Introduction:

Value Added Tax (VAT) is a consumption tax levied on goods and services in the United Arab Emirates (UAE) at a standard rate of 5%. Only VAT registrants are allowed to issue tax invoices and charge VAT on them. Issuing proper tax invoices is essential for complying with the regulations set by the UAE Federal Tax Authority. Let us understand the basic rules and importance of issuing tax invoices under UAE VAT Law:

- Issuing tax invoices is crucial in determining the date of supply

- For claiming input taxes, having proper tax invoices for the purchases or expenses is a must.

- Providing tax invoices enhances the professionalism and credibility of a business.

- Tax invoice provides transparency in the transaction between parties. They detail the value of the goods or services provided, description, rate of tax, amount of tax and other relevant information.

- A Registrant making a Taxable Supply shall issue an original Tax Invoice and deliver it to the Recipient of Goods or Recipient of Services.

- The Registrant shall issue a Tax Invoice within 14 days from the date of supply.

- Failure to issue tax invoices by a registrant will result in penalties.

Q) What are the types of tax invoices?

Ans.) As per Article 59 of Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No. (8) of 2017 on Value Added Tax, a tax registrant can issue two types of tax invoices under various circumstances. They are:

- Full Tax Invoice

- Simplified Tax Invoice

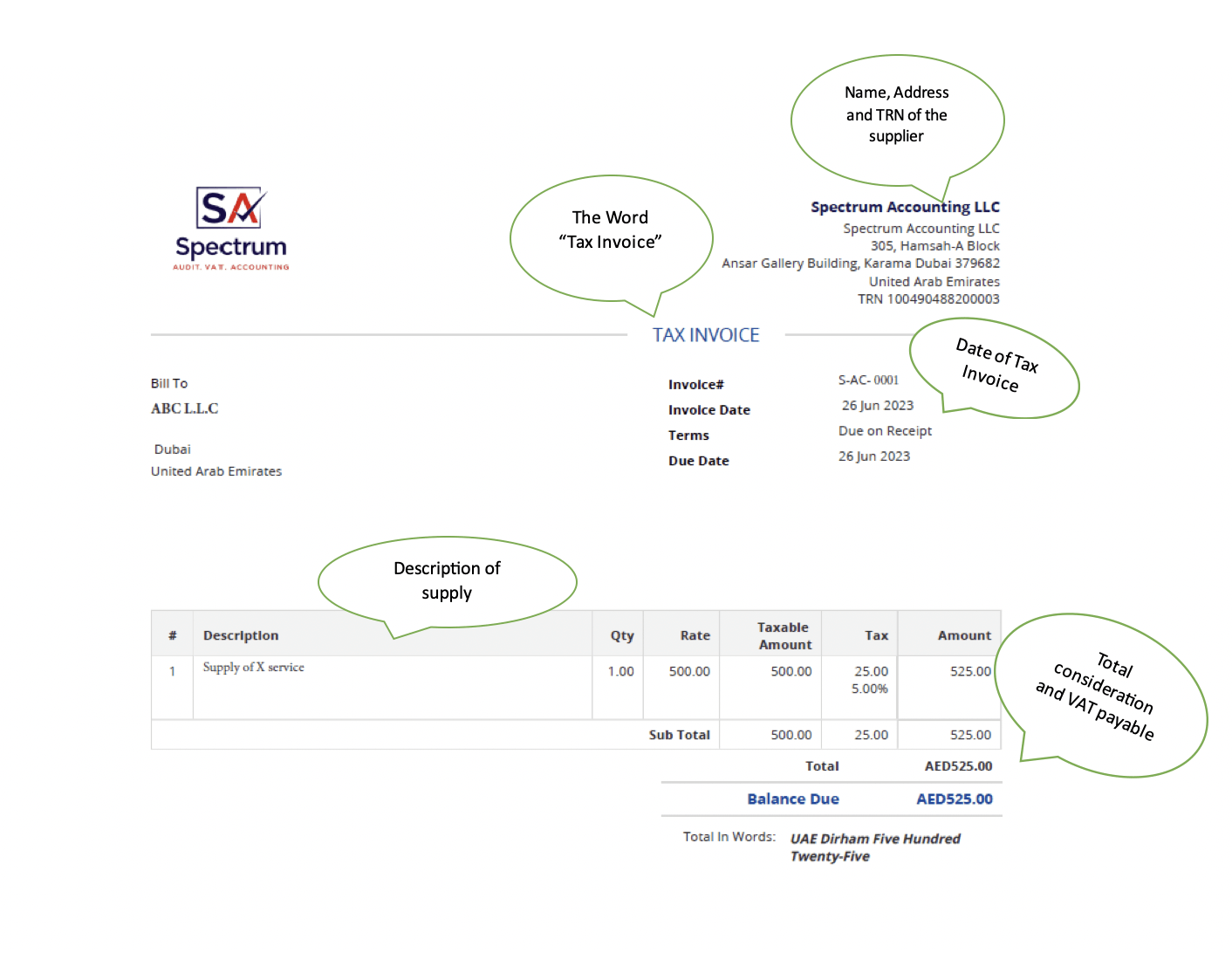

Q) When a simplified tax invoice can be issued and what are the key information should be included in a simplified tax invoice?

Ans.) As per Article 59, Clause 5 of the executive regulations, the Taxable Person may issue a simplified Tax Invoice in either of the following situations:

- Where the Recipient of Goods or Recipient of Services is not a Registrant.

- Where the Recipient of Goods or Recipient of Services is a Registrant and the Consideration for the supply does not exceed AED 10,000

Key information to be included in a simplified tax invoice are:

- The words “Tax Invoice” clearly displayed on the invoice.

- The name, address, and Tax Registration Number of the Registrant making the supply.

- The date of issuing the Tax Invoice.

- A description of the goods or services supplied.

- The total consideration (Gross value of the supply, i.e., value including VAT) and the tax amount charged.

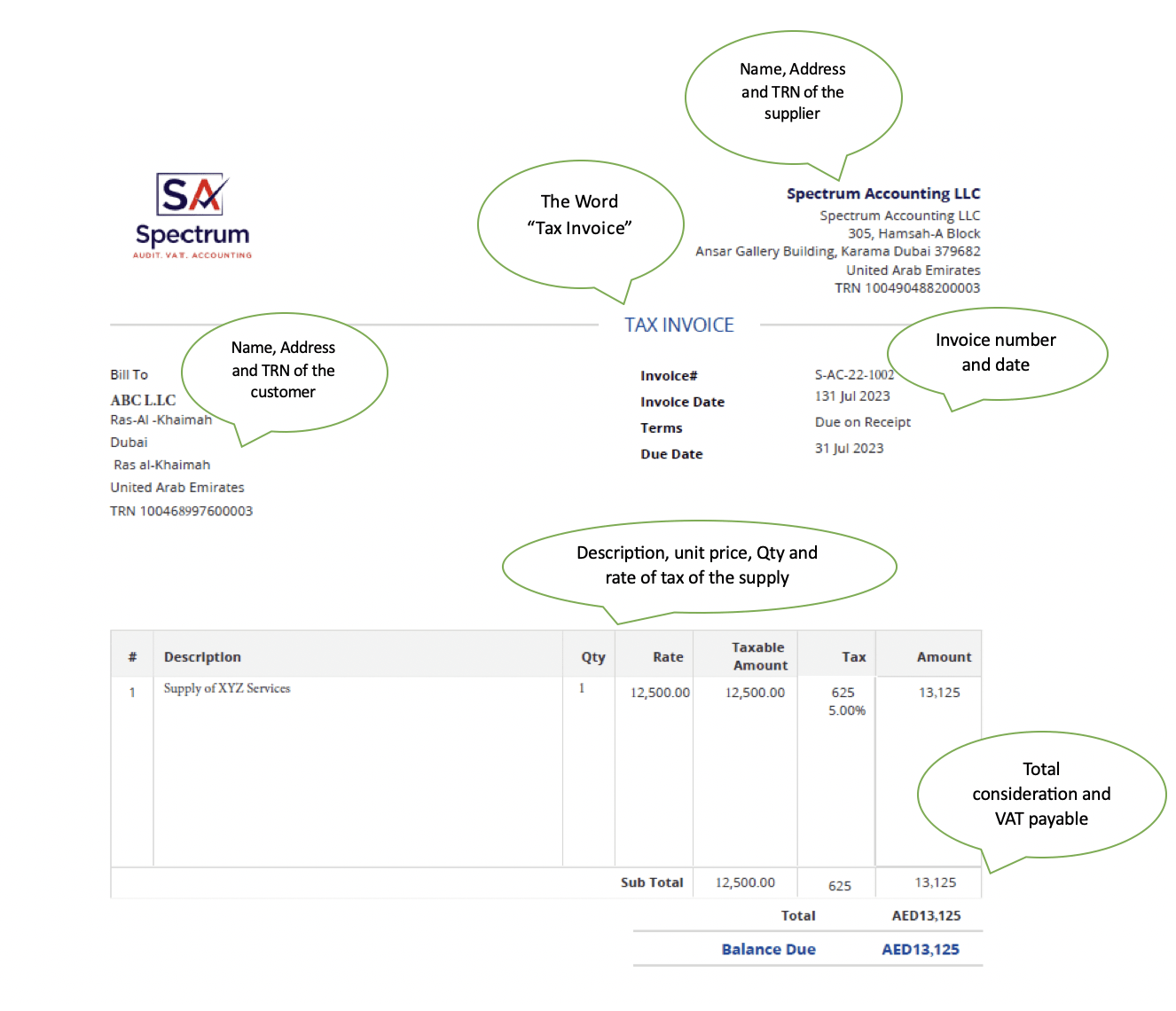

Q) When is a full tax invoice to be issued and what are the key information to be included?

Ans.) If the value of the supply exceeds AED 10,000, the registrant shall issue a full tax invoice to the customer.

Key information to be included in a full tax invoice are:

- The words “Tax Invoice” clearly displayed on the invoice.

- The name, address, and Tax Registration Number of the Registrant making the supply.

- The name, address, and Tax Registration Number of the Recipient where he is a Registrant.

- A sequential Tax Invoice number or a unique number that enables identification of the Tax Invoice and the order of the Tax Invoice in any sequence of invoices.

- The date of issuing the Tax Invoice.

- The date of supply if different from the date the Tax Invoice was issued.

- A description of the Goods or Services supplied.

- For each Good or Service, the unit price, the quantity or volume supplied, the rate of Tax and the amount payable expressed in AED.

- The amount of any discount offered.

- The gross amount payable is expressed in AED.

- The Tax amount payable expressed in AED together with the rate of exchange applied where the currency is converted from a currency other than the UAE dirham.

The other areas need to be taken care of while issuing tax invoices are:

Rounding off tax invoices

Where the invoice amount is a fraction of a fils, the amount should be rounded to the nearest fils (that is, to two decimal places) on a mathematical basis, being:

- rounded up if the fraction is a half or more; and

- rounded down if the fraction is less than half.

Invoices in foreign currency

If a supply is made in a currency other than UAE Dirham, the tax payable amount must be converted into and stated in UAE Dirham based on the exchange rate approved by the UAE Central Bank as at the date of supply on the tax invoice. The invoice may still contain information regarding prices in the original currency.

Formats of proper Tax Invoices

Simple Tax Invoice

Full Tax Invoice

Conclusion:

The invoices play a crucial role in the UAE VAT system. Properly issuing tax invoices that contain all the required information helps businesses maintain compliance with VAT regulations and fosters transparency in transactions. Businesses should always keep themselves updated with the latest guidelines from the UAE Federal Tax Authority to ensure accurate invoicing and avoid potential penalties.

Why Spectrum Auditing?

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it the Value Added Tax (VAT), Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us