{This blog is an updated version of our old blog on ‘Profit Margin Scheme’ present here at: https://www.spectrumaccounts.com/profit-margin-scheme/ and currently the blog is shared in a more useful question & answer format.}

- What is a Profit margin Scheme?

It is a scheme whereby a Taxable Person has an option to calculate Tax on the profit margin earned on a supply, instead of the sale value. The Profit Margin Scheme is available only on supply of certain specified goods, and not services.

The Authority must be notified if the Profit Margin Scheme is to be used. Penalty will be levied on the taxable person if they fail to notify. (Art.76 of the VAT Law)

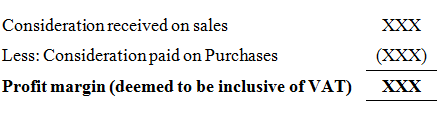

- What would be the Profit margin for Supplier?

It is the difference between consideration paid on purchase of the Goods and the consideration received on sale of the Goods, and the profit margin shall be deemed to be inclusive of Tax.

If Profit margin is zero or if a loss is made, the value of the supply is zero for VAT purposes.In other words, there will not be any VAT liability on the Supplier if the profit margin is zero or if it is loss

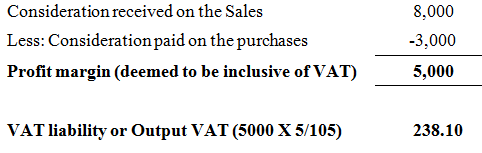

- Give an example for computing the Profit margin and the VAT liability on the same.

Yasmin sells antique furniture which she bought from a member of public for AED 3000. She then sold the dresser for AED 8000 then what would be the Profit Margin and the VAT liability?

In this case, the Input tax will be “Zero”.

- What are the Goods eligible and conditions for applying the Profit Margin Scheme? Only certain goods are eligible to be supplied under the profit margin scheme. Those goods are listed below, but may only be supplied under the scheme where they were subject to VAT before the supply which shall be subject to the profit margin scheme

- Second-hand Goods, meaning tangible moveable property that is suitable for further use as it is or after repair.

- Antiques, meaning goods that are over 50 years old.

- Collectors’ items, meaning stamps, coins and currency and other pieces of scientific, historical or archaeological interest

Conditions for applying the Profit Margin scheme

- only when the above-mentioned eligible goods were purchased from either:

- A Person who is not a Registrant of VAT.

- A Taxable Person who calculated the VAT on the supply by reference to the profit margin i.e., a VAT registered business which already applied the profit margin scheme on the same goods

- When a taxable person made a supply of goods where the input tax was not recovered.

It is also to be noted that, a taxable person will not be allowed to apply the profit margin scheme in such cases where he has issued a tax invoice or any other document mentioning an amount of VAT chargeable in respect of the supply.

In this context, a public clarification has been issued by FTA to identify those goods which qualify to be sold under the profit margin scheme, with respect to the ‘second hand’ goodsbought and sold during the transitional periods which may not have been subject to VAT prior to implementation of VAT in the UAE.

It is to clarify that only those goods which have previously been subject to VAT before the supply will only be subject to the profit margin scheme.

As a result, the following goods will not be eligible to be sold under the Profit margin Scheme-

- stock on hand of used goods which were acquired prior to the effective date of VAT applicability in UAE i.e., 1st January 2018(or)

- which have not previously been subject to VAT for other reasons,

Therefore,VAT is due on the full selling price of such goods.

Detailed discussion:

It is a requirement that the goods which are eligible to be sold under the profit margin scheme are those which have previously been subject to the tax. Therefore, the goods which are generally eligible under the scheme, but are purchased during the period in which they would not have been subject to VAT are not eligible for the scheme.

Clarification

Case 1

If the goods werepurchased in the year 2017 or earlier, and the original purchase was not subject to VAT, then the good is not eligible to be sold under the Profit margin Scheme and VAT should be applied on the full Selling price.

Example:Ahmed Used cars, which is a taxable dealer in second hand cars, sells a second-hand car for AED 8000in Jan 2020, which they bought for AED 5000 in Feb 2017 without any VAT. Are the goods eligible for the Profit Margin scheme, if so, then what would be the amount of VAT liability?

In the given case, the car was bought by the dealer in the year Feb, 2017 where VAT rules are not yetapplicable in UAE. Therefore, the second-hand car will not be eligible to be sold under profit margin scheme and full Selling price of AED 8000 should be considered for VAT liability i.e., 8000X5% = 400.

Case 2

If the goods were purchased in the year 2018 or later, and the original purchase was from a supplier who didn’t charge VAT on the supply, and the goods may have been purchased in a period prior to the effective date of VAT, then the good is not eligible to be sold under the profit margin scheme and VAT should be applied to the full selling priceunless evidence is available to show the good had been subject to VAT on an earlier supply.

Example: An inherited antique painting was sold by Mr.X to Mr.Y in 2017, which in turn was sold by Mr.Y to Anand LLC in 2020, who is a dealer in antique store. Anand LLC cannot apply the Profit margin scheme with respect to the Antique painting since the original purchase by Mr.Y was in 2017 where the VAT is not applicable in UAE. However, if Anand LLC can provide the evidence to the extent that painting has been subject to VAT when purchased from Mr.Y, then the profit margin scheme can be applied.

Case 3

If the goods were purchased in the year 2018 or later, and the original purchase was from a supplier and it is known that the goods would have been purchased by the supplier in a period after the effective date of VAT, then the good is eligible to be sold under the profit margin schemewhere you have the evidence to show that the good has been subject to VAT on an earlier supply.

Example: A second hand car dealer who purchased a second-hand car from Mr. A in the year 2020 and is having an adequate evidence to show that the original purchase of the car by Mr. A is in 2019 i.e., after the effective date of VAT, then the cars are eligible for the Profit Margin scheme.

- What are considered as evidences for applying the Profit Margin Scheme?

A supplier should be confident that a good has previously been subject to tax in order to apply the profit margin scheme. Such evidence or information of this position could include but is not limited to:

- Information relating to the date the good was first manufactured, sold or brought in to use e.g., in the case of a car, the date the car was first registered would indicate its sale would have been subject to VAT if it was registered on a date after 1 January 2018

- Evidence that the supplier paid VAT on their original purchase e.g., by asking the supplier for a copy of the tax invoice relating to their purchase of the good.

- What are the records to be maintained by the Supplier, if they apply Profit margin scheme?

The taxable supplier must maintain the following records in respect of supplies made by him.

- A stock book or a similar record showing details of each Good purchased and sold under the profit margin scheme.

- Purchase invoices showing details of the Goods purchased under the profit margin scheme.Where the Goods are purchased by taxable supplier from persons who are not Registrants, thenthe taxable supplier must get an invoice showing details of the Goods himself, including at least the following information:

- The name, address and Tax Registration Number of the Taxable Person.

- The name and address of the Person selling the Good.

- The date of the purchase.

- Details of the Goods purchased.

- The Consideration payable in respect of the Goods.

- Signature of the Person selling the Good or authorized signatory.

Note:Where a Taxable Person has charged Tax in respect of a supply with reference to the profit margin, the Taxable Person shall issue a Tax Invoice that clearly states that the Tax was charged with reference to the profit margin, in addition to all other information required to be stated in a Tax Invoice “except the amount of tax.”

Why choose Spectrum Auditing?

Spectrum Auditing team is well equipped toadvise and take care of your requirements of Value Added Tax (VAT). Our passion and heart lie in serving the clients and we aim to keep client’s satisfaction as our primary motto. We are registered Auditors under the Ministry of Economy UAE and also registered Tax Agent from Federal Tax Agency UAE, Dubai providing dedicated Audit, Accounting, Tax services, Financial Advisory and Business Advisory Services complying regulatory requirements.

Reach us to have a frills free life in your journey in UAE. We at Spectrum will assist you in taking care of all the procedures involved in the VAT process. Call us today for any kind of assistance at +971 4 2699329 or email us at [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us