Question:- When to de-register VAT in United Arab Emirates (UAE)?

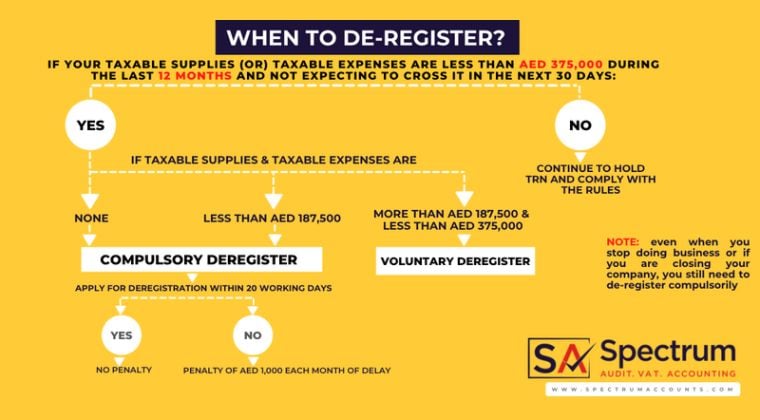

Answer:- If your taxable supplies (or) taxable expenses are less than AED 375,000 during the last 12 months and not expecting to cross it in the next 30 days, then you have following scenarios to consider:

If your taxable supplies & taxable expenses during the last 12 months are:

1) Less than AED 187,500 then you need to go for compulsory de-registration

2) NILL then you need to go for compulsory de-registration

3) More than AED 187,500 & less than AED 375,000 then you may apply for voluntary de-registration

Anytime of the year, if you stop making taxable supplies or if you are closing your company, you need to de-register compulsorily

Read Questions relating to VAT Deregistration here: Click

Read VAT De-registration article here: Click

You can also watch a video on de-registration here:

In case of any query, Call us on +971 4 2699 329 (or) Email: [email protected] to know more.

Visit: www.spectrumaccounts.com

contact us

contact us