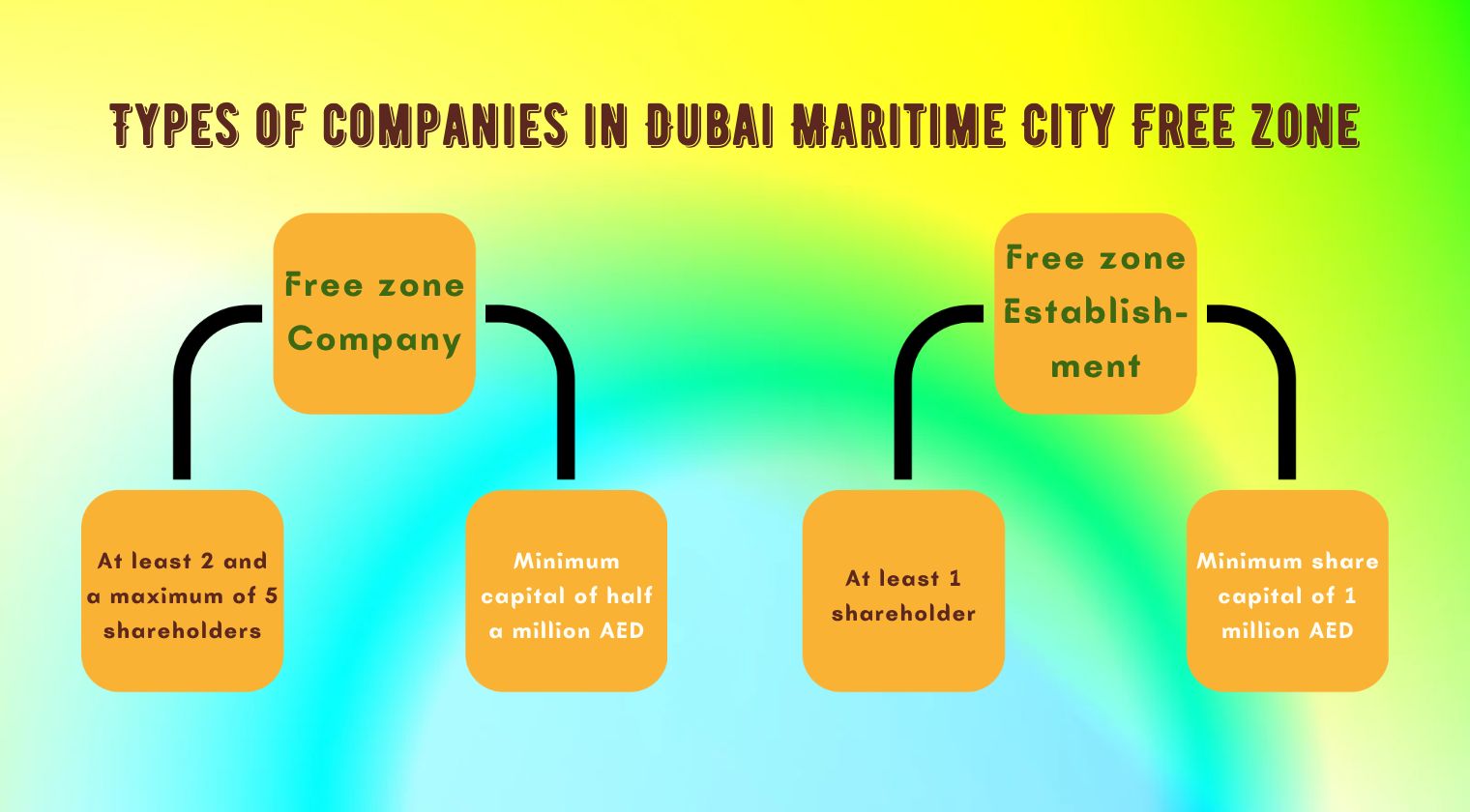

Types of companies in Dubai Maritime City Free Zone (DMC):

Foreign natural persons can register free zone companies and free zone establishments, while foreign companies can set up both types of free zone entities and branch offices.

How to set up a company in Dubai Maritime City Free Zone (DMC)?

Documents required for registration at Dubai Maritime City Free Zone (DMC):

- Shareholder’s passport copies

- Details of managers and directors

- The Manager’s CV

- The lease agreement for the office space

- The company’s article of association

- Power of attorney

Types of Licenses in Dubai Maritime City Free Zone (DMC):

- Marine Crafts License: It is required to build and use vessels as per International maritime standards.

- Maritime Operations Service License: It includes activities such as waste management in seawater.

- Maritime Commercial License: This license is required by companies that carry out maritime activities as well as recreational activities in Dubai waters.

- Maritime Education and Research License: Obtaining this license is mandatory for entities that focus on providing maritime education and research activities.

- Commercial License: It permits general maritime activities in Dubai Maritime City.

Corporate tax applicability to the companies in Dubai Maritime City Free Zone (DMC):

Corporate tax law is going to be applicable for all the companies registered in UAE including the free zones in UAE. The UAE Corporate tax is going to be effective for the financial year beginning on or after 1 June 2023 for the businesses in UAE. Corporate tax will be levied at zero percent on the taxable income (adjusted net profit) of the businesses in the free zones as long as they comply with all the regulations of the respective free zone and do not do any business with the mainland companies, otherwise there is a possibility of levying 9% corporate tax on the taxable income (adjusted net profit) in excess of AED 375,000. Hence companies in the Free Zones need to make sure that they are complying with all the regulations of the free zone and do not do any business with the mainland entities to enjoy the benefit of zero percentage of UAE corporate tax.

{NOTE: Kindly note that the authenticity of this article is limited to the day of publishing this blog. As policies and rules pertaining to each free zone keeps changing from time to time based on the necessity of the respective authority, it is hereby advised you to check the website of the concerned free zone directly to get the latest update on the same. We do not assume any liability if you have taken any decision based on the information provided in the article. We have ensured that the presented information to the visitor is legible to the maximum extent possible so that all the information is available in one page, at one go. Thank you.}

How can Spectrum help you set up a business in Dubai Maritime City Free Zone (DMC)?

Spectrum provides an easy and simple start-up process for companies seeking to set up offices in Dubai Maritime City Free Zone (DMC). Spectrum’s dedicated team will guide you through the process, answer your questions, provide the necessary forms, and serve as your primary point of contact to support you through the whole process.

Spectrum is an expert firm in the Company Formation and Company Liquidation process. Our passion and heart lie in serving the clients and we aim at the utmost client’s satisfaction. We are registered Auditors under the Ministry of Economy UAE and also registered Tax Agent from Federal Tax Agency UAE, Dubai providing dedicated Audit, Accounting, Tax services and various Business Advisory Services complying regulatory requirements.

Call us today for any kind of assistance at +971 4 2699329 or email us at [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Accounts Executive

contact us

contact us