(Based on the public consultation document on corporate tax in the UAE released by the Ministry of Finance)

The United Arab Emirates (UAE) will introduce the federal Corporate Tax (CT) on business profits effective for financial years starting on or after 1 June 2023. As companies prepare for associating the corporate tax to their businesses, many will find it challenging to comprehend the process.

We at Spectrum Auditing assist our clients in incorporating the Corporate Tax to their businesses. Here are some FAQs and their answers related to the compliance requirements under the UAE Corporate Tax regime.

Q1) Is it necessary for businesses to register for corporate tax under UAE Corporate Tax regime? Are there any consequences for not registering?

Ans – Yes, as there is no minimum threshold for registration mentioned in the public consultation document, it can be assumed that all the businesses are required to register for UAE Corporate Tax with FTA and obtain a Tax Registration Number within a prescribed period. Non-compliance would attract fines accordingly as mentioned in the new corporate tax system, as it is in the case of existing VAT system.

Q2) When do businesses have to deregister for corporate tax under UAE Corporate Tax Regime?

Ans) Businesses will have to apply for de-registration when it ceases to be subject to corporate tax (e.g., due to cessation or liquidation of the business). Application should be made to FTA within 3 months from the date of cessation. Once applied, FTA will deregister a business, only if it is satisfied that the business has filed all the Corporate Tax returns and settled all Corporate Tax liabilities and penalties (if any) due for all periods.

Q3) How frequently it is required to file UAE Corporate Tax return?

Ans) A business will only need to prepare and file one tax return under UAE corporate tax regime and other related supporting schedules with the FTA for each tax period. There will be no requirement for a business to file a provisional corporate tax return and make advance payments of corporate tax before completion of the year in the normal course of the business.

Q4) What is the deadline for filing a tax return under UAE Corporate Tax Regime?

Ans- Corporate Tax return must be filed, and Corporate Tax payment should be made within 9 months from the end of the tax period.

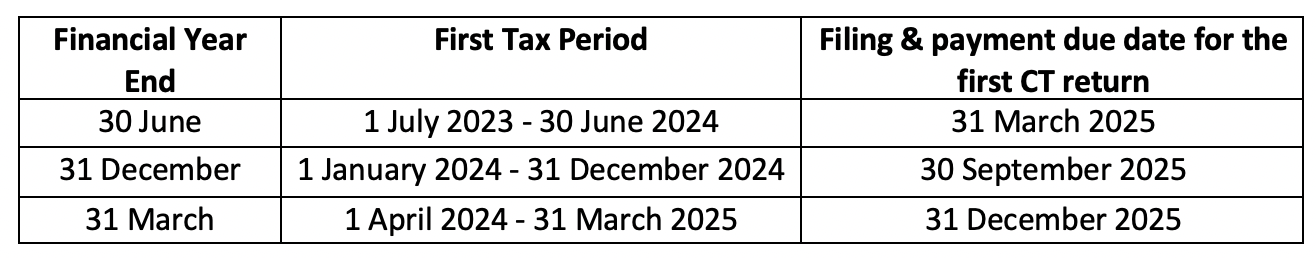

For example:

Q5) What are the expected information requirements while filing Corporate Tax returns?

Ans)

- Financial statements (audited financial statements for free zone entities).

- Taxable income calculation showing adjustments made to the accounting net profit.

- Tax depreciation schedules and worksheets.

- Transfer Pricing documentation.

- Details of related party transactions.

- Movement of provisions.

Q6) Is there any requirement under UAE Corporate Tax regime for a business to get its financial statements audited by accredited audit firm?

Ans) There is no specific requirement as such for a business to get audited under this regime for entities in the mainland. However, the commercial law in UAE requires every company to maintain proper books of accounts and appoint an auditor for the company. And in order to benefit from 0% Corporate Tax regime, free zone companies will have to get their financial statements audited.

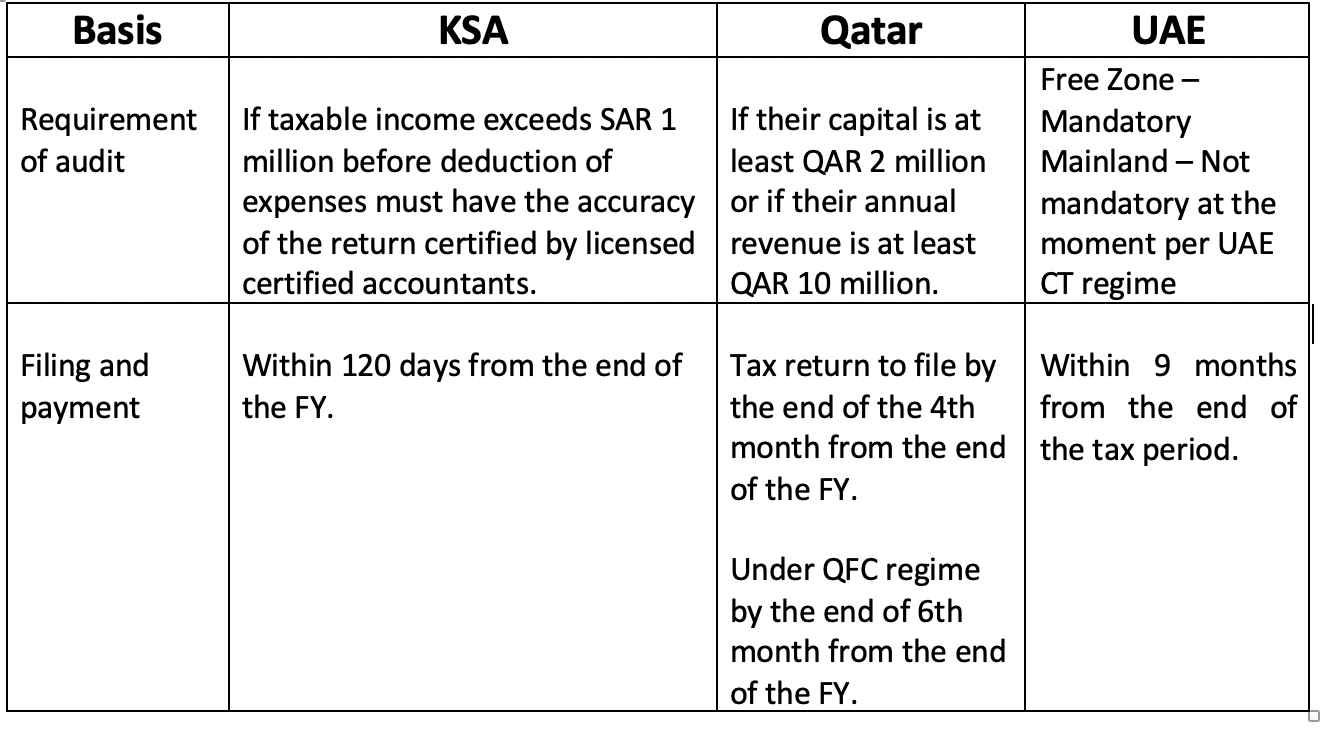

CORPORATE TAX COMPARISON WITH OTHER GCC COUNTRIES

Following is a summary of the comparison of the rules in place at the moment in those respective counties compared with the proposed rules in UAE to get a better understanding:

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Audit Intern

contact us

contact us