The Ministry of Finance has announced a new UAE Cabinet decision relating to ‘qualifying public benefit entities’, whereby Public benefit entities are exempted from the corporate tax.

It’s noteworthy that the Corporate Tax Law provides the legislative basis for the introduction and implementation of a Federal Corporate Tax in the UAE and is effective for financial years starting on or after 1 June 2023. The Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses was issued by the United Arab Emirates on 09 December 2022.

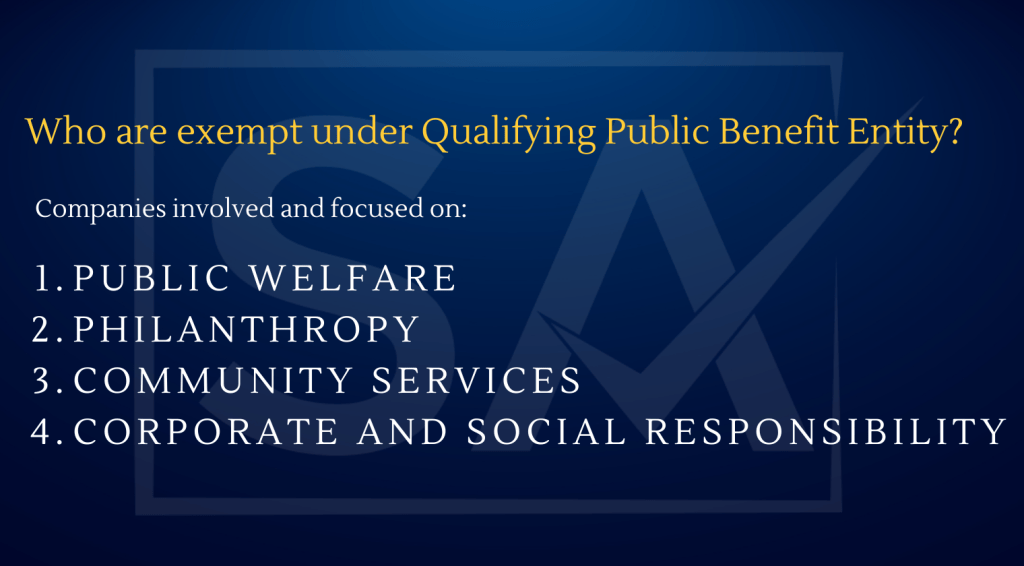

The exemption is designed to reflect the significant role played by public benefit entities, which often include organisations with a focus on areas of religion, charity, science, education and culture.

These entities must continue to comply with all pertinent local, state, and federal laws and notify the Ministry of Finance of any changes that may affect their status as Qualifying Public Benefit Entities in order to be eligible for UAE Corporate Tax exemption. These entities must also meet the requirements under Article (9) of the Corporate Tax Law.

On the Finance Minister’s recommendation, the Cabinet may change, add, or remove entities from the list of Qualifying Public Benefit Entities.

Any change that affects the business’s ability to continue meeting the requirements outlined in this Decision and the Corporate Tax Law must be reported by an entity that is identified in the schedule attached to the decision.

Qualifying public benefit entities are subject to a number of reporting requirements, mostly to ensure that they continue to meet the requirements for approval.

With regard to their deductible expenses under Article 33 of the Corporate Tax Law, taxpayers now have more clarity and transparency thanks to the Cabinet’s decision, as donations and gifts will be recognised as deductible expenses for corporate tax purposes if they are given to one of a qualifying public benefit entity listed in the Cabinet Decision.

The Ministry earlier announced corporate tax exemptions for non-resident persons, government entities, government-controlled entities, as well as extractive businesses and non-extractive natural resource businesses.

All Cabinet Decisions and Ministerial Decisions issued relating to the Corporate Tax Law are available on the Ministry of Finance’s website: www.mof.gov.ae.

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us