Unlocking Business Success: The Vital Role of Accounting

In the intricate web of business operations, accounting stands as the cornerstone that upholds financial stability and guides strategic decision-making. It’s not merely about crunching numbers; rather, it’s the compass that navigates the journey of a business towards its goals. Imagine a ship without a captain or a map – that’s akin to running a business without proper accounting practices. In this blog, we delve into the essence of accounting, its pivotal role in budgeting, financial statement management, and compliance with legal requirements. Join us as we unravel the layers of accounting intricacies and discover how it lays the foundation for a prosperous business journey.

Understanding the Essence of Accounting:

Simply put, accounting is the process of recording and organizing financial information to evaluate the performance of a business. It serves as a vital tool for understanding whether a business is thriving or merely surviving. Without accurate accounting, it’s akin to navigating in the dark, unaware of the financial health and direction of the business.

The Crucial Role of Accounting in Budgeting:

Maintaining a budget is crucial for any business aiming for financial stability. Effective budgeting ensures that resources are allocated efficiently and financial goals are met. Accounting practices play a significant role in this process:

- Expense Tracking: By monitoring regular expenses, businesses gain insights into their spending patterns and can identify areas for cost-saving.

- Operating Costs Tracking: Understanding the costs associated with running the business is essential for setting realistic budgets and pricing strategies.

- Asset Depreciation Calculation: Calculating asset depreciation helps in determining the true value of assets over time, enabling better financial planning and decision-making.

- Bookkeeping: Recording and maintaining financial records accurately is fundamental for budgeting and financial management.

The Significance of Financial Statements:

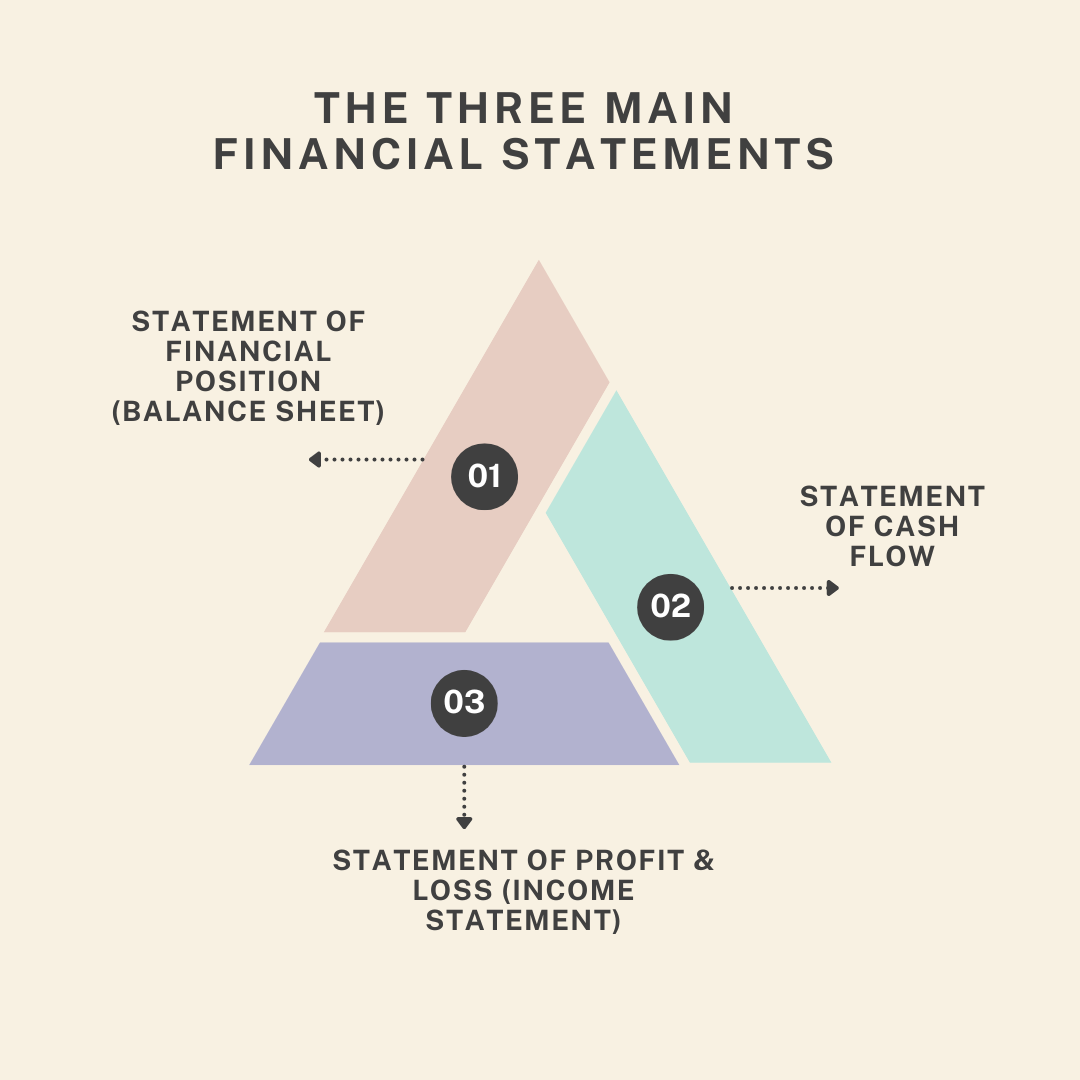

Financial statements provide a snapshot of a business’s financial health and performance. There are three main financial statements that every business should be familiar with:

- Statement of Financial Position (Balance Sheet): This provides an overview of the company’s assets, liabilities, and equity at a specific point in time.

- Statement of Profit & Loss (Income Statement): This outlines the business’s revenues, expenses, and profits over a specific period, providing insights into its profitability.

- Statement of Cash Flow: This tracks the inflow and outflow of cash within the business, offering insights into its liquidity and ability to meet financial obligations.

Compliance and Legal Requirements:

In addition to aiding in financial management, accounting also ensures compliance with legal requirements. Maintaining accurate accounts is not only essential for managing taxes but also mandatory by law for purposes such as Value Added Tax (VAT) and Corporate Tax. Regularly updating and organizing financial records helps businesses stay prepared for audits and inspections, avoiding last-minute hassles.

Building a Foundation for Success:

Accounting is not merely about numbers; it’s about empowering businesses with the insights needed to make informed decisions and chart a path to success. By implementing effective accounting practices, businesses can streamline their operations, achieve financial stability, and lay the groundwork for future growth. Whether you’re a small startup or a medium-sized enterprise, prioritizing accounting is key to building a solid financial foundation and realizing your business’s full potential.

How Spectrum Auditing can help you?

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it the Value Added Tax (VAT), Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us