Spectrum Auditing & Steadfast Business Consulting has come up with a comprehensive guide on: UAE Corporate Tax & Transfer Pricing Regime.

The content covered in full detail include the following topics:

1) Introduction of UAE CT Regime

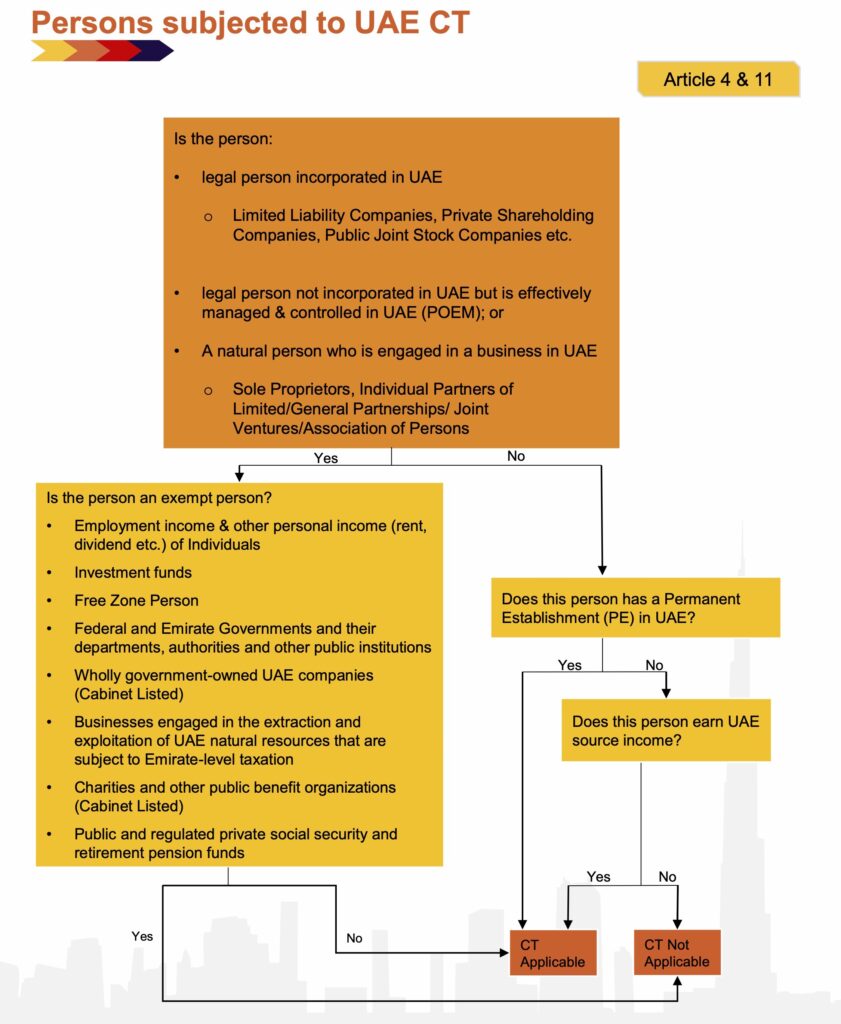

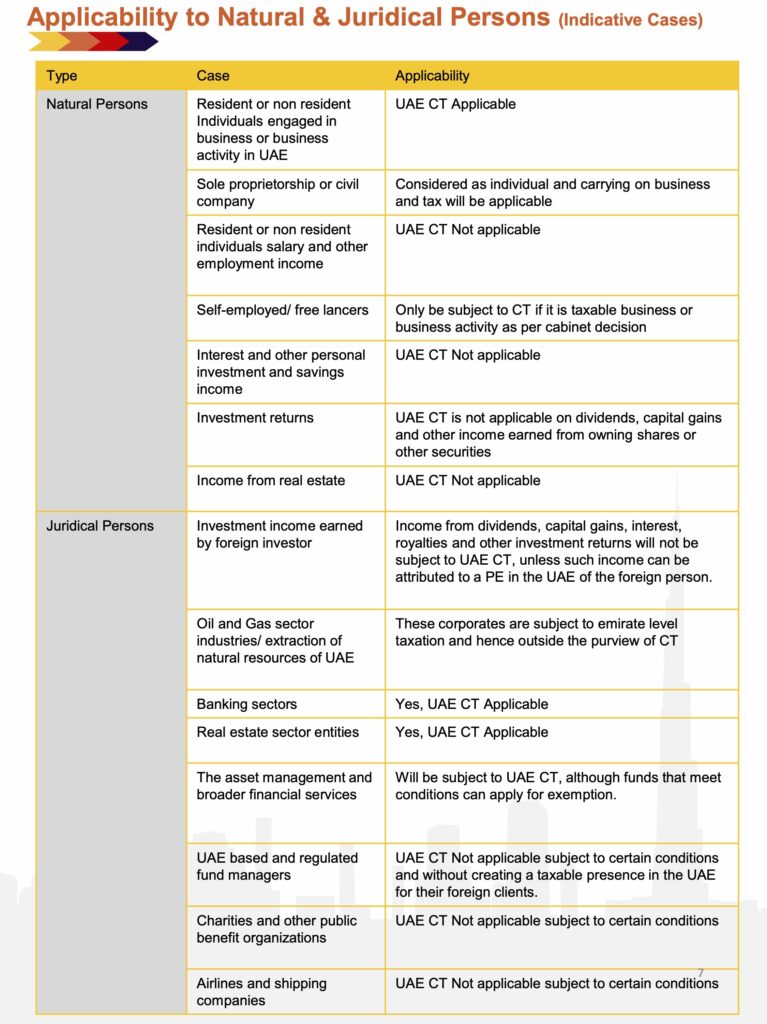

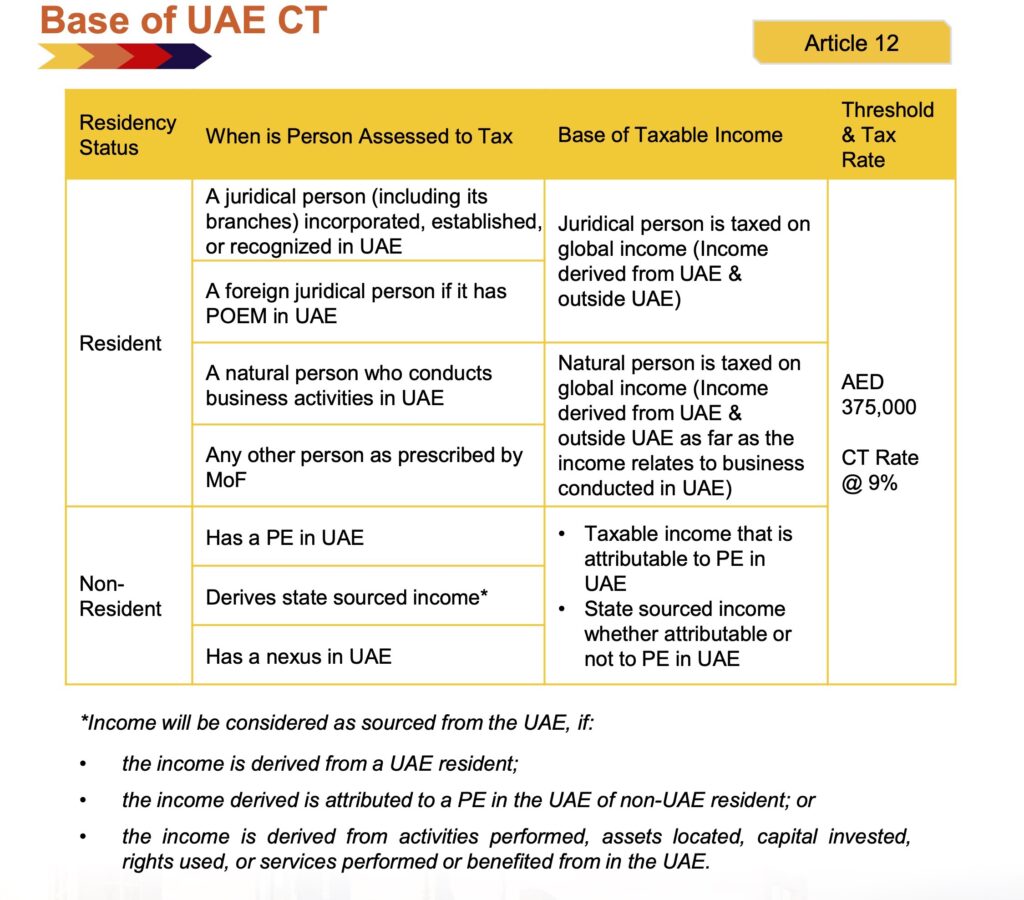

2) Taxable Person and Tax Base

3) Tax Residency

4) Taxable Income

5) Tax Loss Provisions

6) Tax Computation

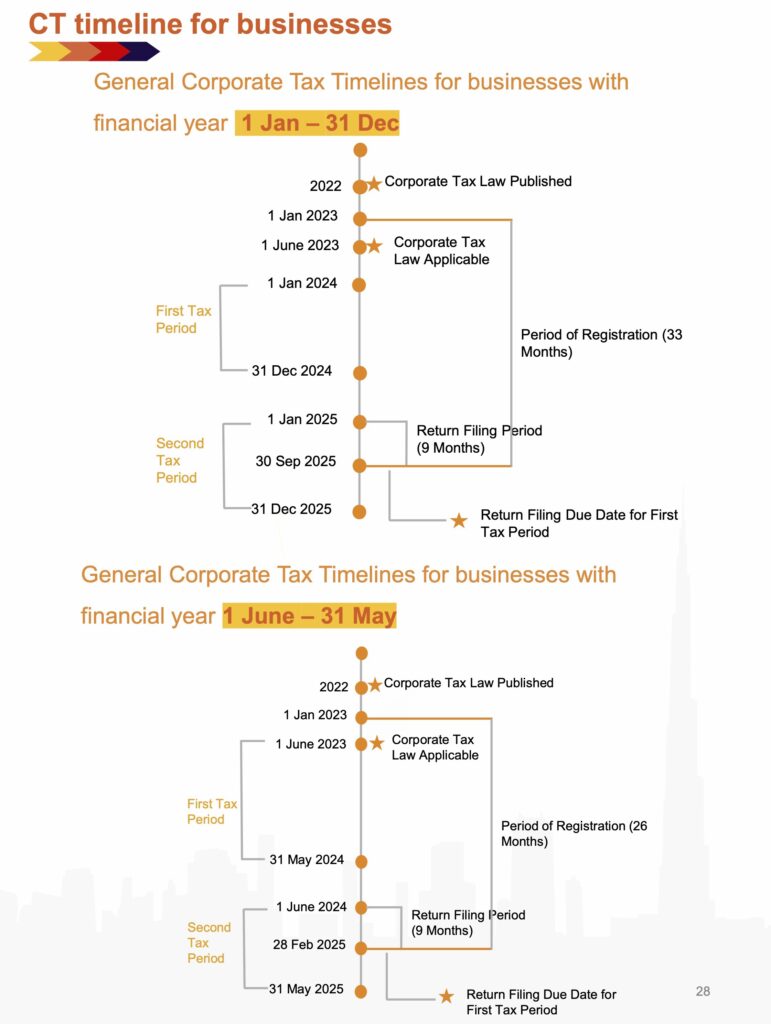

7) Tax Groups

8) Registration & Returns

9) Other Aspects

10) GAAR & BEPS Pillar 2

11) UAE Transfer Pricing Regime

You can download the PDF document from here: Spectrum Auditing Corporate Tax and Transfer Pricing Regime Guide

How Can We Assist You on UAE CT & TP?

The developments in relation to CT & TP in the UAE have far-reaching tax and non-tax/operational implications for affected businesses. Alongside CT & TP, these implications may also relate to legal structure, business model, contracting, accounting, profit and systems and data organization, and the organization of the tax function with a potential impact for various stakeholders within organizations. Considering the timeframe left to prepare for the implementation of CT & TP rules, companies should start assessing the impact for their business and what they need do in order to be prepared given the complexity of these rules. We can assist you with the following:

Corporate Tax & International Taxation –

- Assist in undertaking tax impact analysis for being CT compliant ready

- Assist in Managing Group Tax compliances under single dashboard

- Assisting in preparing and maintaining the Documentation and Reporting to the tax authorities

- Representation/ involvement at the Court or Tribunal level or before tax or non-tax authorities

- Analysis of tax residency and CT & TP implications in UAE

- Advisory on WHT applicability for various international transactions

- Advisory on Global Entity Structuring/Restructuring

- Ensure consistency with OECD and Global International Tax & TP practices, BEPS readiness

Transfer Pricing –

- Analyze the inter-company transaction flows and set a robust TP policy

- Advice on substance test, appropriate business models and remuneration mechanism from a TP and Tax standpoint

- Tax impact analysis factoring TP and BEPS implications

- TP inter-play with CT, VAT, Customs, Accounting, Valuations etc.

- Undertaking TP benchmarking analyses, Drafting inter-company agreement, Group TP policy, SOPs etc.

- Assist with TP Compliances (Disclosure Form, Local File, Master File, Country-by-Country- Report)

- Representations before FTA in due course

- Alternative Dispute Resolution/Preventions (APA/MAPs)

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or WhatsApp +971 50 9866 466 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us