Accounting Record keeping & Auditing

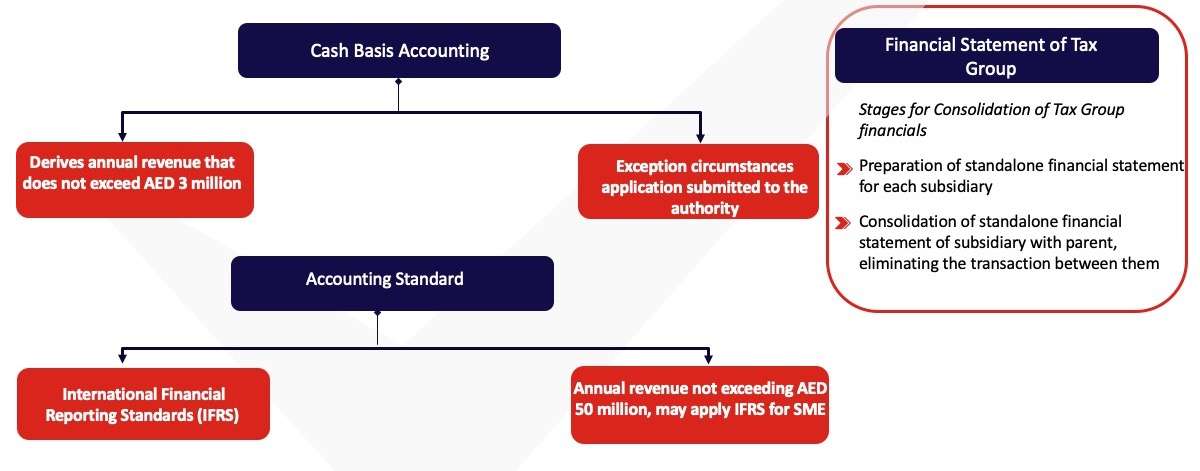

Other than in case of TAX group (Consolidated), UAE entities need to prepare and maintain stand-alone FS for CT purposes

Penalty for Non-Compliance

If the taxable person fails to maintain all the records, documents and other information to

- AED 10,000 for each violation

- AED 20,000 for each subsequent violation within 24 months from the date of the last violation

- AED 5,000, If the taxable person fails to submit data, records and documents related to Corporate Tax in Arabic to the FTA when requested

Note: The Authority may seek further information through auditable documents to verify a person’s Tax obligations and registration responsibility status.

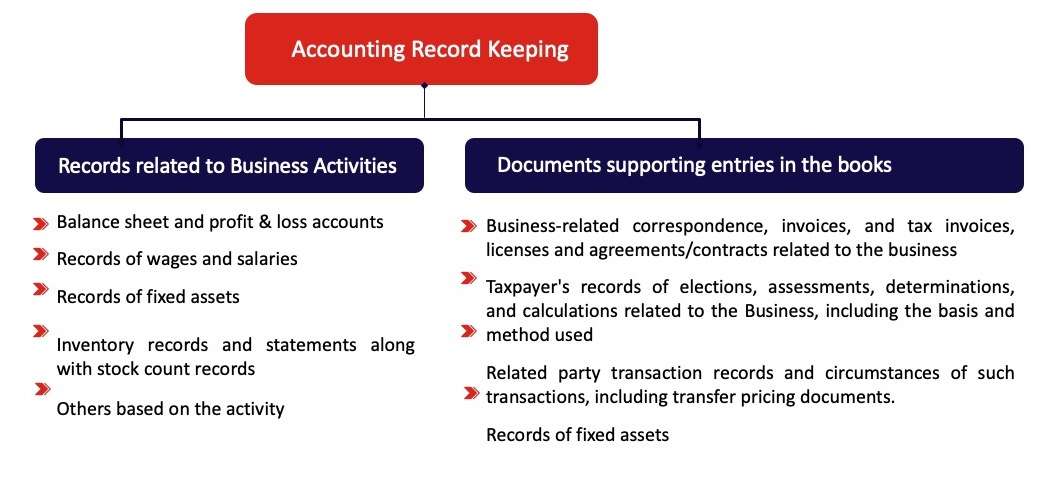

Accounting Record keeping required

Records to be maintained in English and if requested to be translated in Arabic

Ministerial Decision no. 114 – Accounting Standards and Method of Accounting for Corporate Tax Law

Why Spectrum Auditing?

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it the Risk Advisory, Transfer Pricing, Value Added Tax (VAT), Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us