Dubai Expo City is considered to play a vital role in Dubai’s development as a global center for innovation and economic expansion. The main aim is to provide the residents with a comprehensive and balanced way of life with a high-quality destination.

Dubai Expo City Free Zone encourages international firms and provides plenty of opportunities to achieve their sustainable goals. Businesses looking forward to being a part of the 5G-enabled networks must surely go for the Expo City location.

Expo City Dubai free zone will provide an ideal environment and virtual infrastructure that will push innovation to new heights. The city would become a catalyst for change-makers of all ages. They also provide local, regional, and international businesses that can serve their customers.

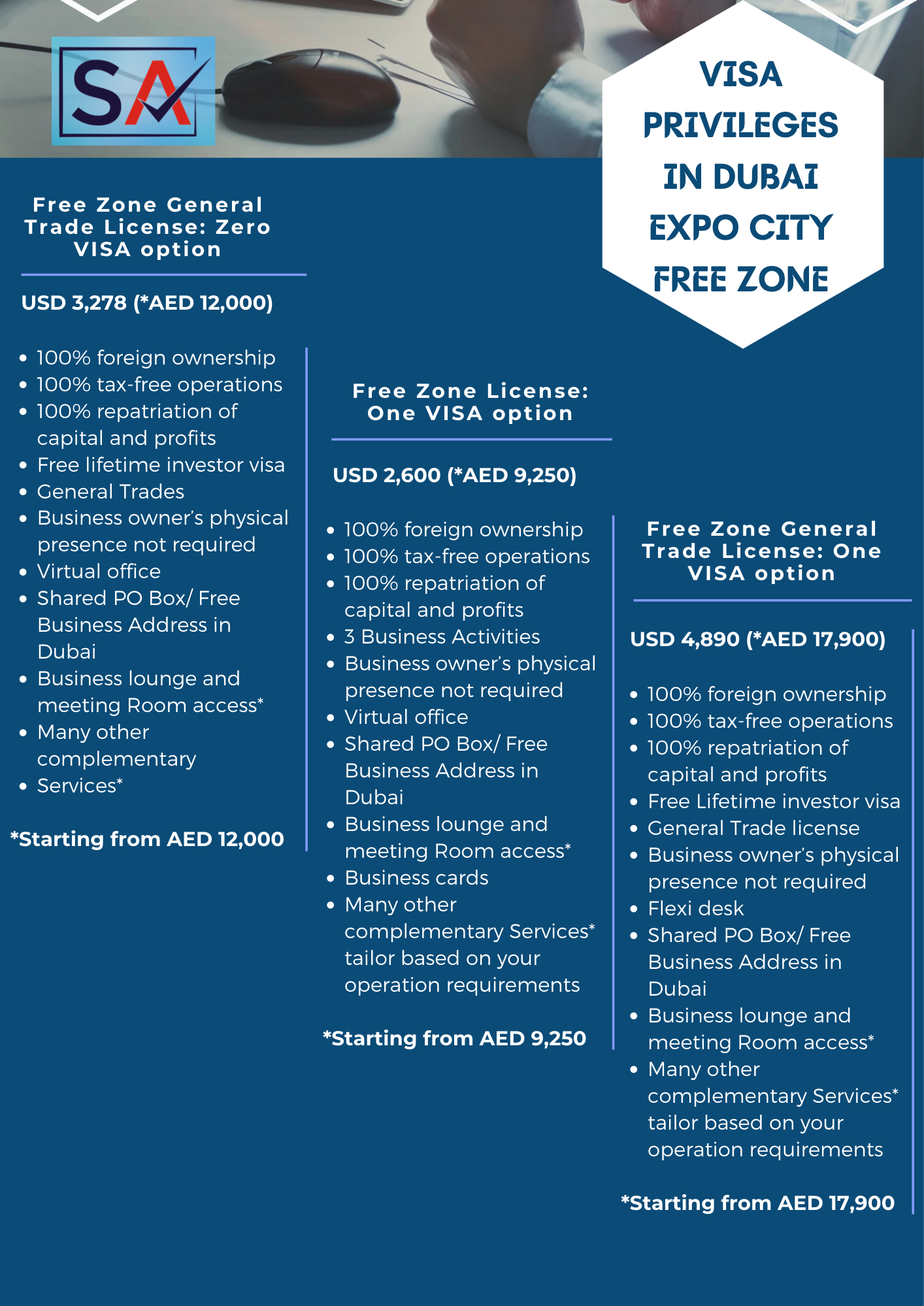

VISA privileges in Dubai Expo City Free Zone:

* The fees stated above and in this article are purely based on the information available on the official websites/sources of the concerned government authority and from publicly available sources. You can anticipate changes in future in the costs mentioned. If you re taking any decisions based on the info provided in this article, kindly recheck with the official authorities/sources before taking any decision. Spectrum is not responsible for any changes in the costs mentioned above.

Leasable office space:

Expo City Dubai will provide leasable commercial spaces for small businesses and global companies. It includes offices and co-working spaces that are also suitable for innovation labs and R & D centers. Local startups to top corporates are found in Expo City Zone.

They provide a flexible and tech-enabled environment for the employees with 5G and Internet of Things (IoT) Technologies.

*IoT refers to the collective network of connected devices and the technology that facilitates communication between devices and the cloud and between the devices themselves.

Expo City Dubai Amenities:

- Retail shops

- F & B outlets

- Schools

- Parks

- Vehicle routes to offices

- Pedestrian walkways

- Cycling tracks

Growth Sectors in Expo City Dubai:

The growth sectors focused on in the Expo City are:

- Smart mobility: Tech-driven mobility apps and solutions.

- Smart logistics: Smart tips for an effective network of traceable goods.

- Industry 4.0: Improving the growth of computer-generated manufacturing systems.

- Smart cities: Provides sustainable and intelligent urban spaces.

Expo City Dubai’s Scale2Dubai Program:

Scale2Dubai is an inclusive global entrepreneur program for both regional and international applicants. Startups or small businesses planning to build their operations in Dubai or the Middle East/North Africa region can apply for this ambitious program. The basic aim of this program is to promote small enterprises and to build strong roots in the UAE market.

Benefits of Scale2Dubai:

- Two years of free workspace and visa.

- Business setup

- Community lifestyle

- Two years of subsidized urban living

- Access to special rates (for service providers)

- Social and networking event calendar

Corporate tax applicability to the companies in Dubai Expo City Free Zone:

Corporate tax law is going to be applicable for all the companies registered in UAE including the free zones in UAE. The UAE Corporate tax is going to be effective for the financial year beginning on or after 1 June 2023 for the businesses in UAE. Corporate tax will be levied at zero percent on the taxable income (adjusted net profit) of the businesses in the free zones as long as they comply with all the regulations of the respective free zone and do not do any business with the mainland companies, otherwise there is a possibility of levying 9% corporate tax on the taxable income (adjusted net profit) in excess of AED 375,000. Hence companies in the Free Zones need to make sure that they are complying with all the regulations of the free zone and do not do any business with the mainland entities to enjoy the benefit of zero percentage of UAE corporate tax.

{NOTE: Kindly note that the authenticity of this article is limited to the day of publishing this blog. As policies and rules pertaining to each free zone keeps changing from time to time based on the necessity of the respective authority, it is hereby advised you to check the website of the concerned free zone directly to get the latest update on the same. We do not assume any liability if you have taken any decision based on the information provided in the article. We have ensured that the presented information to the visitor is legible to the maximum extent possible so that all the information is available in one page, at one go. Thank you.}

How can Spectrum help you set up a business in Dubai Expo City Free Zone?

Spectrum provides an easy and simple start-up process for companies seeking to set up offices in Dubai Expo City Free Zone. Spectrum’s dedicated team will guide you through the process, answer your questions, provide the necessary forms, and serve as your primary point of contact to support you through the whole process.

Spectrum is an expert firm in the Company Formation and Company Liquidation process. Our passion and heart lie in serving the clients and we aim at the utmost client’s satisfaction. We are registered Auditors under the Ministry of Economy UAE and also registered Tax Agent from Federal Tax Agency UAE, Dubai providing dedicated Audit, Accounting, Tax services and various Business Advisory Services complying regulatory requirements.

Call us today for any kind of assistance at +971 4 2699329 or email us at [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Accounts Executive

contact us

contact us