UAE is now fully committed to combat against illegal financial activities such as money laundering and has put in place strict policies & strategies to detect and prevent financial crimes on its land. Recently, UAE has taken some major steps to set up the legal framework and identify institutional paths for implementing the procedures and measures that would contribute to counter money laundering and to combat against the financing of terrorism and illegal organisations. The AML regulations require entities to conduct a risk-based approach while dealing with their customers and thus, UAE firms and companies must adopt policies and controls, based on their risk-based assessments, to guide them in the conduct of their due diligence process for customers.

A licensed money service provider “Wise Nuqud Ltd (Wise)” was given a severe penalty of AED 1.3 million for the violation and non-compliance with AML laws and requirements. The authorities found that Wise was unable to establish and maintain sufficient AML controls to ensure compliance with AML obligations.

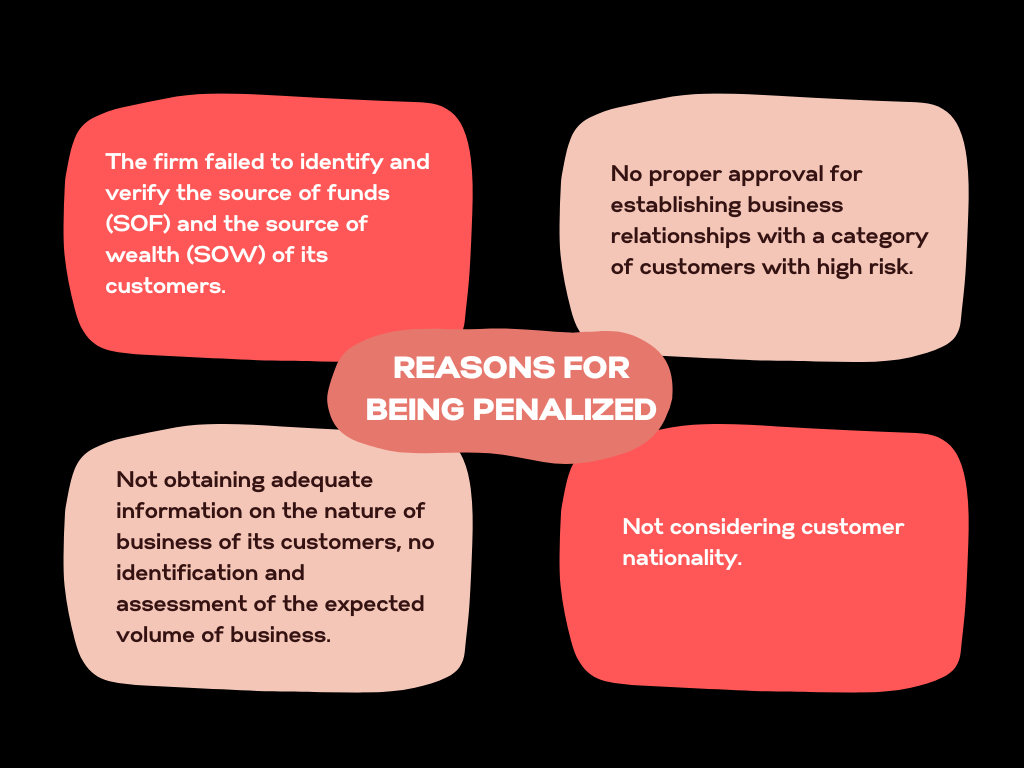

Reasons for being penalized:

- The firm failed to identify and verify the source of funds (SOF) and the source of wealth (SOW) of its customers.

- No proper approval for establishing business relationships with a category of customers with high risk.

- Not considering customer nationality.

- Not obtaining adequate information on the nature of business of its customers, no identification and assessment of the expected volume of business.

The firm was penalized for not having proper controls over AML systems, although the authorities did not identify any instances of actual money laundering during its review. Keeping up with the ever-changing AML regulatory requirements is quite challenging for businesses in UAE and even a minor fault on your part can show you severe consequences. Therefore, it makes absolute sense to approach Anti Money Laundering Consulting Firm’s for the required support to avoid any unpleasant happenings.

We “Spectrum Auditing” are armed with the most experienced professionals who go the whole hog to render quality AML advisory and consulting services for your entire AML journey as being AML compliant is not only crucial for your company but also, it’s a social commitment.

AUTHOR

Audit Manager

contact us

contact us