Country by Country Reporting in the United Arab Emirates – awareness workshop

Purpose of BEPS and CbCR

- CbCR is a part of Action 13 of the Base Erosion and Profit Shifting (BEPS) project that is led by the G20 and the Organisation for Economic Co-operation and Development (OECD)

- The BEPS initiative is aimed at preventing tax planning that exploits gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity

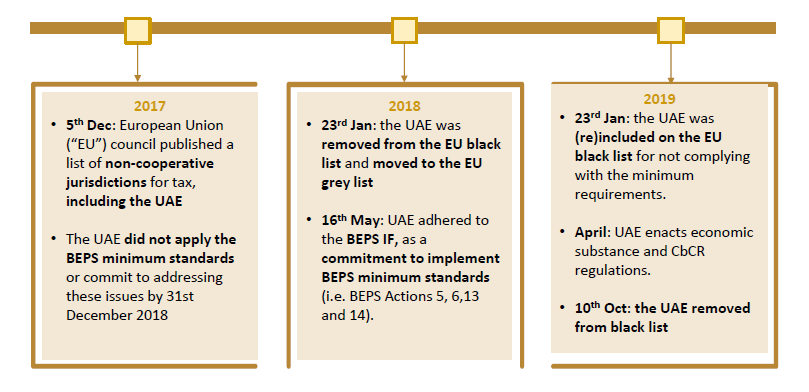

Relevant actions taken by the UAE (to date)

- The UAE joined the BEPS Inclusive Framework (BEPS IF) on 16 May 2018 and has committed to implementing the four BEPS minimum standards, including CbCR

- The UAE has issued a CbCR legislation on April 2019 under the Cabinet Resolution no 32 of 2019

- As of October 2019, the UAE has signed and ratified the multilateral competent authority agreement (MCAA) on the exchange of CbC reports, but has signed 49 agreements for the automatic exchange of CbC reports, effective for periods beginning January 1, 2019

UAE’s BEPS journey

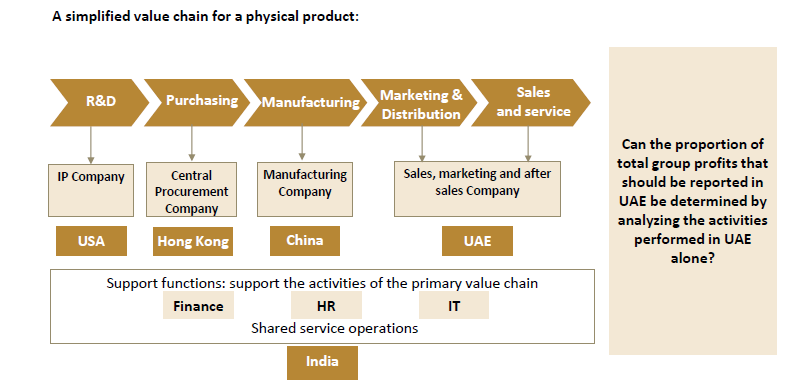

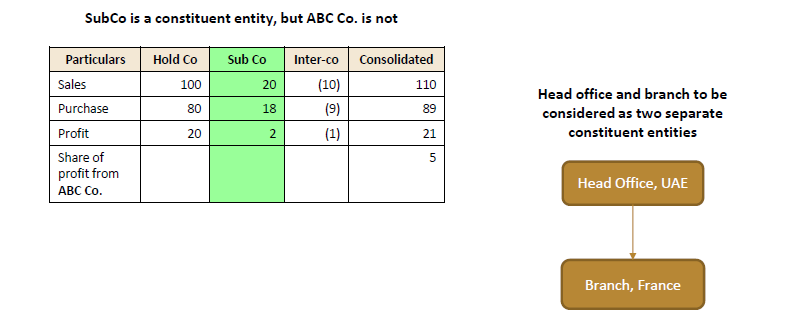

Example of why tax authorities want a global view

The focus of BEPS regulations is to ensure alignment of profit allocation (remuneration) with value creation (functions performed, risks assumed and assets owned) for each entity across the value chain

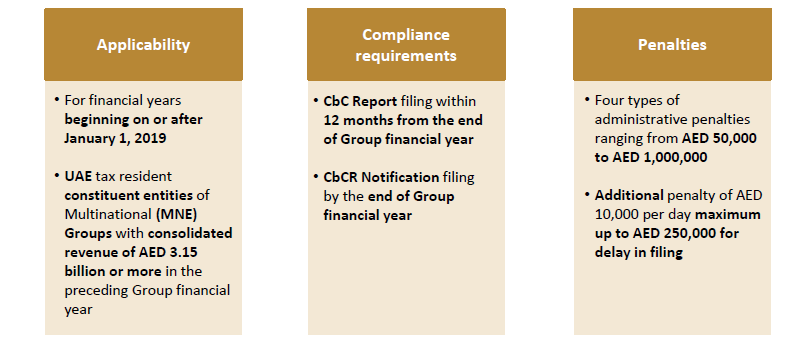

Snapshot of CbCR requirements in the UAE

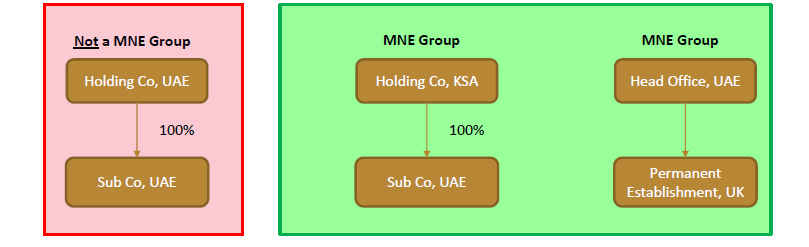

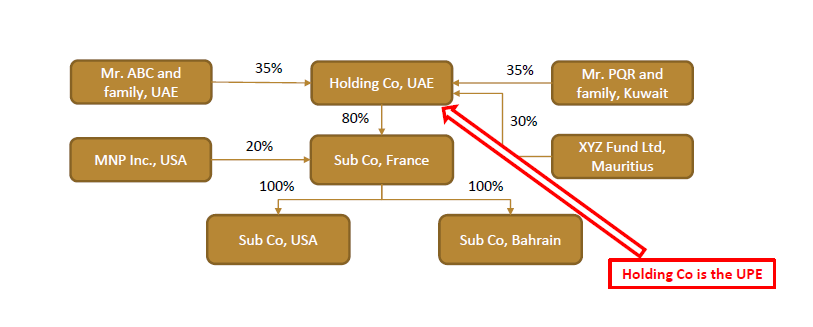

Multinational Group (MNE Group)

For CbCR purposes the MNE Group is the group which consists of two or more enterprises that are residents for tax purposes in different jurisdictions

Constituent entity of MNE Group

1.Any separate business unitof MNE Group that is included in the Consolidated Financial Statements; or

2.Excluded from Consolidated Financial Statements solely on size or materiality grounds; or

3.Any permanent establishment of any separate business unit of the MNE Group referred to in paragraphs 1 or 2 above, if separate financial statements prepared for any purpose

Ultimate parent entity of MNE Group

1.Owns directly or indirectly a sufficient interest in one or more other Constituent Entities of such MNE Group such that it is required to prepare Consolidated Financial Statements; and

2.There is no other Constituent Entity of such MNE Group that owns directly or indirectly an interest in the above Constituent entity.

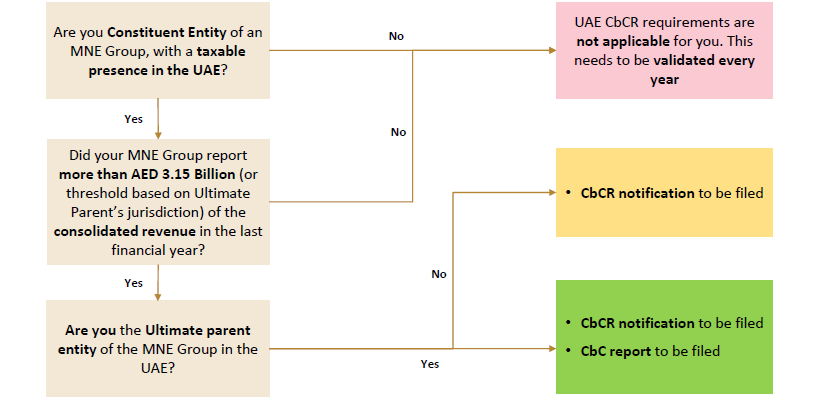

Obligations for the UAE private sector -filing obligations

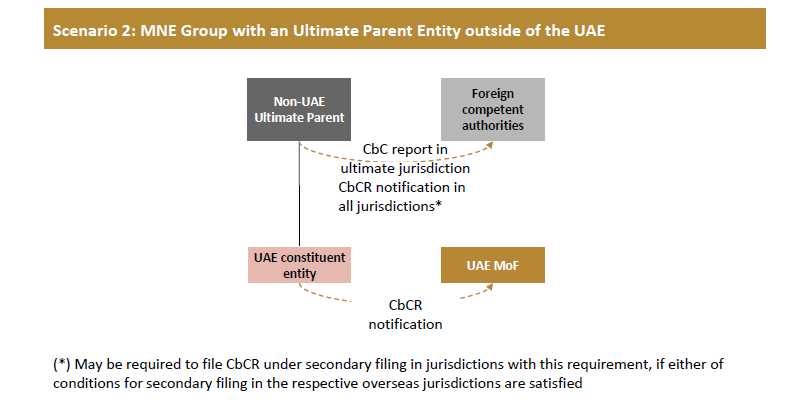

Illustration

Penalties for non-compliance

Failure to file CbCR / CbCR notification in time

An administrative fine of AED 1,000,000 (plus AED 10,000 for each day of failure up to a maximum of AED 250,000)

Failure to maintain information and documentation for five years

AED 100,000

Failure to provide any other information requested

AED 100,000

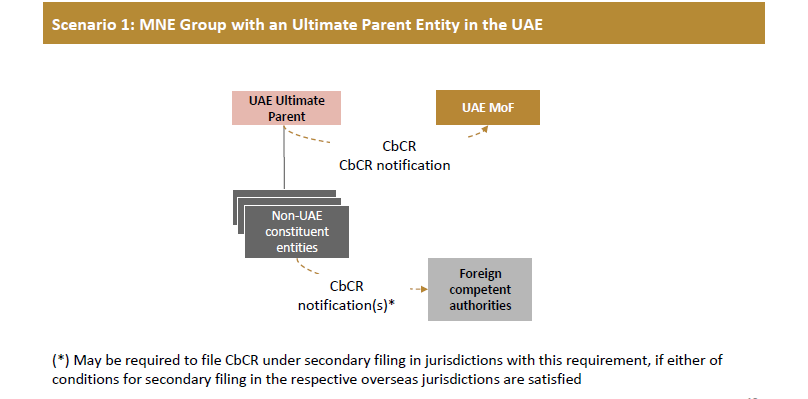

Potential impact of introducing CbCR regulations in the UAE

Key Benefits

- Reporting CbCR information to the UAE MoF(rather than to foreign tax authorities), thereby preserving confidentiality on such (potentially sensitive) information to be within the UAE only

- Extensive network of UAE exchange of information framework(49 agreements) will ensure minimum secondary filing requirements in other jurisdictions

- Groups to get an birds-eye view of operations through CbCR information, where risks can be identified and where Groups can take proactive steps to mitigate such risks

Key challenges

- Additional administrative and compliance burden, particularly for those UAE headquartered businesses that are not already subject to CbCR requirements elsewhere

- Increased oversight from international bodies on how UAE headquartered groups conduct their businesses

CbCR notification requirements in the UAE

Who?

- Constituent entities of MNE Group tax resident in the UAE(including Ultimate parent entities)

When?

- By the end of the MNE Group’s financial years beginning on or after January 1, 2019 (Hence, the closest deadline being 31 December 2019)

How?

- One notification should be submitted on behalf of all UAE entities.

- An online system is being implemented.

CbC Reporting requirements in the UAE

Who?

- UAE tax resident Ultimate parent entity

When?

- Within 12 months from the end of the MNE Group’s financial years beginning on or after January 1, 2019 (Hence, the closest deadline being 31 December 2020)

What?

- Refer subsequent slides for details on the contents of CbC Report.

How?

- An online system is being implemented.

What is a CbC Report

A report including quantitative and qualitative information about the MNE Group. Information such as revenues, profits, employees count, business description, etc. should be reported under three tables:

- Table I–This contains the quantitative information per tax jurisdiction such as third party and related party revenues, stated capital, taxes accrued and paid, employee count, etc.

- Table II–This contains the qualitative information per constituent entity on the main business activities undertaken during the year.

- Table III–This contains any additional information necessary to facilitate the understanding of Tables I and II (e.g. assumptions on exchange rates, source of data, etc.)

General CbCR guidance

Data Sources

- Consolidation reporting packages or Statutory financial statements or Internal management accounts

- The source should be consistent year on year.

Currency

- CbCR should be in the stated functional currency of the MNE Group

- Conversions, if any, should be made at average rate of exchange during the year, with source mentioned in Table 3

Year of data to be included in the CbCR

- For Ultimate Parent Entity –Group financial year

- For other constituent entities –Group financial year or local financial year immediately preceding the Group financial year. E.g. if Group financial year ends December 31, 2019, the financial year end for other constituent entities can be anywhere between Jan 1, 2019 to Dec 31, 2019

contact us

contact us