For more info, please visit the Ministry’s website: https://mof.gov.ae/tax-legislation/

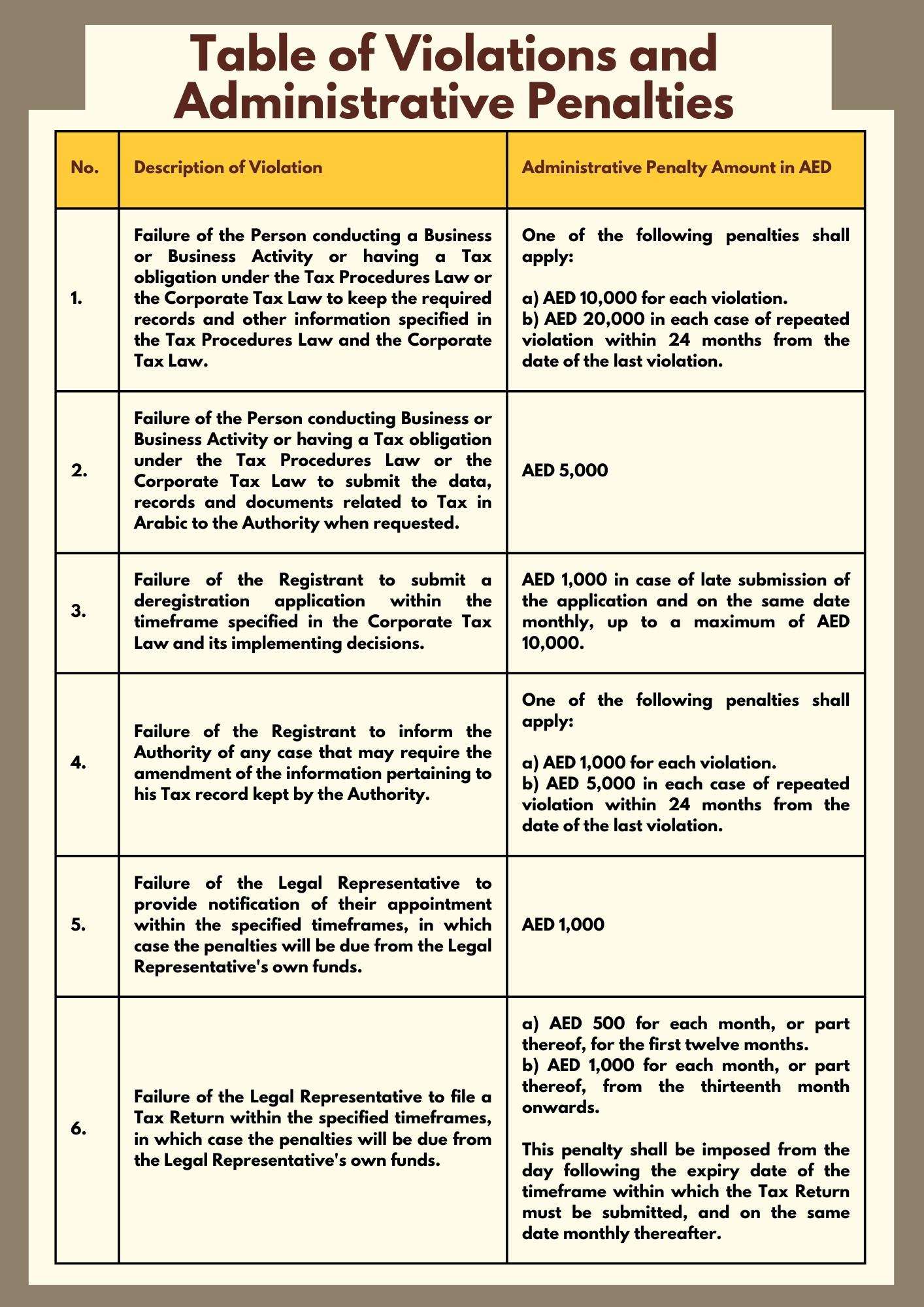

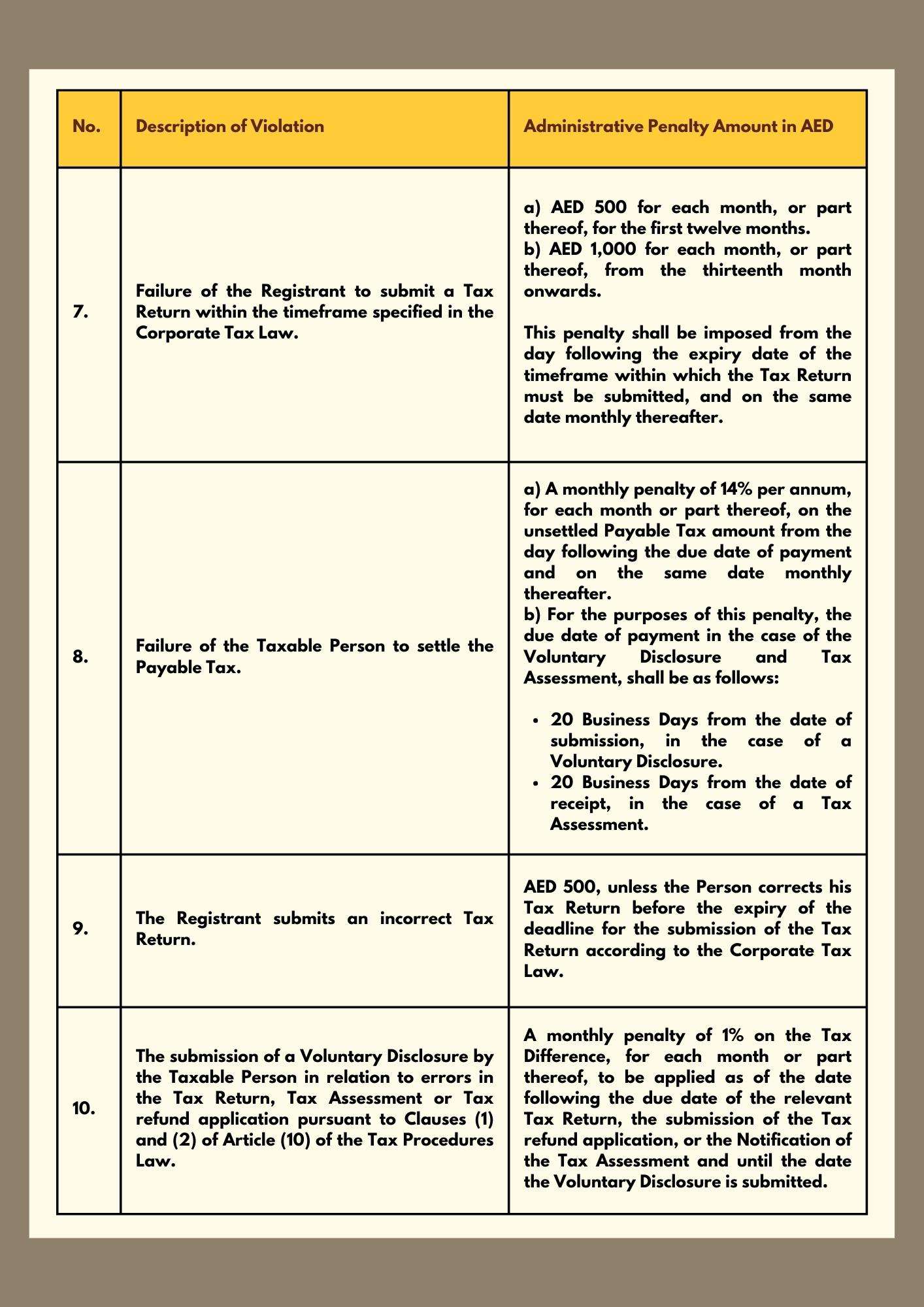

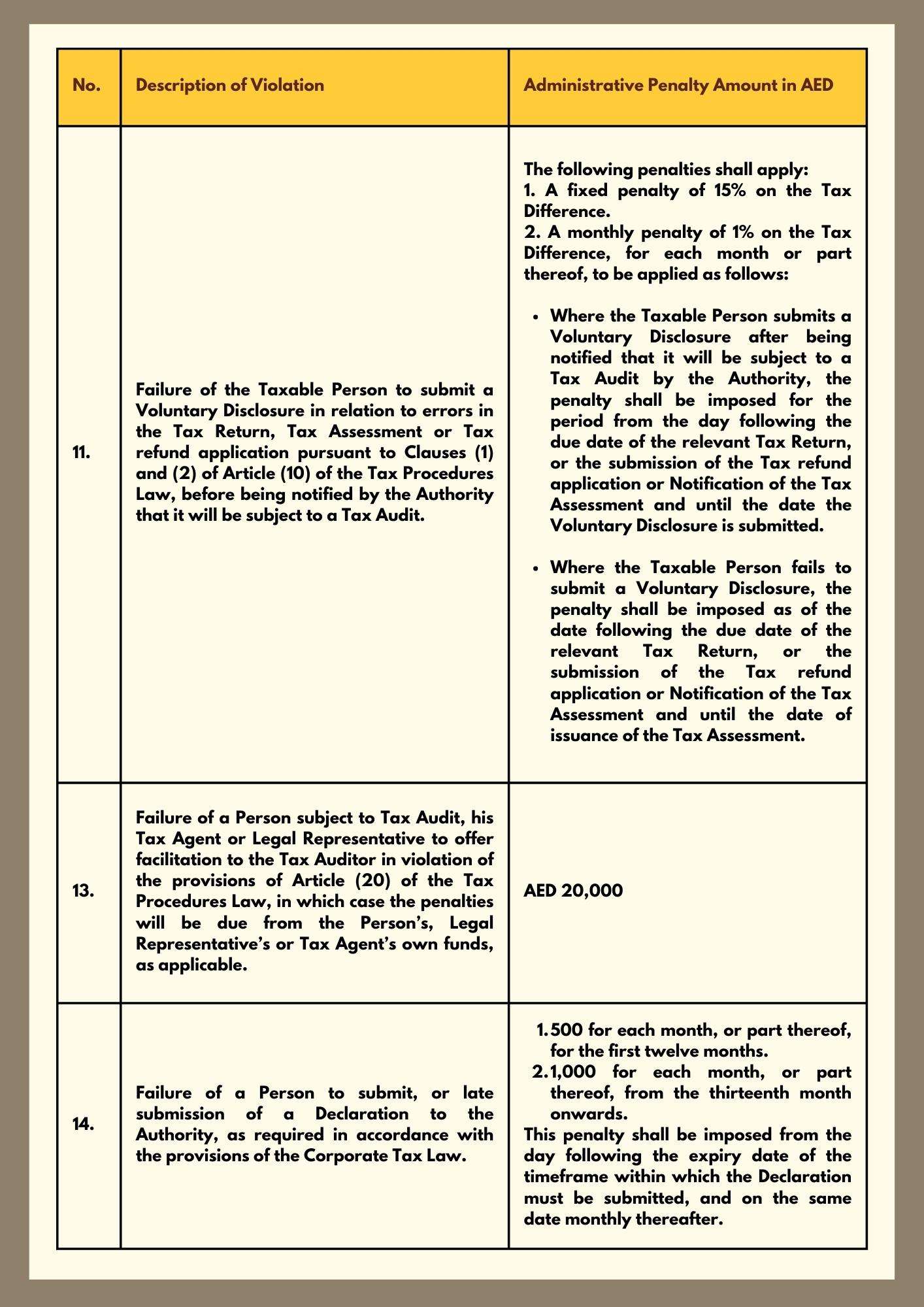

List of Administrative Penalties for Corporate Tax Law Violation starting August 1st 2023:

- Penalties applicable on Taxable Persons, whether an individual or a legal entity, in case of failure to comply with their obligations under the UAE Corporate Tax Law

- Penalties applicable in case of failure to submit the tax return within the specified timeframe

- New structure to be introduced for voluntary disclosure penalties

- Penalties applicable in case of failure of the Registrant to inform the Federal Tax Authority of any case that may require the amendment of the information pertaining to his Tax record kept by the Federal Tax Authority

SOURCE: MOF UAE

Table of Violations and Administrative Penalties Annexed to Cabinet Decision No. (75) of 2023 on Violations Related to the Application of Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses

Why Spectrum Auditing?

Spectrum Auditing will guide you with the laws and regulations of UAE, be it Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business. Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

#corporatetax #spectrumauditing #spectrum #auditing

contact us

contact us