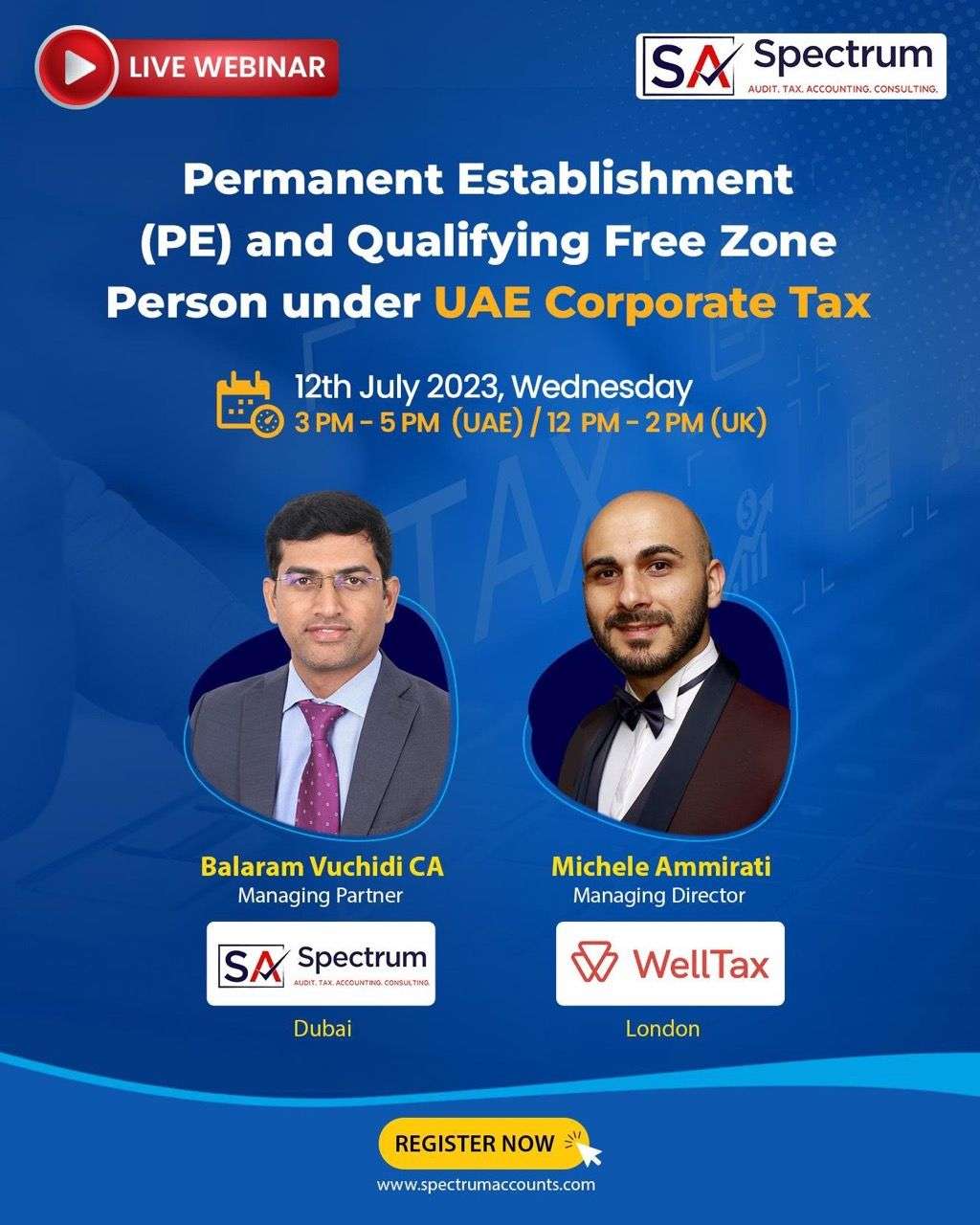

Spectrum Auditing, UAE in collaboration with Welltax Limited, United Kingdom (UK) is conducting a webinar on “Permanent Establishment (PE) and Qualifying Free Zone Person under UAE Corporate Tax”.

Topics under discussion include the following:

- How to determine existence a Permanent Establishment for a Non-Resident in UAE

- Impact of having a Permanent Establishment under UAE CT Law

- Qualifying Free Zone Person – Conditions to get the status

- When do you loose a Qualifying Free Zone Person status and what is the impact

- Question and Answers

SPEAKERS:

Mr. Balaram Reddy, is the Managing Partner of Spectrum Auditing, Dubai, UAE. He is a Chartered Accountant with over 20 years of experience in the field of Audit, Taxation, Advisory and has worked in the Big4 consulting firms (Price Waterhouse Coopers, KPMG & Deloitte) and as well in the Industry. He has vast knowledge in IFRS, US GAAP, and performed financial reporting, Auditing for different industry sectors in the earlier stints.

Michele Ammirati, is the Managing Director of Welltax Limited, London, United Kingdom, a distinguished professional with extensive experience in the field of taxation and finance. With a strong background in tax advisory and compliance, Michele has established himself as a trusted expert in the industry. Michele’s expertise spans various areas of taxation, including corporate tax planning, international tax matters, and VAT compliance. He possesses a deep understanding of the regulatory frameworks and guidelines, allowing him to provide valuable insights and tailored solutions to clients.

Date & Time of the webinar

Wednesday, 12th July 2023 from 3 PM – 5 PM (Dubai Time)

Free ZOOM webinar registration link: https://forms.gle/oaQ7vtEn1DQYE7Tr9

A video recording link as well as the presentation document will be shared post the webinar session. So please block your calendar and be there on time.

Call us today for any kind of information regarding the above webinar at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us