Background

Is there any corporate law in existence in UAE? Is there any framework to issue business licenses in UAE?

Yes! Every Emirate has its own corporate code. Licenses are issued in Dubai and other Emirates fall under four categories professional, commercial, industrial and tourism. Any establishment which intends to conduct business operations in Dubai has to get their license in one of these categories.

Further UAE has structured itself into three jurisdictions to conduct economic activities. The three jurisdictions are as noted below. The Establishments can register and seek licenses to operate under these respective jurisdictions based on respective criteria and nature of the economic operations intended to be performed under the establishment

- (a) Mainland (governed by Department of economic development of respective Emirate);

(b) Free Zone (governed by respective Authority), provide relaxation or benefits to Establishments in the areas of ownership, taxes, customs, repatriation, imports and exports, currency regulations as opposed to establishments registered in the Mainland;

(C) Offshore (governed by respective Authority), unlike establishments in Free Zone any establishment under this jurisdiction does not have an obligation to lease any premises.

What is DMCC? What are the Guidelines issued by the Authority for Winding up of Companies?

Dubai Multi Commodities Centre (“DMCC”), was established to establish hub for global commodities trade. This is one the Free Zones in Dubai regulated by Dubai Multi Commodities Centre Authority. The Authority has issues recently, Companies Regulations 2020 and also issued certain How to Guides, Guidance Notes, Templates, along with these regulations.

The recent issued Guide (source: https://blog.dmcc.ae/new-company-regulations-in-dmcc) is being discussed in this blog to understand the modes of winding up and the processes called for.

Under which all circumstances a branch or a company in DMCC can be liquidated or wound up?

Based on the Guide, we understand that there four modes of winding up – Summary winding up (in case Directors declare affairs being final wound up in 6 months timeline starting commencement of winding up process); Solvent winding up (in case declaration is within 12 months timeline); Insolvent winding up (in case of creditors participation in the process); Involuntary winding up by the competent court (disciplinary action by regulated authority, if any).

What is process to liquidate or winding up a company or branch issued by DMCC?

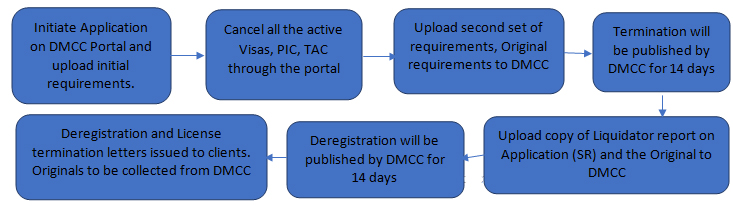

The process has been made applicable for both Company and Branches established in DMCC. Appointment of Liquidator is the must for Companies and not required for Branches. The Process of Liquidation or Winding up is to be initiated by submitting an Application.

Do Consult Spectrum Auditing, to understand the application requirements in detail, Step by step process, and if need specific assistance for the Liquidator reporting aspects. Spectrum Auditing can help clients in taking care of full liquidation process from the beginning till closure of the license.

contact us

contact us