Changing email id used in VAT registration

An Online user can change their account email address, where necessary. The process is divided into the below steps:

- Verifying the new email

- Submitting the email change request to the FTA

- Verify your new email

In order to verify your new email, follow the steps set out below:

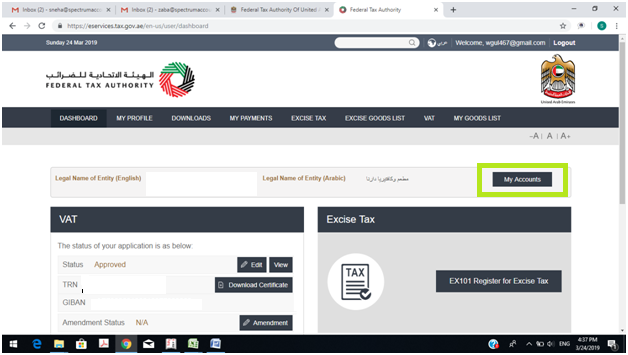

- Log in to the eServices portal, and click on ” My Account”

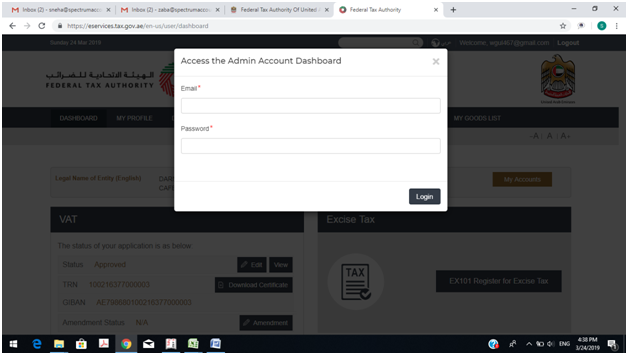

- It will ask for the password again and put your password

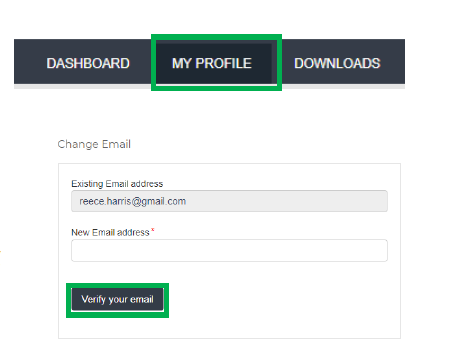

- Then go to MY PROFILE”

- At the bottom left of the screen, you will see the option to add a new email address. Add a new email address and click on “Verify your email”

- You will receive an email link in the newly added email address asking you to verify your email address.

- Verify the email by clicking on the “Click here to verify your new email” link in the body of the email that you have received.

- Submit the email address change request to the FTA

Once you verify the new email and in order to submit the email address change request to the FTA, follow the below steps:

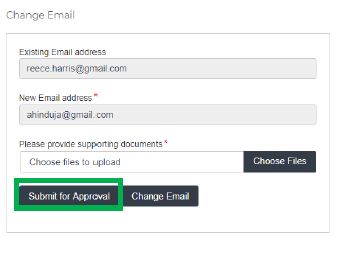

- Log into the eServices portal (using your old email address) and go to the ‘My Profile’ tab.

- Upload the supporting document(s) that will help the FTA review and approve your request for the change of email address and click on the “Submit for Approval” button.

| Supporting documents would be:

· Signed and stamped Letter from Authorized Signatory of the company requesting the email change request and providing the details (name, email address, passport number etc.) of the old and new email holder. This letter must be on official companyheaded paper, include a company stamp and business contact details of the company. · Copy of passport of the old and new email holder · Copy of Emirates ID of the old and new email holder (if applicable)

|

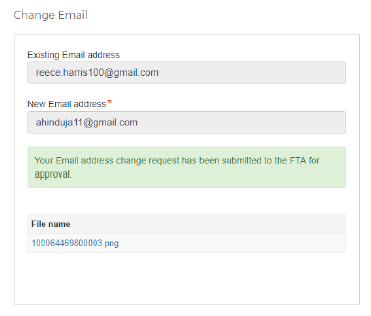

- Once the request is submitted, a confirmation message will be displayed as shown in the screenshot. The FTA will review your request and take appropriate action within 5 business days. If the FTA requires any further details from you in order to process your application, you will receive an email notification setting out the information required from you.

- When the request is approved, you will receive an email notification on the newly registered email address and your email will be updated in the system.

| IMPORTANT: Once the new email address is updated in the system, you will no longer be able to login to the eServices portal using your old email address. Please use the updated email address to login to eServices. Should you require to change back to the old email address, you will be required to follow the same procedures above.

Additionally, all the notifications related to the Taxable Person accounts associated with the account will be sent to the updated email address. 8 |

contact us

contact us