The UAE Ministry of Finance has released a guidance on the corporate tax law and implementing decisions on Non-Resident individuals or entities but have a source of income in UAE.

Residency Criteria

A person is a resident person if they conduct business in UAE or is incorporated or otherwise established or recognized in the UAE or is effectively managed in the UAE.

As per the Cabinet Decision No. 85 of 2022 an individual is considered a resident person if –

- If he has been physically present in UAE for a period of 183 days within 12 consecutive months.

- If he is UAE national and holds valid Residence Permit in UAE and meets the followings conditions –

- Permanent Place of Residence in the UAE.

- An employment or Business in the UAE

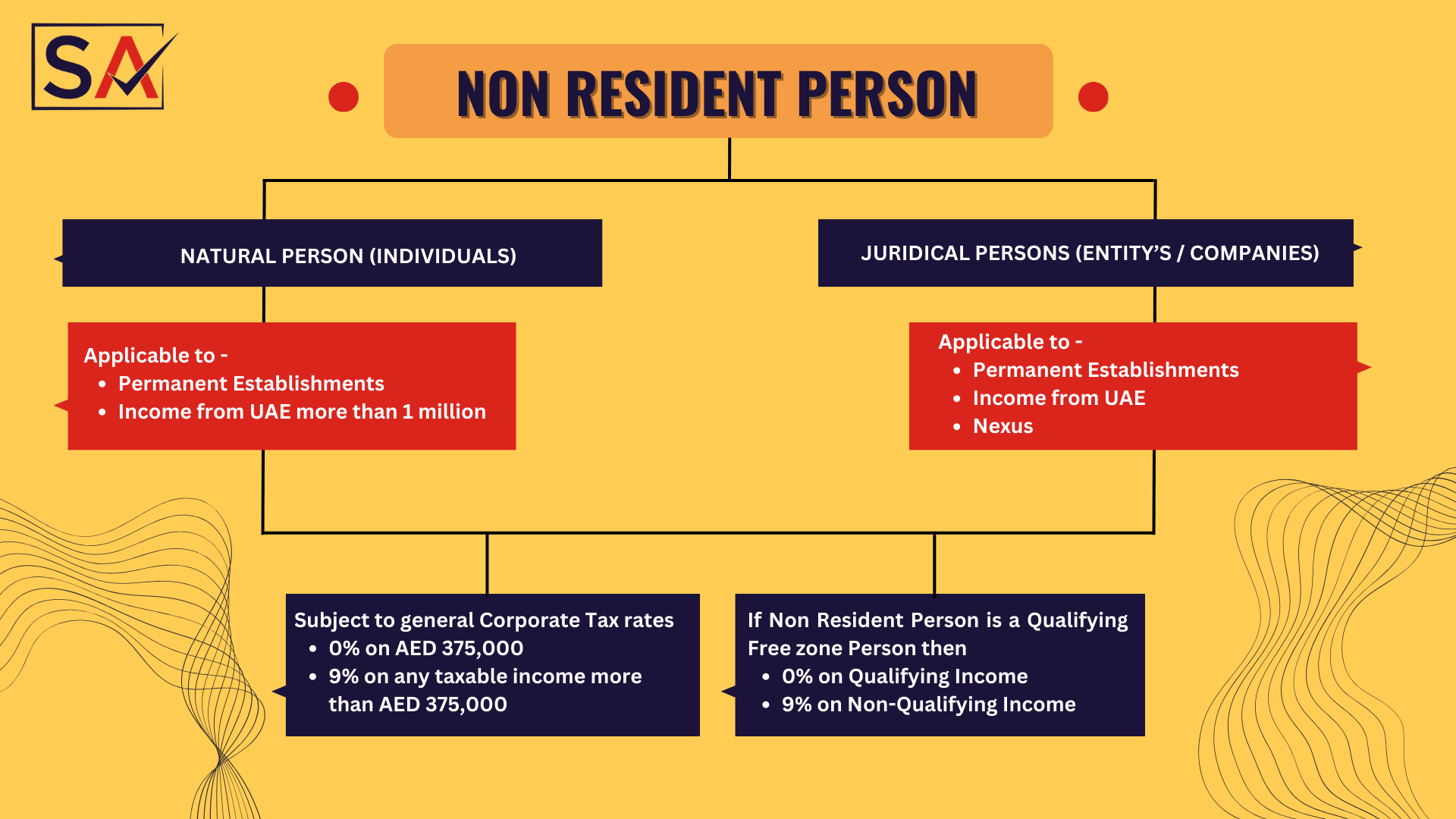

A non-resident person is –

- An individual who is not a resident person but has a Permanent Establishment (PE) from UAE and has a turnover of AED 1 million or more and gets income from UAE.

- An entity who is incorporated outside of UAE has a Permanent establishment in UAE, gets income from UAE or has a nexus.

Individuals who are Non-resident that are subject to Corporate tax

For a non-resident individual who has more than AED 1 million income obtained through Business activities would be subject to corporate tax.

However, the following is not taken into consideration when determining gross taxable income –

- Wages, salary, or any amount received through an employment contract.

- Any return on personal investments

- Income from real estate investments not conducted through a business.

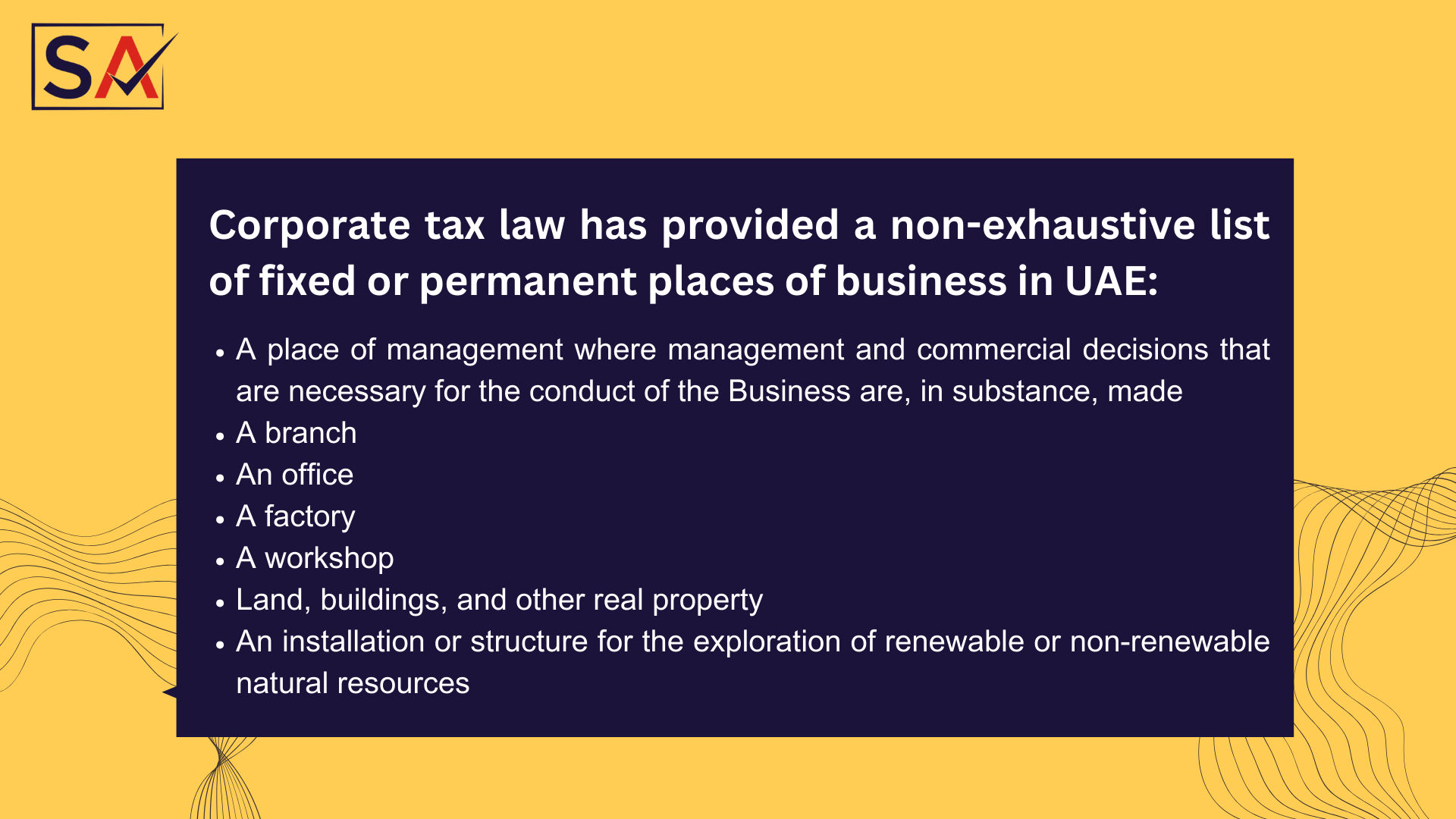

Permanent Establishment

By definition means a fixed or permanent place in UAE through which business is conducted.

There should be a fixed “place of business” in UAE which can be an office, branch or premises which is used to carry out the business activities.

Nexus

Corporate tax is imposed on entities who are non-residents and who have a nexus. The nexus concept does not apply to individuals.

If an entity acquires income through any immovable property in UAE, then it is considered as to have a nexus which means –

- Any area or land over which rights or interest or services can be created.

- Any building, structure or engineering work attached to the land permanently or attached to the seabed.

- Any fixture or equipment which makes up a permanent part of the land or is permanently attached to the building, structure or engineering work or attached to the seabed.

Taxable income

Any income derived by a non-resident person, (either Individual or Entity) from a Permanent Establishment (PE) or Nexus is subject to corporate tax at the following rates –

- 0% on the first AED 375,000 of Taxable income

- 9% on the amount that exceeds AED 375,000.

In the case the Non-Resident person is a Qualifying Free Zone Person as per Cabinet Decision no. 55 of 2023 then corporate tax will be imposed as follows –

- 0% on the Qualifying income

- 9% on Taxable income that is not qualifying income.

Non-resident persons are also supposed to maintain books of accounts as per IFRS (International Financial Reporting Standards).

Non-resident persons (individuals & entities) are not eligible for Small Business Relief.

Why Spectrum Auditing?

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it the Risk Advisory, Transfer Pricing, Value Added Tax (VAT), Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us