After release of IFRS 15 – Revenue from contracts with customers (“IFRS 15” or the “Standard”), many companies have got impacted and had re-look at their accounting policies relating to revenue recognition and make the necessary adjustments to the books of accounts. Hence it is important to understand the main concepts relating to the standard and see the impact of the changes on the accounting treatment relating to the revenue recognition. The standard explains how and when an entity should recognize revenue in its books of accounts.

Following are few important definitions that are relevant to understand the concept well:

Q) What is revenue?

A) In simple terms, revenue is the value of all sales of goods or services recognized by a company in a period. In other words, revenue is the total amount of income generated by a company from the sale of goods and services related to the primary operations of a business.

Q) What is contract?

A) A contract is an agreement between two or more parties which is enforceable by law. A contract may be in oral or written form. A contract includes certain rights and obligations between the parties.

Q) What is a Customer?

A) A customer is a person who buys goods or services from a company or business in exchange of consideration. Customer is an important factor for a business. They drive revenue for a business. Without customer, a business cannot continue to exist.

Applicability of IFRS 15

IFRS 15 is effective for annual reporting periods beginning on or after 1 January 2018.

This standard applies to all contracts with customers, except for;

- Revenue from Lease contracts (IFRS 16)

- Revenue from Insurance contracts (IFRS 4 replaced by IFRS 17)

- Financial Instruments and other contractual rights or obligations within the scope of IFRS 9 (Financial Instruments), IFRS 10 (Consolidated Financial Statements), IFRS 9 (Joint Arrangements) and IAS 28 (Separate Financial Statements)

- Non-monetary exchanges between entities in the same line of business to facilitate sales to customers or potential customers

Objective of IFRS 15

The objective of IFRS 15 is to establish the principles that should be applied by an entity in order to report useful information to users of financial statements about the nature, amount and timing and uncertainty of revenue and cash flows arising from a contract with a customer.

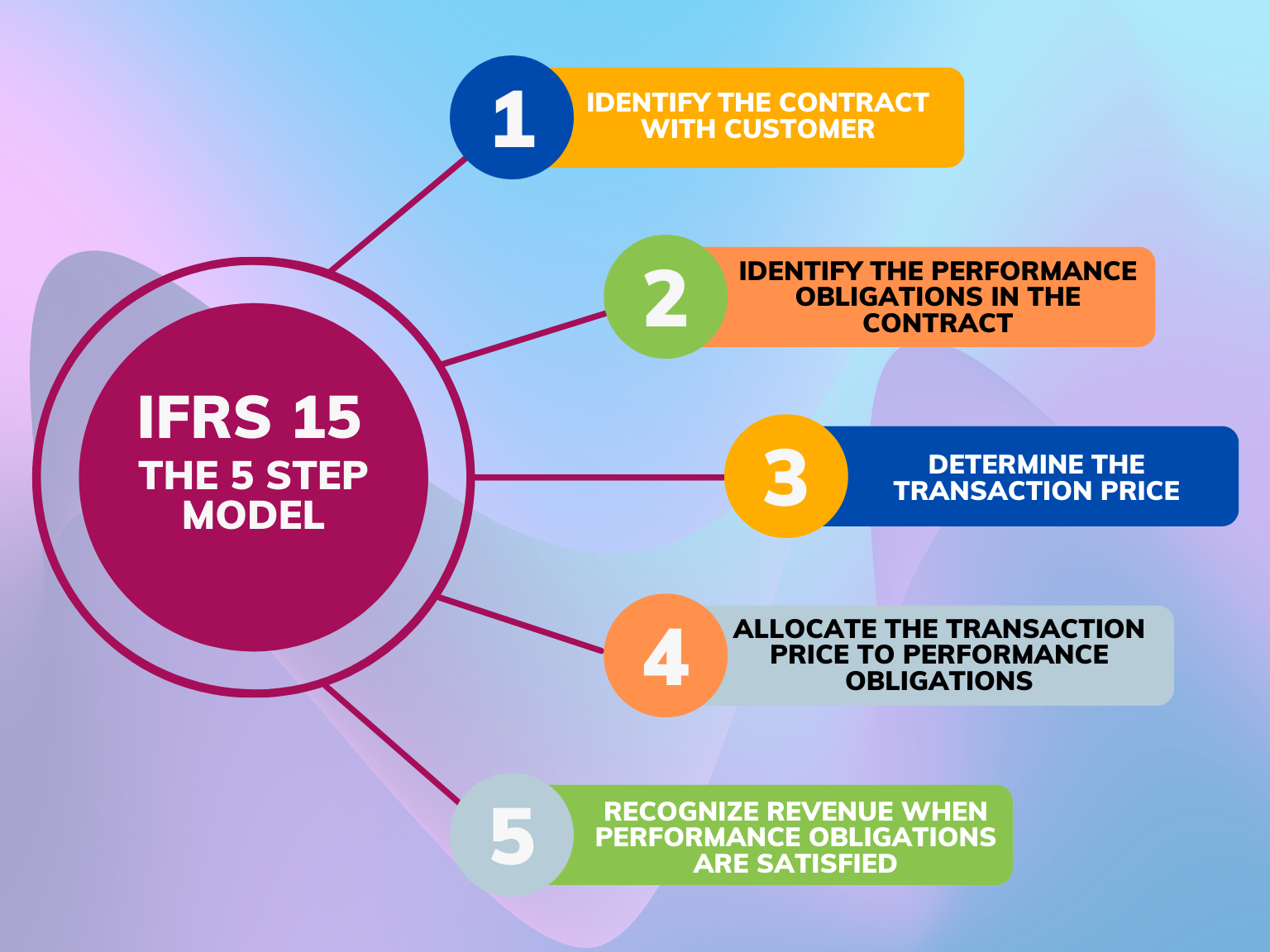

The 5 Step Model

In order to recognize revenue as per IFRS 15, the standard provides a 5 step model which are mentioned below:

- Identify the contract with customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to performance obligations

- Recognize revenue when performance obligations are satisfied

Let us go through each of the steps in detail to understand how these are implanted practically.

Step 1 – Identify the contract with customer

A contract is an agreement between two or more parties that creates enforceable rights and obligations. The parties involved must approve the contract.

A contract with a customer is within the scope of IFRS 15 only if the following conditions are met:

- The parties have approved the contract

- Each party’s rights can be identified

- The payment terms can be identified

- The contract has commercial substance

- It is probable that the entity will collect the consideration to which it will be entitled

- The contract can be written, verbal or implied

Step 2 – Identify the performance obligations in the contract

Performance obligations are promises in a contract to transfer to a customer goods or services that are distinct. Once there is a contract between the parties, the entity must identify the goods or service promised in the contract. i.e. What goods or service the entity must transfer to the customer?

What the contract requires the entity to transfer or deliver to the customer is the entity’s performance obligation.

Step 3 – Determine the transaction price

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. This amount excludes amounts collected on behalf of a third party – for example, government taxes. An entity must determine the amount of consideration to which it expects to be entitled in order to recognize revenue.

Step 4 – Allocate the transaction price to performance obligations

After determining the transaction price, the next step is to allocate the transaction price to each performance obligation in the contract. Price is allocated to each obligation based on the relative standalone selling price of each performance obligation.

Standalone selling price is the price at which a seller sells a promised good or service separately to a customer.

Step 5 – Recognize revenue when performance obligations are satisfied

An entity satisfies its performance obligations when it transfers the promised goods and services to the customer. An asset is transferred when the customer gets control over the asset.

revenue in respect of goods is recognized when the significant risks and rewards of ownership of the goods are transferred to the customer. An entity satisfies a performance obligation by transferring control of a promised good or service to the customer, which could occur over time or at a point in time.

An illustrative example explaining 5 step model to recognize revenue

ABC LLC is a mobile phone trading company that sells mobiles phones and provides repairs and after sales services also.

In August 01, 2022, ABC LLC agreed to sell customer X, a new branded iPhone 13 along with a special warranty of 30 months starting from August 02, 2022. Customer agreed to buy.

Total consideration agreed is 5000 AED (Excluding VAT). The standalone selling prices are AED 4800 for iPhone 13 and AED 400 for special warranty of 30 months. Customer will pay VAT.

Step 1: Identify the contract with customer

In the case, a contract exist as there is an agreement for customer X to exchange consideration of AED 5000 for iPhone 13 and 30 months special warranty.

Step 2: Identify the performance obligations in the contract

ABC LLC has an obligation to provide iPhone 13 and 30 months special warranty. Here there is 2 separate performance obligations. i.e. sell the phone and provide warranty after the sale.

Step 3: Determine the transaction price

The transaction price for this contract is AED 5000 for iPhone and special warranty. The price excludes VAT.

Step 4: Allocate the transaction price to performance obligations

Supply of iPhone and warranty are separate performance obligations. So the transaction price is allotted to each obligation in proportion to their standalone prices.

The transaction price allotted is;

iPhone 13 = (AED 4800/AED 5200)*AED 5000 = AED 4615.38

Special Warranty = (AED 400/AED 5200)*AED 5000 = AED 384.62

Step 5: Recognize revenue when performance obligations are satisfied

The transfer of promised goods and services can occur at a point in time, like when the ABC LLC hands over the phone to the customer X.

The transfer of promised goods and services can also occur over time, like when ABC LLC provides warranty services over the period of 30 months.

In this case, the revenue for iPhone 13 is recognized at a point in time (i.e. on August 01, 2022). However, the revenue for warranty is recognized over time as the ABC LLC performs the warranty starting from August 02 onwards.

The revenue recognized in 2022 for the warranty will be AED 64.10 (5/30)*384.62

Total revenue recognized in 2022 will be AED 4679.48 (4615.38+64.10)

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to IFRS and Auditing standards across the world. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Audit Executive

contact us

contact us