VAT 702 CASH DEPOSIT RELEASE FOR NON- REGISTERED IMPORTERS

VAT 702 is a form provided by the Federal Tax Authority (“FTA”) pursuant to which a non-registered importer notifies the FTA to either cancel or liquidate an e-Guarantee or to refund or collect an e-Dirham deposit.

When to submit VAT 702?

• You have provided an e-Guarantee or e-Dirham deposit to FTA on the FTA e-Services portal using VAT 301 while importing goods under tax suspension

• You have completed the duty suspension claims process with the relevant customs authority

• One business day has passed since the approval of your claim by customs

Scenarios to consider for filing:

1. If goods were imported under tax suspension and have been exported completely, then the importer shall submit the duty claim to the relevant custom authority and the VAT declaration will be updated automatically.

2. If the goods were imported under tax suspension and have been sold or used partially in the UAE, then the importer shall submit the duty claim to the relevant custom authority and applicable VAT will be deducted from the deposit/e-guarantee for the goods sold or used in the UAE on VAT 702.

3. If the goods were imported under tax suspension and have been sold or used completely in the UAE, then the importer shall submit the duty claim to the relevant custom authority and applicable VAT will be deducted from the deposit/e-guarantee for the goods sold or used in the UAE on VAT 702.

Who should submit a VAT 702?

• You are not registered with the FTA

• You have imported goods under duty suspension regime after 1st January 2018

• You have paid an e-Dirham deposit or provided an e-Guarantee to the FTA upon import of goods

• You have either exported the goods outside the UAE, sold, consumed, damaged or lost the goods while still under suspension in the UAE.

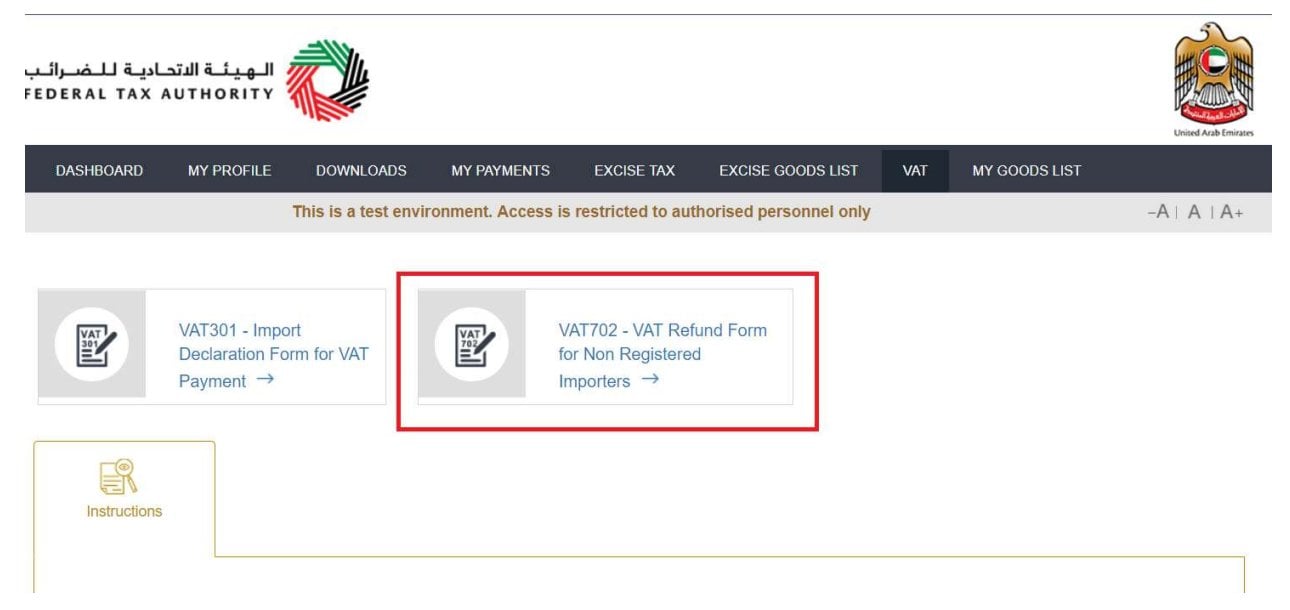

How to access VAT 702 on portal?

VAT 702 is available on the e-Services portal in the respective (VAT) section.

For submitting a VAT-702 Form, go to select VAT from the main menu and click on the VAT 702 button:

Note: As part of VAT 702, under the applicable scenarios you are required to provide the bank account details or the e-Guarantee number. Please ensure that this information is correct.

Completing VAT 702

The following steps are involved to complete VAT 702 submission:

a) Declaration Information

b) Claim Details

c) Finish

d) Refund Review by FTA

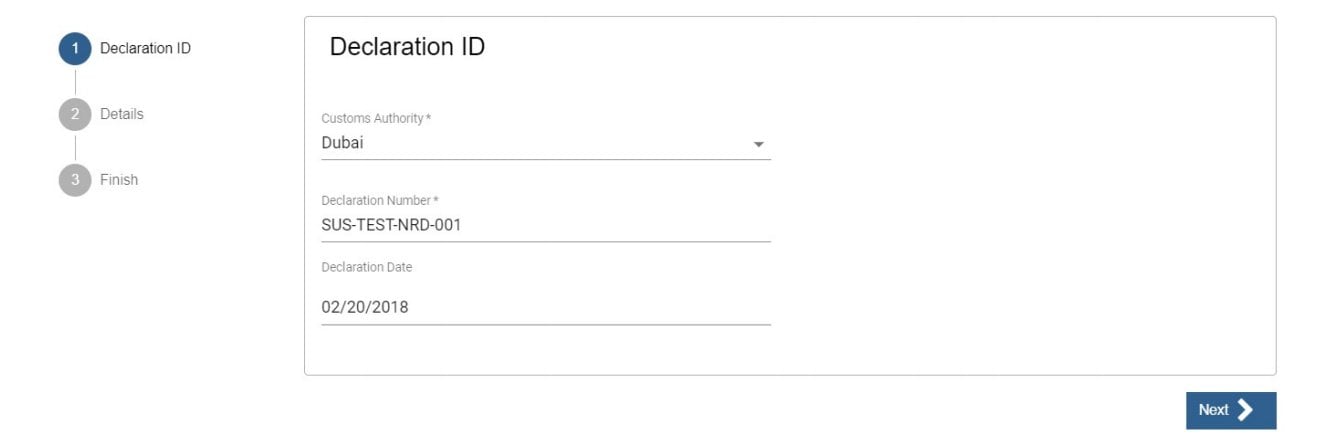

a) Declaration Information:

Fill in the declaration details: Enter the following details in the form

• Customs Authority

• Declaration Date (i.e. Import Declaration Date)

• Declaration Number (i.e. Import Declaration Number)

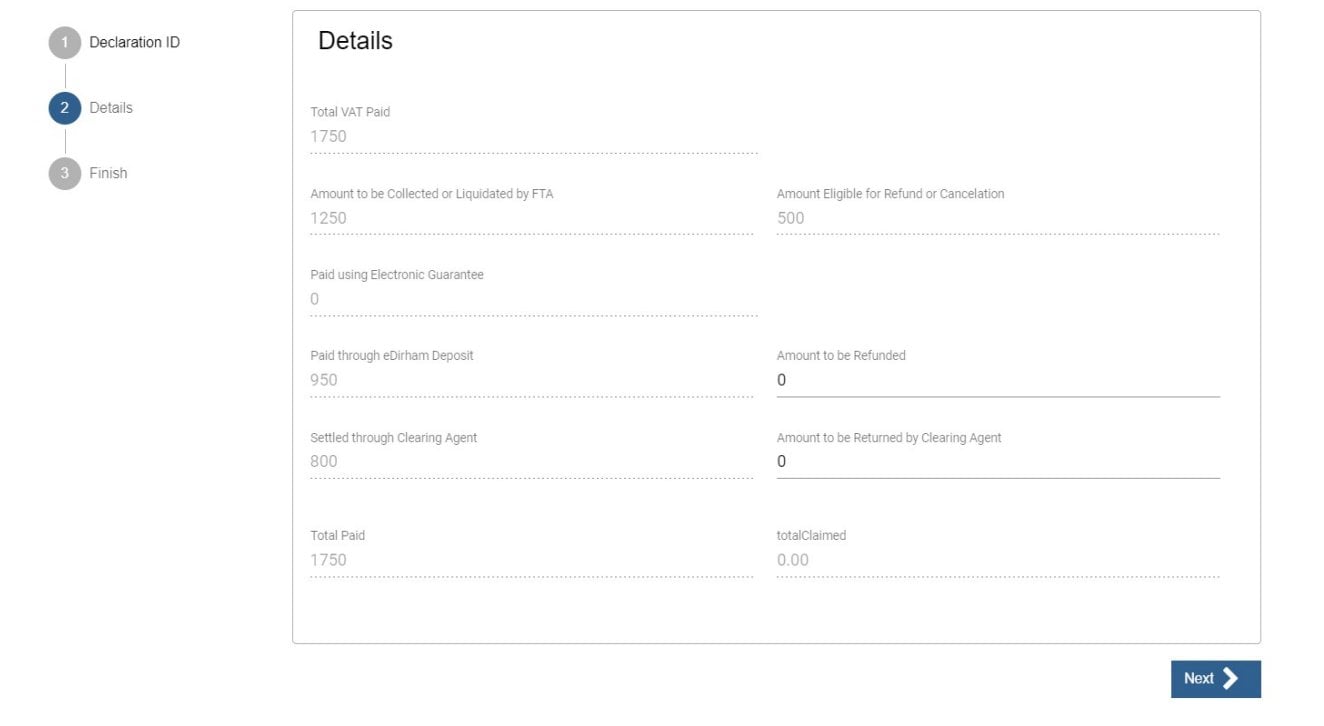

b) Claim Details:

Fill in the claim details: Please review the details of the claims as received from the customs authority. This will some or all include the following field:

• Total VAT paid

• Amount to be collected

• Amount eligible for refund

• Paid using e-Guarantee

• Amount to be cancelled from e-Guarantee

• Paid through e-Dirham deposit

• Amount to be refunded

• Settled through Clearing Agent

• Amount to be returned by Clearing Agent

• Total paid

• Total Claimed

The fields available will depend on the payment method used for settling your import declaration.

Example: If the amount deposited with the authorities is AED 200,000 then the amount being claimed as refund cannot exceed AED 200,000.

Note: The total amount requested for refund must not exceed the amount eligible for refund, as per the records of the customs authority. Furthermore, the specific refund paid method requested must not exceed the initial amount paid using the same method.

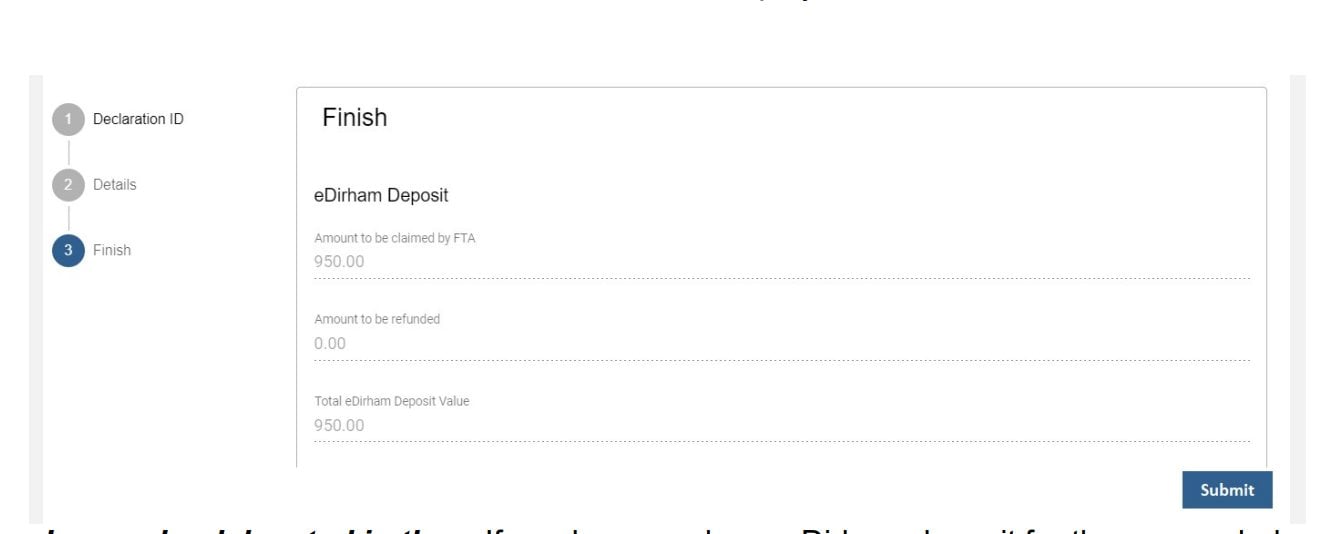

c) Finish

o Payment Summary: The summary of the amount that will be deducted from your deposit /e-Guarantee and the amount that will be refunded will be displayed

o Is your bank located in the UAE? IBAN BIC/ SWIFT etc: If you have made an e-Dirham deposit for the suspended declaration, you can be eligible for a refund from your bank.

o Upload the IBAN Validation Number: Upload the letter issued and stamped by your bank which includes details about the account holder name (must be the same as the applicant’s name), bank’s name and the IBAN.

Note: You must ensure that your account details are accurate. Some accounts cannot receive payments electronically. We recommend that you check with your provider before submitting this form if you are unsure whether or not your bank has made this facility available to you.

d) Final Review by FTA

After completing the submission, the FTA will review your request and process it.

Help needed?

Spectrum Accounting LLC provides a one stop solution to all your accounting and taxation matters. Our industry focused specialists help business manage their indirect taxes effectively by providing technical support, guidance on effective processes implementation and leveraging technology solutions.

contact us

contact us